Why Is Interpublic (IPG) Down 5.5% Since its Last Earnings Report?

A month has gone by since the last earnings report for The Interpublic Group of Companies, Inc. IPG. Shares have lost about 5.5% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is IPG due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Interpublic Misses Q1 Earnings & Revenue Estimates

The Interpublic Group of Companies reported weak first-quarter 2018 results with revenues and earnings lagging the Zacks Consensus Estimate.

Interpublic reported first-quarter 2018 GAAP loss of $14.1 million or loss of 4 cents per share against earnings of $24.7 million or 6 cents in the year-earlier quarter. Excluding non-recurring items, earnings of 3 cents missed the Zacks Consensus Estimate by 1 cent.

Interpublic’s first-quarter 2018 net revenues of $1,774 million also missed the Zacks Consensus Estimate of $1,793.1 million. However, the figure increased 5.9% year over year. The year-over-year growth was driven by favorable foreign currency movement of 3% and organic growth of 3.6%. There was a negative impact of 0.7% from net divestures.

First-quarter 2018 total revenues were $2,169.1 million, up 5.1% from the year-ago quarter.

Interpublic witnessed organic growth of 4.3% in the United States and 2.6% in international markets.

Operating Results

Operating income in first-quarter 2018 increased 11.8% year over year to $38.8 million. Operating margin on net revenue was 2.2% compared with 2.1% in the year-ago quarter. Operating margin on total revenue was 1.8% compared with 1.7% in the year-ago quarter. Operating expenses increased 5% from the year-ago quarter to $2,130.3 million.

Balance Sheet

Interpublic exited first-quarter 2018 with cash, cash equivalents and marketable securities of $597.4 million compared with $778.1 million in the year-ago quarter. As of Mar 31, 2018, total debt was $2.09 billion compared with $1.37 billion at the end of 2017.

Share Repurchase Program and Dividend

During the first quarter of 2018, the company repurchased 2.4 million shares at an aggregate cost of $54.9 million and an average price of $22.59 per share, including fees.

During the reported quarter, the company also declared and paid a cash dividend of 21 cents per share, aggregating $80.8 million.

2018 Outlook

Interpublic reaffirmed its target for 2018. The company expects organic revenue growth of 2% to 3% and operating margin expansion of 60 to 70 basis points from its restated 2017 results.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed an upward trend in fresh estimates. There have been four revisions higher for the current quarter. In the past month, the consensus estimate has shifted by 15.8% due to these changes.

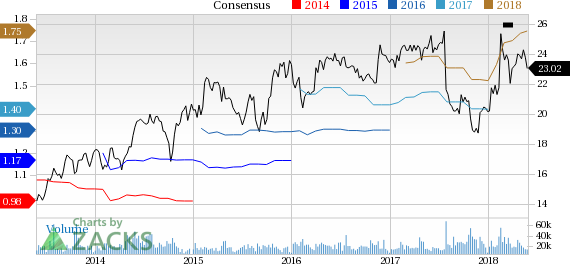

Interpublic Group of Companies, Inc. (The) Price and Consensus

Interpublic Group of Companies, Inc. (The) Price and Consensus | Interpublic Group of Companies, Inc. (The) Quote

VGM Scores

At this time, IPG has a poor Growth Score of F, however its Momentum is doing a lot better with an A. However, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than value investors.

Outlook

Estimates have been trending upward for the stock and the magnitude of these revisions looks promising. It comes with little surprise IPG has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research