Why Clorox Stock Lost 12% in April

What happened

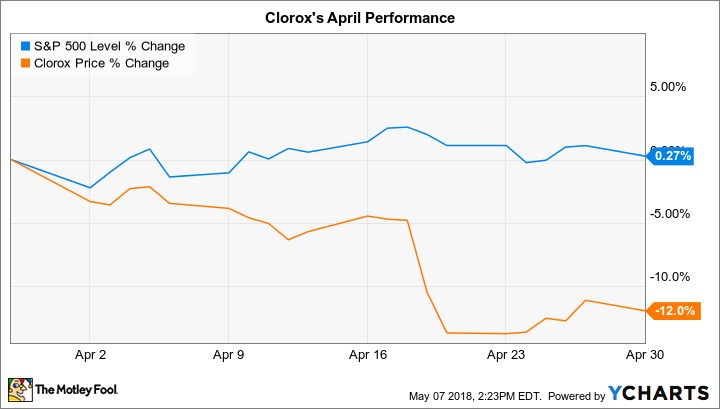

Consumer staples giant Clorox (NYSE: CLX) trailed the market last month. The stock lost 12%, according to data provided by S&P; Global Market Intelligence, compared to a roughly flat result for the S&P; 500.

The drop left shareholders looking at relatively weak returns, with shares down 9% in the last year versus a 12% increase for the broader market.

So what

Clorox stock dipped in sympathy with other industry giants last month as investors worried that demand for branded staples would stay weak even as cost pressures increased. Procter & Gamble seemed to add fuel to that pessimistic reading in April when it announced sluggish sales and falling prices as part of its fiscal third-quarter report.

Image source: Getty Images.

Now what

Clorox's own quarterly report, issued in early May, was impacted by the same trends that hurt P&G. Sales inched higher by 3% as pricing held steady. Clorox's profit margin fell to 42.8% of sales from 44% as increased input costs overwhelmed benefits from its cost-cutting initiatives.

CEO Benno Dorer and his executive team still believe sales will rise by 3% this year to touch the low end of their long-term target of between 3% and 5% annual gains. Profitability should take a step lower due to cost pressures, but investor returns will rise in any case -- thanks to a falling tax rate and a dividend that management hiked by 14% earlier in the year.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.