Why Build-A-Bear Workshop Inc’s (NYSE:BBW) CEO Pay Matters To You

Sharon John has been the CEO of Build-A-Bear Workshop Inc (NYSE:BBW) since 2013. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we’ll consider growth that the business demonstrates. Third, we’ll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for Build-A-Bear Workshop

How Does Sharon John’s Compensation Compare With Similar Sized Companies?

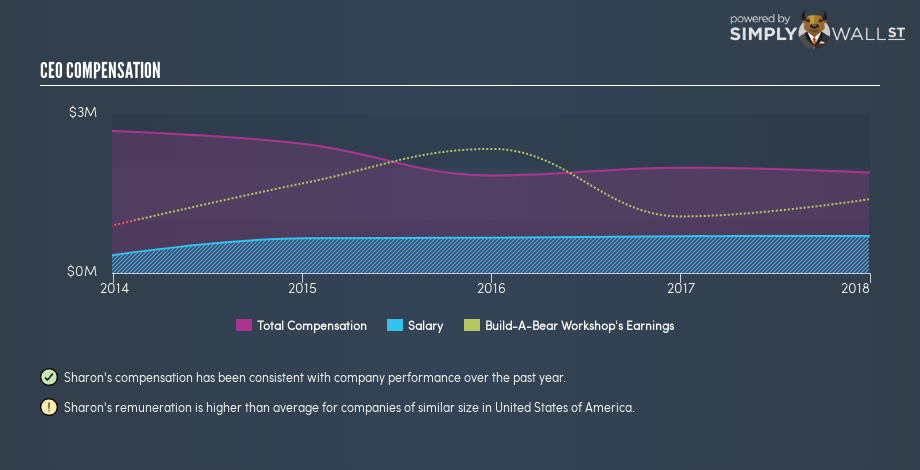

Our data indicates that Build-A-Bear Workshop Inc is worth US$111m, and total annual CEO compensation is US$1.9m. (This figure is for the year to 2017). While this analysis focuses on total compensation, it’s worth noting the salary is lower, valued at US$700k. We examined a group of similar sized companies, with market capitalizations of below US$200m. The median CEO compensation in that group is US$296k.

As you can see, Sharon John is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Build-A-Bear Workshop Inc is paying too much. We can get a better idea of how generous the pay is by looking at the performance of the underlying business.

You can see a visual representation of the CEO compensation at Build-A-Bear Workshop, below.

Is Build-A-Bear Workshop Inc Growing?

Build-A-Bear Workshop Inc has reduced its earnings per share by an average of 42% a year, over the last three years. It saw its revenue drop -1.8% over the last year.

Few shareholders would be pleased to read that earnings per share are lower over three years. And the fact that revenue is down year on year arguably paints an ugly picture. It’s hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration.

You might want to check this free visual report on analyst forecasts for future earnings.

Has Build-A-Bear Workshop Inc Been A Good Investment?

With a three year total loss of 42%, Build-A-Bear Workshop Inc would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary…

We examined the amount Build-A-Bear Workshop Inc pays its CEO, and compared it to the amount paid by similar sized companies. We found that it pays well over the median amount paid in the benchmark group.

Neither earnings per share nor revenue have been growing sufficiently fast to impress us, over the last three years.

Over the same period, investors would have come away with nothing in the way of share price gains. In our opinion the CEO might be paid too generously! So you may want to check if insiders are buying Build-A-Bear Workshop shares with their own money (free access).

Or you could feast your eyes on this interactive graph depicting past earnings, cash flow and revenue.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.