What's in The Cards For HollyFrontier (HFC) In Q4 Earnings?

HollyFrontier Corporation HFC is set to release fourth-quarter 2019 results before the opening bell on Feb 20. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 50 cents per share on revenues of $3.8 billion.

Let’s delve into the factors that might have influenced the company’s performance in the December quarter. But it’s worth taking a look at HollyFrontier’s previous quarter performance first.

Highlights of Q3 Earnings & Surprise History

In the last reported quarter, the Dallas, TX-based company beat the consensus mark on stronger throughput volumes. HollyFrontier reported net income per share (excluding special items) of $1.68 per share that surpassed the Zacks Consensus Estimate by 25 cents. However, the bottom line was 15.15% lower than the year-ago adjusted earnings of $1.98 due to weak gross margins. Meanwhile, revenues of $4.42 billion surpassed the Zacks Consensus Estimate of $4.33 billion but declined 7.3% from the third-quarter 2018 sales of $4.77 billion.

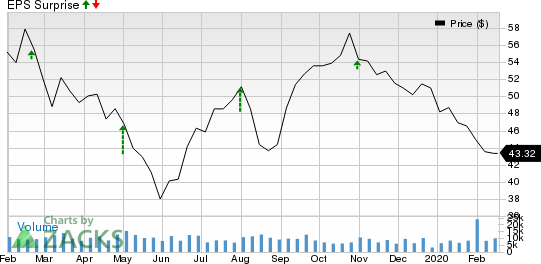

As far as earnings surprises are concerned, the downstream operator is on an excellent footing, having gone past the Zacks Consensus Estimate in each of the last four reports, with the average positive surprise being 27.77%. This is depicted in the graph below:

HollyFrontier Corporation Price and EPS Surprise

HollyFrontier Corporation price-eps-surprise | HollyFrontier Corporation Quote

Factors to Consider

The Zacks Consensus Estimate for refined products sales volume is pegged at 415,000 barrels per day (bpd), indicating a decrease from 443,670 bpd reported in the fourth quarter of 2018 due to significant plant maintenance. In the third quarter, HollyFrontier averaged 485,500 bpd. Moreover, throughput volume is likely to have deteriorated to 413,000 bpd from 440,550 bpd last year, while operating expenses per barrel most likely rose by 7.3% over the same period to $7.64 per barrel.

On a further bearish note, the Zacks Consensus Estimate for gross refining margin in HollyFrontier’s Mid-Continent region – the company’s largest – is pegged at $10.22 per barrel, down from $19.01 in the corresponding quarter of 2018. Consequently, HollyFrontier is likely to have experienced a 59.4% year-over-year decrease in net operating margin to $6.11 a barrel.

As a result, the company’s fourth-quarter income from the Refining segment – the main contributor to HollyFrontier earnings – is pegged at $108 million, compared with $180.7 million in the corresponding period of 2018.

However, on a somewhat positive note, strong gathering volumes are expected to get reflected in the midstream segment bottom-line number, which may have increased 4.6% year over year to $69 million. The company’s Lubricants and Specialty Products segment is also likely to have performed well in fourth-quarter 2019 on base oil market improvement. Segment income is pegged at $12 million, turning around from the loss of $17.1 million in fourth-quarter 2018.

What Does Our Model Say?

The proven Zacks model does not conclusively predict an earnings beat for HollyFrontier in the fourth quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: HollyFrontier has an Earnings ESP of 0.00%. This is because both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 50 cents.

Zacks Rank: HollyFrontier has a Zacks Rank of 3.

Stocks to Consider

Here are some firms from the energy space you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this season:

Berry Petroleum Corporation BRY has an Earnings ESP of +2.50% and a Zacks Rank #1. The company is scheduled to release earnings on Feb 26.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Cimarex Energy Co. XEC has an Earnings ESP of +0.89% and is Zacks #3 Ranked. The firm is scheduled to release earnings on Feb 19.

QEP Resources, Inc. QEP has an Earnings ESP of +15.79% and is Zacks #3 Ranked. The company is scheduled to release earnings on Feb 26.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QEP Resources, Inc. (QEP) : Free Stock Analysis Report

Berry Petroleum Corporation (BRY) : Free Stock Analysis Report

Cimarex Energy Co (XEC) : Free Stock Analysis Report

HollyFrontier Corporation (HFC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research