Why Bank of America Is Bullish on Medical Properties

Joshua Dennerlein of Bank of America (NYSE:BAC) has recently assigned a buy rating to Medical Properties Trust (NYSE:MPW), citing improved risk-reward facets as his focal point.

In a published note, Dennerlein said, "We expect the Steward ABL to be permanently extended in December, (and) management has alluded to a multi-party transaction involving Prospect." He also added, "Tenants should start to see improving fundamentals from payor rate hikes, improving labor markets and slowing inflation, and a pivot to a more dovish Fed is a positive for this high-yielding REIT."

After its near 50% year-to-date drawdown, Medical Properties' stock is in a spot of bother. However, key metrics indicate the real estate investment trust could be set to pivot, and Dennerlein's upgrade could be a key catalyst to improving market opinion on the stock.

Why Medical Properties has struggled

Since the turn of the year, the real estate sector has struggled overall, but Medical Properties in particular has endured torrid times due to sluggish post-pandemic patient volumes and rising labor costs as many health care professionals either died of Covid or decided to pursue other career paths because of terrible working conditions. In addition, factors such as waning government fiscal benefits and intensified staffing shortages have also inflicted damage on Medical Properties.

What could change?

Despite its troubles, the medical REIT reported improved financial results in its third quarter, bypassing analysts' earnings estimates by 7 cents per share.

Medical Properties hosts a vast portfolio of assets spanning 435 properties and 44 000 licensed beds around the globe. The REIT's global exposure allows it to benefit from cross-border synergies and trade deals, which eases implicit costs. Explicitly, the REIT's geographical diversification enables it to diversify risk, subsequently providing an enhanced revenue model.

The REIT's latest financial quarter shows how robust it can be as it produced $272 million in net funds from operations, a welcome increase from the $263 million it brought in a year ago.

Looking ahead, Medical Properties estimates that it will rake in roughly $537 million from yearly gains on sales, along with net income per share of $2.01 , which is two cents higher than its previous estimate. Thus, considering its most recent results and its outlook, the zeitgeist could change for the better among those who are interested in the stock.

An outstanding feature of Medical Properties' third-quarter results is its planned debt repayment ($650 million committed). The REIT sold 11 of its facilities to Prime Healthcare and used the proceeds to declare a significant portion of its short-term debt, amplifying investors' residual value.

The REIT has recycled $1.8 billion of capital since the turn of the year, which it plans to return to shareholders in stock repurchases, dividends and debt reduction. Despite passing through value to shareholders, Medical Properties says it still intends to make "selective investments" when necessary.

The macroeconomic picture

Various macroeconomic variables must be considered as well. Real estate assets typically wane during bearish interest rate hiking cycles due to higher mortgage rates and cooling property markets. However, with a lower-than-anticipated October CPI report (+0.4% month-over-month), interest rate hikes might find calm and allow the REIT asset class to recoup some of its losses.

In addition, Medical Properties could benefit from a cooling U.S. wage climate and lower input costs, though labor shortages and global supply chain issues persist.

Source: Trading Economics (U.S. Hourly Wage Growth)

Critical quantitative metrics

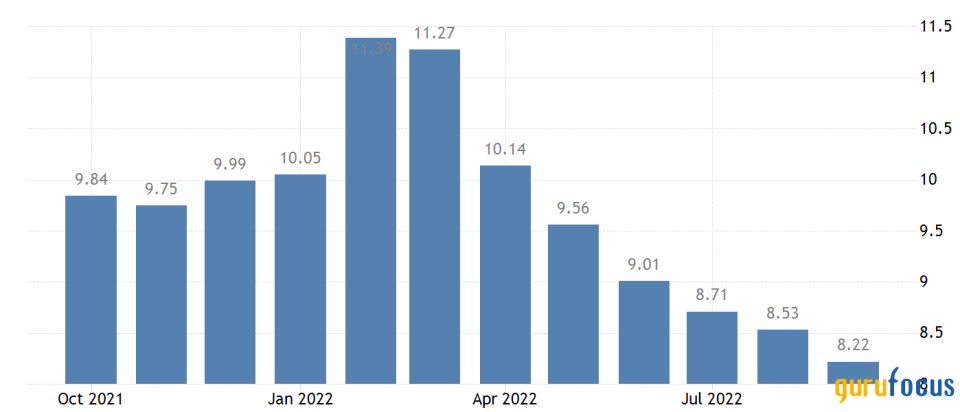

The primary quantitative metric to take note of is an REIT's price-to-adjusted-funds-from-operations (P/AFFO) ratio. Medical Properties' P/AFFO ratio of 7.54 is considered low as it's at a near 50% discount compared to the past five years, implying that the ratio is at a cyclical bottom.

The P/AFFO ratio exhibits an economic representation of a REIT's value gap as it measures the company's generated funds from operations less non-cash income relative to the REIT's traded market value. Thus, it's likely that Medical Properties presents good value for the money as its P/AFFO ratio is at a steep normalized discount.

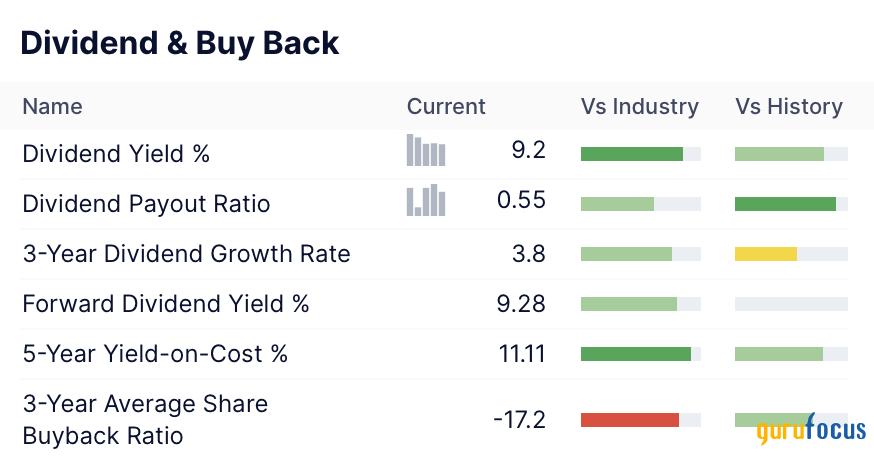

Furthermore, Medical Properties offers a 9.2% dividend yield, which is better than approximately 85% of its peers. Additionally, the REIT's five-year yield on cost of 11.11% implies that its current dividend yield isn't just a flash in the pan but instead a sustainable distribution. As such, it's plausible to conclude that this asset provides lucrative income-generating prospects.

Collectively, Medical Properties' key metrics convey encouraging total return potential with its valuation and dividend metrics aligning with a bullish total return argument.

An oversold REIT with ground to make up

Medical Properties Trust hasn't experienced the best year in 2022 as its cyclical attributes and health care industry-related factors coalesced to send the REIT's market value into the abyss. However, with settling wage inflation, debt reduction, a renewed full-year outlook and favorable valuation metrics, Medical Properties Trust could be set for upside potential in my view. Additionally, the REIT presents a "best-in-class" dividend opportunity, ensuring investors will have something to sweeten the deal while they wait for a price recovery.

This article first appeared on GuruFocus.