Why Energous Corporation’s (NASDAQ:WATT) CEO Salary Matters To You

Steve Rizzone took the helm as Energous Corporation’s (NASDAQ:WATT) CEO and grew market cap to US$462.81M recently. Recognizing whether CEO incentives are aligned with shareholders is a crucial part of investing. This is because, if incentives are aligned, more value is created for shareholders which directly impacts your returns as an investor. I will break down Rizzone’s pay and compare this to the company’s performance over the same period, as well as measure it against other US CEOs leading companies of similar size and profitability. See our latest analysis for Energous

What has WATT’s performance been like?

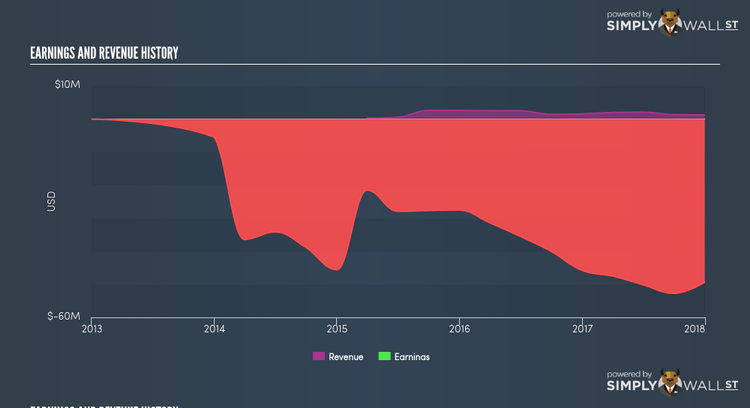

Earnings is a powerful indication of WATT’s ability to invest shareholders’ funds and generate returns. Therefore I will use earnings as a proxy of Rizzone’s performance in the past year. Most recently, WATT produced negative earnings of -US$49.38M , which is a further decline from prior year’s loss of -US$45.82M. Moreover, on average, WATT has been loss-making in the past, with a 5-year average EPS of -US$3.54. In the situation of unprofitability the company may be incurring a period of reinvestment and growth, or it can be a signal of some headwind. Regardless, CEO compensation should be reflective of the current state of the business. In the most recent financial statments, Rizzone’s total remuneration grew by 12.04% to US$5.37M.

Is WATT’s CEO overpaid relative to the market?

Though no standard benchmark exists, since compensation should account for specific factors of the company and market, we can evaluate a high-level yardstick to see if WATT is an outlier. This exercise can help direct shareholders to ask the right question about Rizzone’s incentive alignment. Generally, a US small-cap is worth around $1B, generates earnings of $96M, and pays its CEO circa $2.7M annually. Usually I would look at market cap and earnings as a proxy for performance, however, WATT’s negative earnings lower the usefulness of my formula. Given the range of pay for small-cap executives, it seems like Rizzone’s pay is above other similar companies.

What this means for you:

CEO pay is one of those topics of high controversy. Nonetheless, it should be talked about with full transparency from the board to shareholders. Why is Rizzone remuneration above that of similar companies? Is this justified? As a shareholder, you should be aware of how those that represent you (i.e. the board of directors) make decisions on CEO pay and whether their incentives are aligned with yours. If you have not done so already, I highly recommend you to complete your research by taking a look at the following:

Governance: To find out more about WATT’s governance, look through our infographic report of the company’s board and management.

Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Other High-Growth Alternatives: Are there other high-growth stocks you could be holding instead of WATT? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.