Why Is Cooper Tire & Rubber (CTB) Down 10.8% Since Its Last Earnings Report?

A month has gone by since the last earnings report for Cooper Tire & Rubber Company CTB. Shares have lost about 10.8% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is CTB due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Cooper Tire's Q4 Earnings, Revenues Miss Estimates

Cooper Tire & Rubber posted adjusted earnings of 50 cents per share in the fourth quarter of 2017, missing the Zacks Consensus Estimate of 62 cents.

Cooper Tire registered net sales of $757 million, missing the Zacks Consensus Estimate of $770 million in comparison with the year-ago revenues of $784 million.

Operating profit was $47 million in the fourth quarter of 2017, down 55.4% from the year-ago quarter.

Segment Details

Americas Tire Operations registered a 7.1% decrease in net sales to $645 million. Operating profit in this segment declined 47.8% to $61 million while operating margin decreased from 16.8% to 9.4%.

International Tire Operations registered a 30.5% rise in revenues to $162 million. Operating profit came in at $6 million, increasing from $1 million in the year-ago quarter. Operating margin rose to 3.7% from 1.1% in the year-ago quarter.

Financial Position

Cooper Tire had cash and cash equivalents of $371.7 million as of Dec 31, 2017, down from $504.4 million as of Dec 31, 2016. Capital expenditures increased to $54 million in the fourth quarter of 2017 from $49 million in the year-ago quarter.

Share Repurchases

In February 2017, Cooper Tire increased the share repurchase amount by $300 million and extended it till December 2019. During the fourth quarter of 2017, the company spent $20.7 million on repurchasing 576,242 shares at a price of $35.87 per share. Since August 2014 through Dec 31, 2017, Cooper Tire has brought back a total of 14.8 million shares at an average price of $34.42 per share.

Outlook

Cooper Tire expects operating margin for full-year 2018 to be at the low end of 9-11%. For 2018, capital expenditures are still expected between $215 and $235 million. The effective tax rate for the year is expected to be 23-26%.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been three revisions lower for the current quarter.

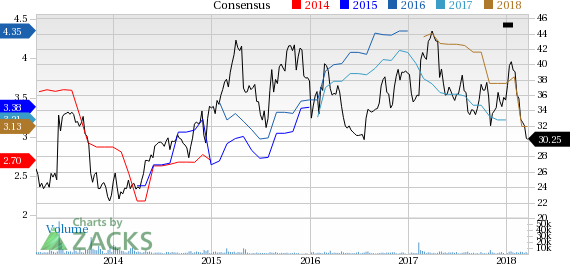

Cooper Tire & Rubber Company Price and Consensus

Cooper Tire & Rubber Company Price and Consensus | Cooper Tire & Rubber Company Quote

VGM Scores

At this time, CTB has an average Growth Score of C, though it is lagging a lot on the momentum front with an F. The stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stocks has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than growth investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Interestingly, CTB has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cooper Tire & Rubber Company (CTB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research