What's in the Offing for Cummins (CMI) This Earnings Season?

Cummins Inc. CMI is slated to release second-quarter 2020 results on Jul 28, before the opening bell. The Zacks Consensus Estimate for the quarter’s earnings is pegged at 92 cents per share on revenues of $3.65 billion.

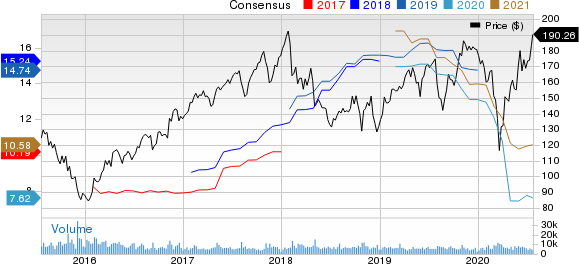

The company delivered better-than-expected results in the last reported quarter on solid contribution from the Components and Engine segments. Over the trailing four quarters, Cummins beat estimates on two occasions for as many misses, the average surprise being 12.22%. This is depicted in the graph below:

Cummins Inc. Price and Consensus

Cummins Inc. price-consensus-chart | Cummins Inc. Quote

Which Way are the Estimates Headed?

The Zacks Consensus Estimate for Cummins’ second-quarter earnings per share has been revised upward by 4 cents to 92 cents in the past seven days. This compares unfavorably with the year-ago quarter’s $4.27 per share. The Zacks Consensus Estimate for revenues also suggests a year-over-year plunge of 41.31%.

Key Factors

With the pandemic rattling the auto industry, Cummins is expected to have been affected by the decline in customer demand and the bleak world economy outlook. Its second-quarter performance is likely to have taken a hit due to disruptions across customer and supplier operations, and lower end-market demand. Moreover, the company withdrew the 2020 guidance in response to disruptions to its supply chain due to the coronavirus crisis.

The Zacks Consensus Estimate for the engine segment’s quarterly net sales is pegged at $1,174 million, lower than the year-ago quarter’s $2,703 million. The EBITDA for the segment is estimated at $85 million, calling for a 79.6% slump year on year.

The Zacks Consensus Estimate for its power system segment’s quarterly net sales is pinned at $768 million, lower than the prior-year quarter’s $1,203 million. Further, the components segment has a Zacks Consensus Estimate of $1,267 million for its quarterly net sales, down from the year-ago quarter’s $1,846 million. The EBITDA estimate for the same also indicates a decline of 42.1% to $172 million in the June-end quarter.

The second-quarter sales estimate for the distribution segment is pinned at $1,632 million, lower than the year-earlier quarter’s $2,028 million. The distribution segment’s EBITDA estimate stands at $101 million, suggesting a decrease from the prior-year's $172 million.

The Zacks Consensus Estimate for its new power segment’s to-be-reported quarter net sales is pegged at $14.99 million, higher than the first-quarter figure of $10 million. The segment’s EBITDA is pegged at a loss of $38 million, as against the earnings of $10 million reported in the prior quarter.

Nonetheless, Cummins is focusing on cost-cutting efforts, including temporary reduction in salaries in the quarter, amid the pandemic. While rising R&D expenses for product development and high material costs might have hurt the company’s quarterly performance, solid cost-containment efforts are anticipated to have offered some respite.

What the Zacks Model Says

Our proven model does not conclusively predict an earnings beat for Cummins this time around. The combination of a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that is not the case here as elaborated below. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Cummins has an Earnings ESP of -21.18%. This is because the Most Accurate Estimate of 72 cents per share comes in 20 cents lower than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Cummins carries a Zacks Rank of 3 (Hold) currently.

Stocks to Consider

Here are a few stocks worth considering, as these have the right combination of elements to come up with an earnings beat this time around:

O’Reilly Automotive, Inc. ORLY has an Earnings ESP of +40.19% and carries a Zacks Rank #2 at present. The company is slated to release second-quarter 2020 earnings on Jul 29.

Penske Automotive Group, Inc. PAG has an Earnings ESP of +207.14% and currently carries a Zacks Rank #3. The company is scheduled to report quarterly numbers on Jul 29.

Group 1 Automotive, Inc. GPI has an Earnings ESP of +114.82% and carries a Zacks Rank #3 currently. The company is set to announce earnings figures on Jul 30.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Penske Automotive Group, Inc. (PAG) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

OReilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

To read this article on Zacks.com click here.