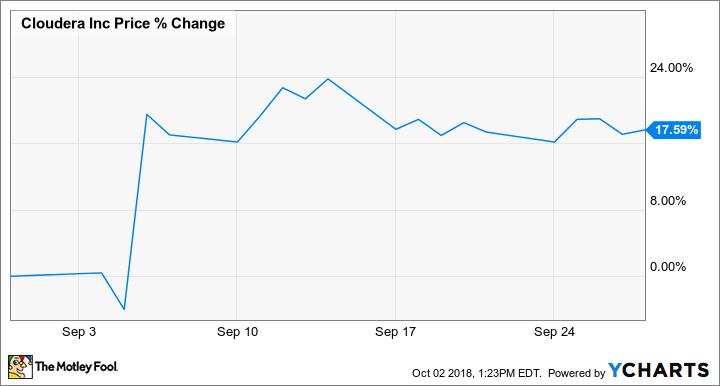

Why Cloudera Inc. Stock Gained 17.6% in September

What happened

Cloudera Inc. (NYSE: CLDR) stock climbed 17.6% in September, according to data provided by S&P Global Market Intelligence. The cloud-software company's share price gained ground following better-than-expected earnings results.

Cloudera reported second-quarter earnings after market close on Sept. 5, delivering sales and earnings that came in ahead of expectations. The company's share price popped roughly 24% in the next day's trading to reach $17.93, and closed out the month slightly below that range.

Image source: Getty Images.

So what

Sales for Cloudera's quarter including July increased 23% year over year to reach $110.3 million, topping the average analyst estimate's call for sales of $107.7 million. Subscription revenue (an important metric for the company because it suggests a floor for sales in the near term) climbed 26% compared with the prior-year period to reach $93 million and comprise 84% of total sales -- up from 82% in the prior-year period.

Non-GAAP margins for subscription revenue were also up, rising to 87% from 85% in the second quarter of 2017. The sales beat and improved margins helped the bottom line come in better than anticipated, with the average analyst estimate calling for a per-share loss of $0.15 in the quarter, and actual results coming in at a loss of $0.08.

Now what

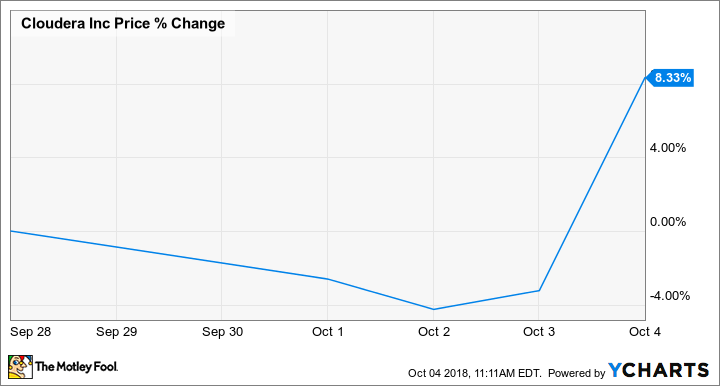

The positive pricing momentum for Cloudera stock has continued in October, with shares up roughly 8% in the month as of this writing thanks to the company's merger with Hortonworks (NASDAQ: HDP).

Cloudera and Hortonworks published a press release on Oct. 3 detailing an all-stock deal to merge the two businesses that had been approved by each company's respective board of directors. Here's Cloudera CEO Tom Reilly's comment on the significance of the deal:

Our businesses are highly complementary and strategic. By bringing together Hortonworks' investments in end-to-end data management with Cloudera's investments in data warehousing and machine learning, we will deliver the industry's first enterprise data cloud from the Edge to AI. This vision will enable our companies to advance our shared commitment to customer success in their pursuit of digital transformation.

The merger is still subject to approval by each company's shareholders, but management anticipates that the deal will improve the combined business' position in Internet of Things services, streaming, data warehouse, hybrid cloud, and artificial intelligence -- and also create more than $125 million in annual cost synergies. The merger is expected to close in the first quarter of calendar 2019.

More From The Motley Fool

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.