What's in Store for Cloudflare (NET) This Earnings Season?

Cloudflare NET is slated to release fourth-quarter 2020 results on Feb 11.

Notably, the company completed its initial public offering (IPO) in September 2019 and has reported quarterly earnings ever since.

Management expects third-quarter revenues between $117.5 and $118.5 million. The Zacks Consensus Estimate for the top line is currently pegged at $118.22 million, indicating 40.85% year-on-year growth.

Non-GAAP net loss per share of 4-3 cents is expected for the quarter. Notably, the consensus mark for loss has remained unrevised at 4 cents per share for the past 30 days.

Let’s see how things have shaped up prior to this announcement.

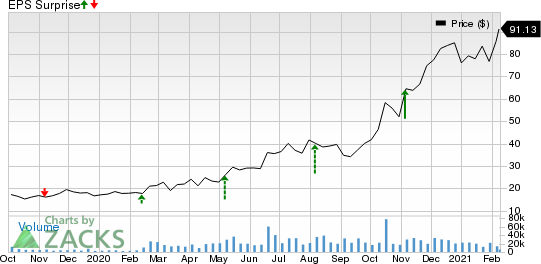

Cloudflare, Inc. Price and EPS Surprise

Cloudflare, Inc. price-eps-surprise | Cloudflare, Inc. Quote

Factors to Consider

Cloudflare’s diversified customer base is anticipated to have aided top-line growth during the fourth quarter. At the end of the third quarter, the company had more than 3 million free and paying customers. Moreover, it had added roughly 4,800 new paying customers sequentially, bringing the total count to approximately 101,000 across more than 160 countries.

Large customers (annual billings of more than $100,000) were 736 at third-quarter-end, up from the 637 recorded at the end of the second quarter. This uptrend, which has prevailed over the past few quarters, is likely to have continued in the to-be-reported quarter as well on elevated demand for its cloud-based solutions amid the pandemic-led remote-working wave.

Further, Cloudflare’s recurring subscription-based business model provides relative stability to its top line, despite the COVID-19 pandemic-induced disruptions.

Additionally, solid demand for security solutions, which became imperative due to aggravated cyberattacks, bring-your-own-device policies and a zero-trust approach, is likely to have supported the top line in the quarter under review.

Moreover, the company’s capital expenditure is likely to have trended sequentially lower, which is a positive for margins.

However, Cloudflare’s significant exposure to small and medium businesses (SMBs), the worst-hit cohort by the pandemic, might have continued to impede growth during the quarter to be reported.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Cloudflare this season. The combination of a positive Earnings ESP and Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell, before they’re reported, with our Earnings ESP Filter.

Cloudflare currently has a Zacks Rank of 3 and an Earnings ESP of 0.00%.

Stocks With Favorable Combinations

Here are some companies, which, per our model, have the right combination of elements to post an earnings beat in their upcoming releases:

Vishay Intertechnology, Inc. VSH has an Earnings ESP of +4.82% and a Zacks Rank of 2, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Agilent Technologies, Inc. A has an Earnings ESP of +4.64% and a Zacks Rank of 2, currently.

Adobe Inc. ADBE has an Earnings ESP of +0.36% and currently, a Zacks Rank of 3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research