What's Next After Carvana's Surge?

Carvana's stock has surged by a scintillating 164% in the past month, fueled by investors' high-beta proclivity and a first-quarter earnings beat. Although the stock's recent returns are best-in-class, the question beckons: Is Carvana's latest surge sustainable? Let us delve into a deeper discussion of the company to see if we can determine the answer.

Assessing Carvana's latest performance

I believe Carvana's stock has been pushed higher mainly by two variables. Firstly, market-based data suggests that investors have reignited their interest in growth stocks, concurrently providing systemic support to Carvana.

Furthermore, the company released its first-quarter earnings report in early May, beating analysts' estimates with a revenue surplus of $30 million. Carvana's management also raised its second-quarter guidance, stating that the company is positioned to achieve positive Ebitda in the next three months.

After releasing its first-quarter report, Carvana's CEO, Ernie Garcia, stated the following:

"The first quarter was a big step in the right direction, and there are more steps to come... Given our strong start to the year, we expect to achieve positive adjusted Ebitda in Q2 2023. It is clear our strategy and execution are working as evidenced by our 61% increase in gross profit per unit, the best first quarter GPU in company history."

Although Carvana's recent events suggest that the stock could experience further momentum, there is a high probability that all the positive news has been priced in by the market already, leaving new investors with an overvalued stock. However, it's not unheard-of for some stocks to grow into high valuations; could this be the case with Carvana?

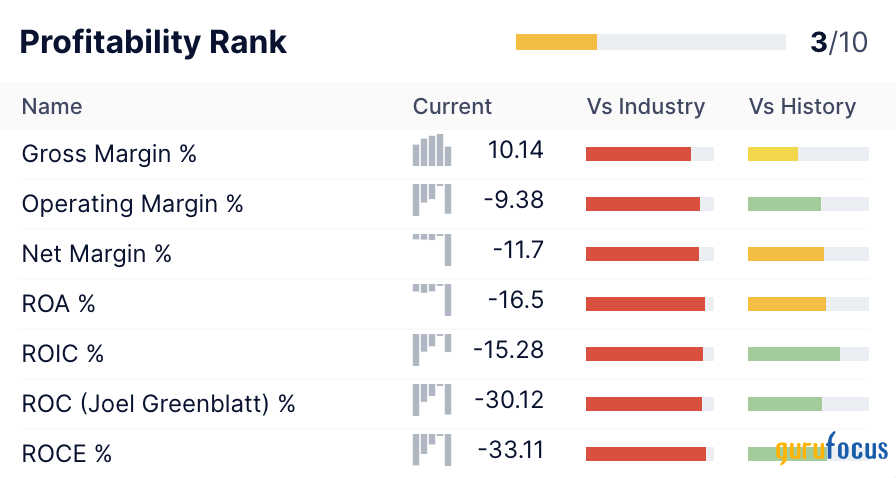

Fundamental analysis

Even though Carvana eclipsed analysts' estimates for its first-quarter earnings results, the company's revenue still slumped by 20% year-over-year amid a cyclical decline for the automobile industry.

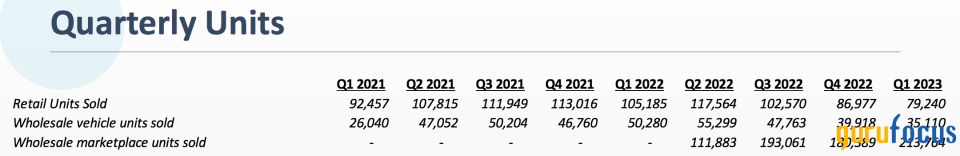

Based on salient macroeconomic factors, I think another cyclical shift might soon occur. However, automotive industry participants may have to wait a while longer before receiving fundamental support. For example, the U.S. yield curve is showing signs of steepening at the longer end, yet bond costs remain elevated, echoed by Carvana's decline in wholesale and retail units sold.

Source: Carvana

Furthermore, used car prices in the U.S. continue to taper. Unlike new car prices, used car prices are primarily determined by demand-side factors. As such, tapering of prices signals softening demand, which might persist until a substantial interest rate pivot unfolds.

Source: Market Radar

Lastly, an assessment of Carvana's accounts reveals a few worries. The company experienced benefits from allowance adjustments in its first quarter and marked-up sales on some of its older inventory. The allowance adjustment added significant non-core growth to the business' earnings, corroborated by its Beneish M-Score of -1.44, which is a measure of premature earnings recognition. A score below -1.78 is usually desired; the fact that Carvana's is above this is suggesting that Carvana might have partaken in earnings manipulation.

Valuation and tchnical analysis

I believe growth stocks are better assessed via metrics like earnings yield, free cash flow yield and price-sales ratios, as they do not have mature income statements or developed asset bases.

According to GuruFocus' database, Carvana has an earnings yield of -20.7%, an enterprise-value-to-free cash flow ratio of -9.02 and a price-sales ratio of 0.14. Apart from the price-sales ratio, the rest of its metrics are poorly aligned, revealing no signs of value. Therefore, there is no reasonable basis to label Carvana as undervalued.

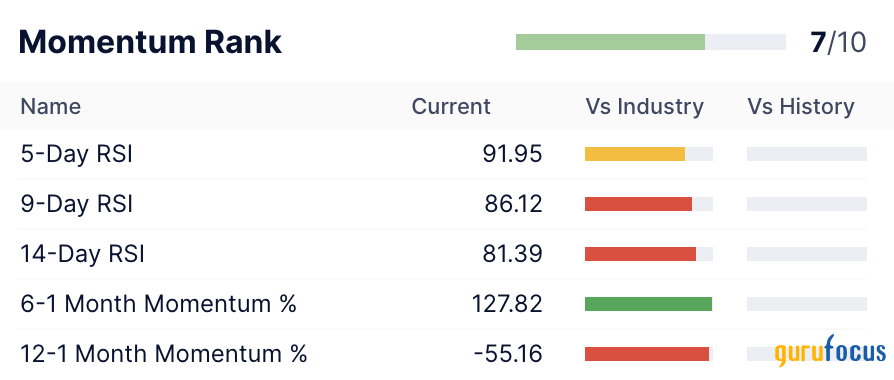

As Carvana is significantly influenced by beta sensitivity, technical analysis of its stock is of the utmost importance. Based on key metrics, the stock is technically overvalued, as its relative strength index ranks among the worst in its industry. Moreover, Carvana's latest surge has sent the stock beyond its 50-, 100- and 200-day moving averages.

In essence, key data metrics imply that Carvana's latest surge has sent its stock into an uninvestable territory.

Insider trading

Corporate insider trading can provide a useful data point on whether insiders may potentially see value in their company's stock. Nevertheless, investors must consider the metric alongside other data before making investment decisions, as it is merely one indicator.

A buying spree has reignited after a prolonged sell-off by Carvana's senior management. During the company's previous operating quarter, it recorded six insider buys. At six buys, Carvana's insider buying index reached its second-highest number ever, revealing potential management positivity.

Final word

Key data points and fundamental aspects suggest that Carvana's recent surge has priced new investors out of the market. Despite upgrading its guidance, the company's sales have continued to soften amid a slowdown in vehicle demand. Moreover, fragilities exist within the company's income statement, revealing faultlines.

To conclude, I believe Carvana's latest stock price surge is most likely due to its stock's beta sensitivity and a positive earnings surprise. However, the price is still based mostly on speculation, so a backslide is possible.

This article first appeared on GuruFocus.