Is Wheaton Precious Metals a Buy?

Barrick Gold (NYSE: ABX) and SSR Mining Inc. (NASDAQ: SSRM) dig gold and silver out of the ground and sell it. They are miners. Wheaton Precious Metals (NYSE: WPM) sells these precious metals, too, but it doesn't get its hands dirty running gold and silver mines. Wheaton is a streaming company. Barrick, SSR, and Wheaton are all ways to get exposure to precious metals, but Wheaton's streaming model has some advantages. Here's what you need to know.

At the margin

Mining is an expensive and dangerous business. This is a simplification, but you have to find a good spot to dig, build a mine, run the mine, and then properly shut the mine down when it's depleted. There are potential pitfalls all along the way, some of which can lead to higher-than-expected costs and others that can completely shut a project down. And even the best mines generally face rising prices over time as they age.

Image source: Getty Images.

Wheaton Precious Metals sidesteps most of these issues. It is a precious metals streaming company, which means it provides miners cash up front for the right to buy gold and silver in the future at reduced rates. Currently, it pays around $4 an ounce for silver and $400 an ounce for gold. That's well below current spot prices and what it costs most miners to pull the metals from the ground.

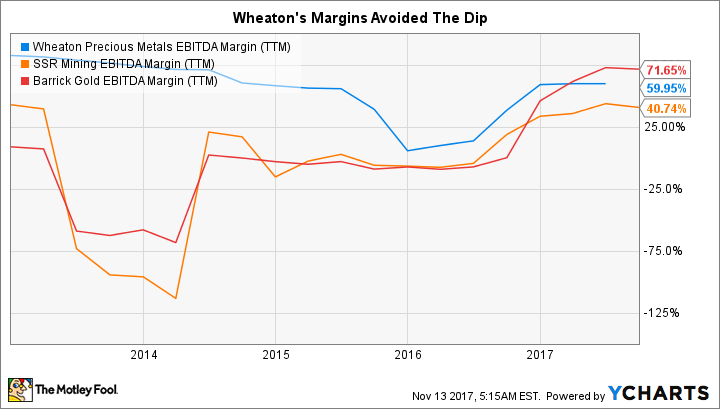

The real benefit here is that these contractually locked-in low costs provide Wheaton with wide margins even when gold and silver prices are weak. Take a quick look at the chart below, Barrick, SSR, and Wheaton all have wide EBITDA margins today. However, back in 2013 and 2014 Barrick and SSR saw their margins dip deep into the red, while Wheaton's margins didn't skip a beat.

WPM EBITDA Margin (TTM). Data by YCharts.

A big part of the reason for Wheaton's margins holding up better is the combination of locked-in low prices and the avoidance of variable mining costs. But this isn't the only reason to like Wheaton.

Diversification, dividends, and more

The fact that Wheaton provides cash up front for the right to buy gold and silver in the future makes it more like a specialty finance company that happens to own a portfolio of silver and gold investments. Today, that portfolio includes 28 assets, 20 operating mines and eight in some stage of development. Five mines account for around 70% of Barrick's production and SSR has just three operating mines.

Wheaton Precious Metals' portfolio of assets. Image souce: Wheaton Precious Metals.

Generally speaking, Wheaton will offer you more diversified exposure to precious metals than a miner. But there's another little fact that's interesting here. Wheaton's model of providing cash to miners allows it to take advantage of commodity downturns because that's pretty much when miners are most in need of cash. For example, it inked big deals with giant miners Glencore and Vale in 2015 that helped drive record gold and silver sales in 2016 -- just as commodity prices were starting to rise.

Another intriguing fact is that Wheaton's dividend is set at 30% of the average cash generated by operating activities in the previous four quarters. This is a mixed blessing since it means the dividend will be variable. However, it helps to ensure that shareholders are rewarded well during the good times. And since gold and silver tend to do best when other assets, like stocks, are struggling, that gives Wheaton's dividend a little bit of a countercyclical feel since you could be getting dividend hikes right when other investments you own are struggling and perhaps even cutting dividends.

A better option

Wheaton Precious Metals is a good option for most investors seeking to add a little silver and gold exposure to their portfolios. The streaming model affords the company more stable margins than miners, Wheaton's mine portfolio is more diversified than most miners, and its business and dividends both have a countercyclical element to them. The price of Wheaton will go up and down with the prices of the commodities it sells, just like a miner, but if you want to own a little silver and gold, Wheaton is a great option for doing that. It's worth a deep dive today.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.