What's in the Offing for Cummins (CMI) This Earnings Season?

Cummins Inc. CMI is slated to release first-quarter 2020 results on Apr 28, before the opening bell. The Zacks Consensus Estimate for the quarter’s earnings is pegged at $2.20 per share on revenues of $4.95 billion.

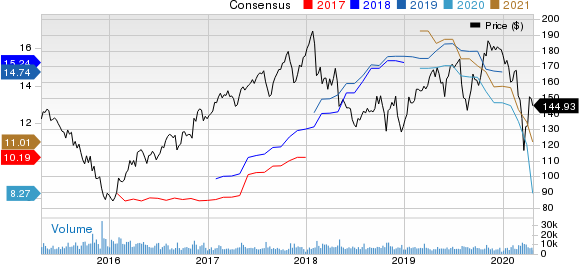

The leading global designer of diesel and natural gas engines witnessed better-than-expected results in the last reported quarter due to solid contribution from the Components segment. Over the trailing four quarters, Cummins beat estimates on two occasions for as many misses, the average positive surprise being 5.7%. This is depicted in the graph below:

Cummins Inc. Price and Consensus

Cummins Inc. price-consensus-chart | Cummins Inc. Quote

Which Way are the Estimates Headed?

Hit by the coronavirus crisis, the Zacks Consensus Estimate for Cummins’ first-quarter earnings per share has been revised downward by 3 cents to $2.20 in the past seven days. This compares unfavorably with the year-ago quarter’s $4.20 per share. The Zacks Consensus Estimate for revenues also suggests a year-over-year decrease of 17.63%.

Key Factors

Heightening coronavirus fears, especially in March, are likely to have thwarted vehicle demand. A few of Cummins’ end markets are likely to have witnessed lower levels of industry production of trucks in the quarter due to reduced build rates amid the pandemic. The coronavirus crisis is expected to have hurt Cummins’ sales due to temporary plant closures, change in processes and cut in production level. Moreover, the company withdrew the 2020 guidance in response to disruptions to its supply chain due to the pandemic-led crisis.

Notably, the Zacks Consensus Estimate for the engine segment’s quarterly net sales is pegged at $1,936 million, lower than the year-ago quarter’s $2,653 million. The EBITDA for the segment is estimated at $243 million, indicating a 44.5% slump year over year.

The Zacks Consensus Estimate for its power system segment’s quarterly net sales is pegged at $950 million, lower than the prior-year quarter’s $1,077 million. The segment’s EBITDA is pegged at $77 million, calling for a 44.2% plunge year over year.

Further, the components segment has a Zacks Consensus Estimate of $1,535 million for its first-quarter net sales, lower than the year-ago quarter’s $1,861 million. The EBITDA estimate for the same also indicates a decline of 36% to $208 million in the first quarter.

The first-quarter sales estimate for the distribution segment is pinned at $1,922 million, lower than the year-ago quarter’s $2,001 million. The distribution segment’s EBITDA estimate stands at $164 million, suggesting a decrease from the prior-year's $171 million.

Cummins is expected to have countered elevated expenses, due to rising R&D expenses for product development toward commercial launch and high-material costs during the March-end quarter. Further, expenses are expected to have flared up due to the launch of on-highway products that comply with China’s standard six-emission regulation. Additionally, tariff-related commodity costs and fluctuating foreign currencies are likely to have dragged down Cummins’ margins in the quarter.

What the Zacks Model Says

Our proven model does not conclusively predict an earnings beat for Cummins this time around. The combination of a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that is not the case here as elaborated below. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Cummins has an Earnings ESP of -3.43%. This is because the Most Accurate Estimate of $2.13 per share comes in seven cents lower than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Cummins carries a Zacks Rank of 4 (Sell) currently.

Stocks to Consider

Here are a few stocks worth considering, as these have the right combination of elements to come up with an earnings beat this time around:

Anthem, Inc. ANTM has an Earnings ESP of +1.28% and carries a Zacks Rank #3 currently. The company is slated to release first-quarter 2020 earnings on Apr 29.

The Allstate Corporation ALL is set to report quarterly numbers on May 6. The company has an Earnings ESP of +2.45% and holds a Zacks Rank of 3, at present.

Cigna Corporation CI is scheduled to release earnings figures on Apr 30. The stock has an Earnings ESP of +1.53% and currently carries a Zacks Rank #2.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cummins Inc. (CMI) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

Cigna Corporation (CI) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.