Where Will Nucor Corporation Be in 10 Years?

U.S. steel giant Nucor Corporation (NYSE: NUE) is an industry leader, and it has rewarded investors incredibly well over the years. For example, it has an amazing 44-year history of consecutive annual dividend increases -- despite that fact that it operates in the highly cyclical steel industry. But that's the past. Where will Nucor be in 10 years?

A bit about today

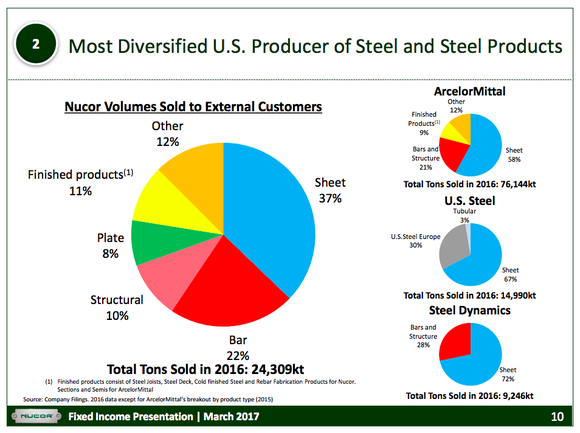

Nucor is one of the lowest-cost producers of domestic steel. It uses flexible electric arc mini mills, has a vertically integrated business that gives it material control over its input costs, and it has a unique profit-sharing pay model that rewards employees when times are flush, but asks them to share in the pain during the lean years (which helps protect Nucor's margins). It also has a highly diversified product portfolio, with a focus on moving up the value chain toward higher-margin steel products. In addition, the steel company has a rock-solid balance sheet. Nucor is really built to lead today.

Image source: Getty Images.

But that's today. United States Steel Corporation (NYSE: X) was once a steel industry leader, too. And yet it hasn't been able to shift and adjust with the times and now appears to be playing catchup. So it makes sense for investors to wonder where Nucor will be in 10 years.

Changing times

One of the biggest issues that steelmakers like U.S. Steel and Nucor are facing today is global overcapacity. That's being driven largely by China's steel industry, but it's reverberating around the world. The impact on the U.S. steel industry has been rough, with cheap foreign imports flooding into the market and taking share away from domestic players. Don't expect that to change over the next decade, and it could even get worse if China's economy continues to slow -- decreasing the country's need for the steel it produces. China might shut down some mills for environmental reasons, but that's not likely to have a huge impact.

That said, Nucor has managed through the current import influx very well. It reported the first loss in its history at the end of the deep 2007 to 2009 recession, but has remained profitable since -- unlike many peers. Part of that is the company's flexible mills and low costs. But a more important piece of the story is its ongoing effort to increase the amount of value-added steel it produces. This helps to protect margins and shifts it away from the typically commodity-based steels that are being imported. Since moving up the value scale is a core growth tenet, it's reasonable to expect Nucor to continue to fare relatively well on this issue over the next decade.

Nucor is one of the most diversified U.S. steel mills. Image source: Nucor Corporation.

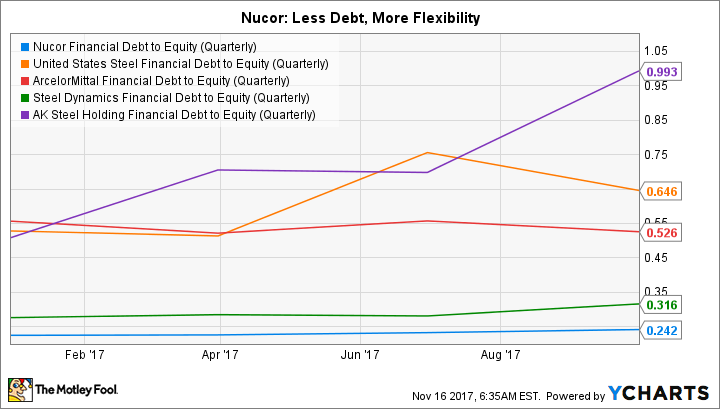

Nucor's strong balance sheet is going to help, since it can easily afford to shift its business with the times. More leveraged competitors won't have as much flexibility. To put a number on that, Nucor's debt-to-equity ratio is easily the lowest of its peers. Meanwhile, companies like AK Steel (NYSE: AKS) and U.S. Steel are not only working with businesses based around high-cost blast furnace technology, but they are also among the most leveraged of the group. (Excessive leverage is one of the reasons why this duo has bled a painful amount of red ink since 2009.)

But what about demand? For example, Nucor has been increasingly pushing into the automobile market. That's been a great growth area, with Nucor offering up high-tech light steels. That growth engine could stall if there's a material change in auto technology (more carbon fiber and aluminum use, for example) or, worse, the world's demand for cars drops because of autonomous cars and car sharing.

These are material long-term issues to consider, but at this point it doesn't appear that there will be a big enough shift over the next decade to notably impact Nucor. One reason is that auto companies have huge facilities that will have to be retooled or scrapped before they shift to new materials. That's not an overnight change, so a slow shift, at least at first, is more likely. And steel is still hard to beat cost-wise, which is a big headwind for alternative materials to overcome.

NUE Financial Debt to Equity (Quarterly). Data by YCharts.

In fact, some in the steel industry believe that the big shift toward electric vehicles will increase demand for certain types of steel. So there is a risk here, but I don't believe it will be a huge headwind over the next decade. And the actual outcome of the changes in the auto industry aren't perfectly clear just yet.

Those same trends toward alternative materials aren't unique to autos. Steel could just as easily be replaced in the construction market as well, which is a key business for Nucor. However, the 10-year time frame isn't likely to see the kind of shift that would hurt Nucor. Steel is simply too cheap, relative to alternatives, to be easily or quickly displaced at this point.

These concerns also assume that Nucor does nothing to change with the times, which isn't a reasonable conclusion when you consider the company's long and successful history. In fact, it's interesting to note that Nucor's sales to the auto sector are rising despite the increasing use of aluminum and adoption of electric cars.

No worries, yet

A decade is a long time, but the products that could replace steel and business shifts that could reduce steel demand are still relatively early in their development. Meanwhile, Nucor has proven adept at dealing with oversupply issues and there's no reason to think that's going to change. There's likely to be important shifts over the next decade, with demand headwinds picking up speed. However, it's unlikely that Nucor will see a sea change in its business. Steel's problems are further out. And then there's the fact that Nucor is one of the most diversified and financially strong steel mills. If any company is going to adjust to shifting supply and demand dynamics, I'd expect it to be Nucor.

Steel is cyclical, so it's hard to predict where the stock price of a steelmaker will be in six months, let alone a decade. But Nucor is highly likely to remain an industry leader in 10 years time despite the changes taking place within the steel market and at its main customers. And while the advances in competing products (aluminum and carbon fiber) is an issue worth monitoring, I think they are more than a decade away from replacing steel.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Reuben Gregg Brewer owns shares of Nucor. The Motley Fool recommends Nucor. The Motley Fool has a disclosure policy.