Why Facebook Is a Fantastic Business and an Even Better Investment

Facebook's (NASDAQ: FB) share of the social-media ad revenue market is evidence of an extraordinary business franchise.

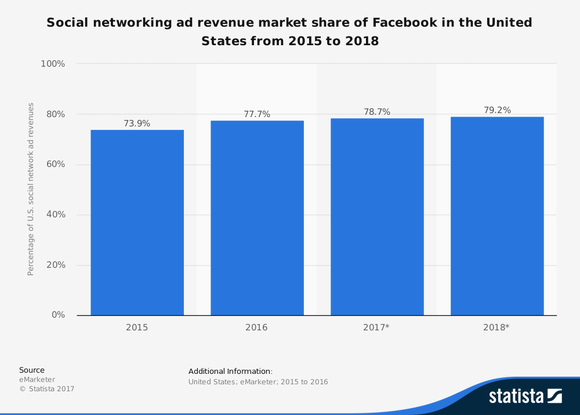

Calculated by dividing a network's ad revenue by total social-network ad spending, social-networking ad revenue market share tells investors just how desirable a platform is to marketers. Facebook's share of this key industry metric, currently estimated to be 78.7%, is staggering -- the best example of just how much power Zuckerberg and company wield.

Ad spending is competitive in social media. Facebook's consistent ability to capture over three-quarters of all social-network ad spending, therefore, speaks to its near-monopoly position:

Image source: Statista.

Most social networks are free to use. Instead, to generate revenue, networks serve up ads. Facebook's top line last year was $27.64 billion, and a whopping 97% of that total came from advertising on its platforms. But that's also a potential problem. In its 2016 annual report, Facebook listed its reliance on advertising as its second biggest risk factor, beaten out only by user-count growth.

Nonetheless, Facebook bulls believe the company will be able to maintain its position as top dog in the social-networking world. The monthly active user (MAU) metric surpassed 2 billion this year, and the information Facebook has on its users is extremely valuable to advertisers.

That MAU figure, incidentally, is astounding. Put another way, it means approximately 26.4% of the human race is on a social network that was founded at Harvard in February 2004.

A few kinks in the armor, but nothing critical

Facebook always faces the risk that another social-media outfit could come along to supplant it. Myspace, after all, already had 1 million users by the time Facebook came on the scene. And there's also a matter of trust. Facebook has come under fire for the inadvertent sale of politically motivated ads to Russian buyers during the 2016 election. An estimated 126 million users were exposed to the ads. Should Facebook users no longer trust the ads Facebook presents them, they won't bite, and click-through rates -- the percentage of users who click on an ad -- would be the first casualty. Facebook's ability to command top dollar for ads would suffer as a result.

To stave off challengers to its social-media supremacy, Facebook continues to make its ecosystem more valuable to users, through initiatives such as Facebook Marketplace and the ability to order food through the platform. As for maintaining trust with its users, Facebook has announced several transparency-based initiatives and cooperated with the federal government to hand over all requested data in relation to the Russian ad situation.

Foolish bottom line

For now, the recent hiccups haven't slowed Facebook down. Its Q3 earnings, reported on Nov. 1, showed a 47% year-over-year revenue surge to $10.14 billion, while profit exploded by 79% to $4.7 billion. Its MAU figure rose 16% year over year, and its ad market share is expected to surpass 79% in 2018.

Moreover, its growth in revenue and earnings far exceeds that of the average S&P 500 corporation, while the shares trade for 26 times forward EPS estimates -- right in line with the S&P 500's forward P/E. This is an extraordinarily rare business, and its stock appears to be an even more exceptional bargain.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Sean O'Reilly has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Facebook. The Motley Fool has a disclosure policy.