What's in the Offing for Infosys (INFY) This Earnings Season?

Infosys Limited INFY is scheduled to report first-quarter fiscal 2023 results on Jul 24.

Over the trailing four quarters, the India-based IT services provider’s earnings beat the Zacks Consensus Estimate once, met the same on two occasions and missed it once, the average beat being 0.2%.

In the last reported quarter, Infosys’ adjusted earnings of 18 cents per share missed the Zacks Consensus Estimate by a penny but increased 9.2% year over year. Revenues of $4.28 billion jumped 18.5% year over year but fell short of the consensus mark of $4.30 billion.

The Zacks Consensus Estimate for fiscal first-quarter revenues is pegged at $4.38 billion, suggesting a 15.8% increase from the year-ago period. The consensus mark for earnings stands at 18 cents per share, 5.9% higher than the year-ago quarter.

Let’s see how things have shaped up before this announcement.

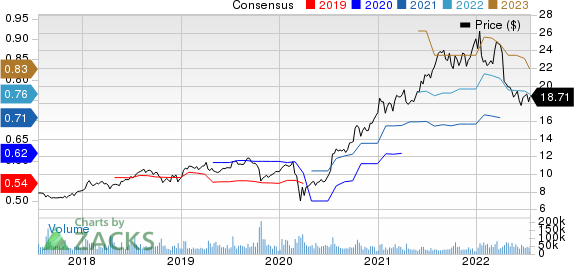

Infosys Limited Price and Consensus

Infosys Limited price-consensus-chart | Infosys Limited Quote

Factors to Consider

Infosys’ first-quarter performance is likely to have benefited from the stellar demand for the cloud, data-analytics solutions and services, the Internet of Things and security products and solutions. Also, higher investments by clients in digital transformation, AI and automation are anticipated to have been conducive to its fiscal first-quarter performance.

Continued large deal wins and growth in digital services are likely to have driven INFY’s quarterly revenues during the to-be-reported quarter. The company’s efforts to reinforce digital transformation capabilities for expanding and solidifying its position in the highly competitive environment are a steady tailwind.

Infosys added 110 clients in the fourth quarter of fiscal 2022. It also signed multiple large deals of a contract value worth $2.3 billion.

The growing traction of its solutions and services in the commercial and corporate banks, consumer, cost and payments, wealth management and custody and mortgage portfolios of its business is likely to have been an upside during the quarter under review.

However, the Indian software giant’s decision to move its business out of Russia following Moscow’s war against Ukraine is likely to have somewhat negatively impacted the top line in the first quarter. Also, inflationary pressures and possible global slowdown concerns are anticipated to have led many organizations push their large IT investments.

Additionally, inflated investments in sales and localization and rising costs to grab large deals might have hurt Infosys’ bottom line during the quarter under discussion.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for INFY this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that’s not the case here.

Infosys carries a Zacks Rank #4 (Sell) and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Per our model, Valero Energy VLO, Merck & Co. MRK and Apple AAPL have the right combination of elements to post an earnings beat in their upcoming releases.

Valero sports a Zacks Rank #1 and has an Earnings ESP of +10.22%. The company is scheduled to report second-quarter 2022 results on Jul 28. Valero’s earnings surpassed the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 84.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for VLO’s second-quarter earnings is pegged at $8.78 per share, indicating a sharp improvement from the year-ago quarter’s earnings of 48 cents per share. The consensus mark for revenues stands at $39.7 billion, suggesting a year-over-year increase of 42.9%.

Merck currently sports a Zacks Rank #1 and has an Earnings ESP of +7.18%. The company is slated to report its second-quarter 2022 results on Jul 28. Merck’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing the same on one occasion, the average surprise being 13.4%.

The Zacks Consensus Estimate for Merck’s second-quarter earnings stands at $1.77 per share, implying a year-over-year increase of 35.1%. MRK is estimated to report revenues of $13.9 billion, which suggests growth of 21.5% from the year-ago quarter.

Apple is slated to report third-quarter fiscal 2022 results on Jul 28. The company carries a Zacks Rank #3 and has an Earnings ESP of +0.88% at present. Apple’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while meeting the same on one occasion, the average surprise being 11.9%.

The Zacks Consensus Estimate for quarterly earnings is pegged at $1.13 per share, suggesting a year-over-year decline of 13.1%. AAPL’s quarterly revenues are estimated to increase 0.5% year over year to $81.9 billion.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Infosys Limited (INFY) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research