Why GrubHub Inc. Stock Lost 33.1% in October

What happened

Shares of GrubHub (NYSE: GRUB) dipped 33.1% in October, according to data provided by S&P Global Market Intelligence. The online food-ordering company's stock saw big declines amid a pullback for the broader market last month and earnings guidance for the current quarter that investors found disappointing.

GrubHub reported third-quarter results before the market opened on Oct. 25, delivering results for the period that actually came in ahead of average targets. Sales for the period rose 52% year over year to reach $247 million and top the average analyst estimate's call for revenue of $238.5 million. Earnings per share of $0.45 also topped the average analyst estimate target of per-share earnings of $0.41.

However, the company's EBITDA guidance for the current quarter fell far short of expectations and triggered sell-offs late in the month.

Image source: Getty Images.

So what

Analysts had expected GrubHub's fourth-quarter EBITDA to climb 30% year over year, but the company is actually guiding for EBITDA to decline between 12% and 30% compared to the prior-year period. The expected decline comes even as management anticipates sales for the period to be up between 38% and 43% year over year and is evidence of increased spending in order to stave off competition from Uber Eats, Door Dash, and other rivals.

Now what

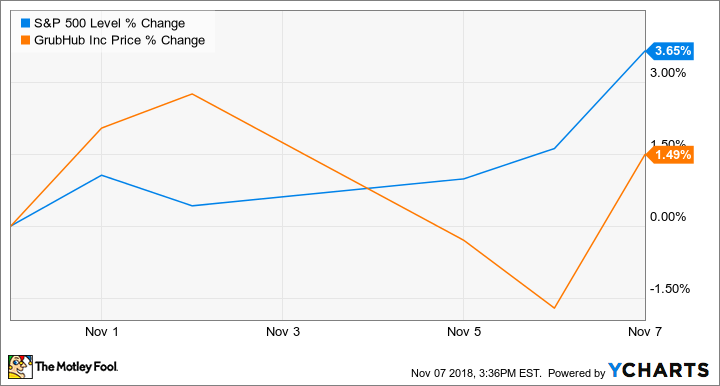

GrubHub stock has regained a bit of ground in November, trading up roughly 1.4% in the month so far but its recovery has lagged the broader-market's rebound.

Shares still are up roughly 30% year to date, even after last month's sell-off, and trade at roughly 53 times this year's expected earnings and 8.5 times expected sales. That's a growth-dependent valuation and suggests that the stock could see more steep declines if market volatility continues or spending increases outpace sales gains for a prolonged stretch. GrubHub, however, also could benefit from its recent string of acquisitions and a growing market for online food ordering and delivery.

More From The Motley Fool

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.