Why to Invest in Beacon's (BECN) Stock Amid Supply Woes

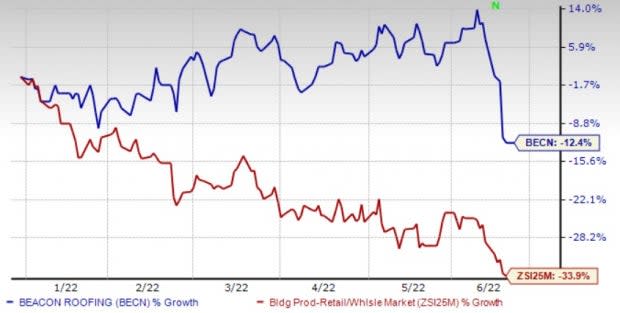

Beacon Roofing Supply, Inc. BECN has been benefiting from strategic initiatives, and focus on enhancement of digital platforms despite supply chain challenges, inflationary pressures and lengthening project cycle times. Shares of this largest publicly-traded distributor of residential and non-residential roofing materials have broadly outperformed the industry year to date.

The 2022 earnings estimate for this Zacks Rank #2 (Buy) company have moved upward to $6.58 per share from $6.35 over the past 30 days. This positive trend signifies bullish analysts’ sentiments, indicating robust fundamentals and the expectation of outperformance in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Let’s delve deeper and find out the factors that should drive growth further.

Strategic Initiatives

The company has been focusing on its Ambition 2025 targets which emphasize operational excellence, above market growth trajectory and accelerated stockholder value creation. The financial targets of Ambition 2025 assume that sales will reach $9 billion (8% CAGR) and $1 billion of EBITDA (10% CAGR), which would translate into 11% EBITDA margins (up 100 basis points from 2021).

Meanwhile, back in 2020, the company undertook the strategic review decision. Under this, the company integrated 40 brands across the United States and Canada that sell exterior products under Beacon Building Products. The new name reflects its ability to supply customers with a broad range of residential and commercial building products, and a unique service offering across North America.

Digital Focus

The company is also expected to benefit from its successful execution of technology initiative in the growing e-commerce platform. Its digital sales contributed 17% to the total residential sales during first-quarter 2022. It remains on track with the long-term target of generating $1 billion annual digital sales. The company has nearly 50% more active users on its online platform. The company is expanding its digital platform in value-added ways. Beacon continues to enhance the platform and add capabilities based on customer feedback. Given the lower cost to service, digital sales are generally accretive to gross margin.

Solid ROE & Higher Earnings Growth Rate

BECN’s superior return on equity (ROE) is also indicative of its growth potential. The company’s ROE currently stands at 26.2% which is in line with the industry. This indicates efficiency in using shareholders’ funds and the ability to generate profit with minimum capital usage.

Earnings growth is also a key factor in stock valuation. The Zacks Consensus Estimate for 2022 earnings of $6.58 per share calls for 36.2% year-over-year growth. The solid growth rate depicts the stock's promising future.

Inorganic Strategy

BECN’s systematic inorganic strategy has been supplementing organic growth, and expanding access to additional markets and products. On Jun 1, 2022, Beacon acquired Complete Supply, Inc., a distributor of residential roofing and exterior building supplies to contractors and homebuilders in Willowbrook, IL. Complete Supply has been serving customers in the greater Chicago market for their residential and complementary product requirements and this buyout has expanded Beacon’s footprint in Chicago.

On Apr 29, 2022, BECN acquired a distributor of complementary residential exterior building supplies, Wichita Falls Builders Wholesale, Inc., for an undisclosed amount. Builders Wholesale has a three-decade history and strong reputation for serving customers in greater Wichita Falls, TX.

Other Top-Ranked Stocks From the Broader Retail-Wholesale Sector

Other top-ranked stocks in the Zacks Retail-Wholesale sector are Tecnoglass Inc. TGLS, MarineMax, Inc. HZO and BBQ Holdings, Inc. BBQ.

Tecnoglass carries a Zacks Rank #1. Shares of the company have lost 33.5% year to date.

The Zacks Consensus Estimate for TGLS’ 2022 sales and EPS suggests growth of 21.3% and 28.7%, respectively, from the year-ago levels.

MarineMax sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 32.8%, on average. Shares of the company have declined 37.2% in the past year.

The Zacks Consensus Estimate for MarineMax’s 2022 sales and EPS suggests growth of 16% and 21.5%, respectively, from the year-ago levels.

BBQ Holdings carries a Zacks Rank #2. BBQ Holdings has a long-term earnings growth of 14%. Shares of the company have decreased 32.7% in the past year.

The Zacks Consensus Estimate for BBQ Holdings’ 2022 sales and EPS suggests growth of 46.1% and 67.6%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research