Why Investors are Holding ConocoPhillips (COP) Stock Now

ConocoPhillips COP is well poised for growth on the back of production possibilities and strong financial flexibilities. However, rising exploration costs and a weak commodity price environment continue to be concerns.

Headquartered in Houston, TX, ConocoPhillips is primarily involved in the exploration and production of oil and natural gas. Considering proved reserves and production, the company is one of the largest explorers and producers in the world.

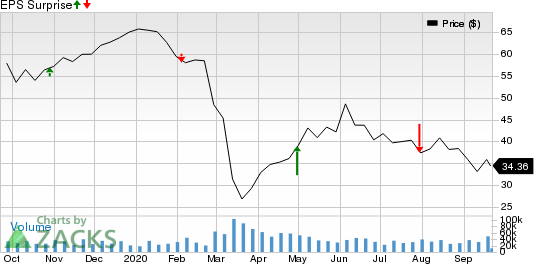

It beat the Zacks Consensus Estimate for earnings twice in the last four quarters and missed the same on the other two occasions. As such, it delivered an average surprise of 13% during this period.

ConocoPhillips Price and EPS Surprise

ConocoPhillips price-eps-surprise | ConocoPhillips Quote

Let’s take a closer look at the factors that substantiate its Zacks Rank #3 (Hold).

What’s Favoring the Stock?

The bulk of acres that ConocoPhillips holds in the three big unconventional plays, namely Eagle Ford shale, Delaware basin and Bakken shale, are rich in oil. The company has long-term plans to spend almost $4 billion per annum on the shale plays and operate around 20 rigs across four major fields. This is expected to ramp up production from the regions from more than 400,000 barrels a day to more than 900,000 barrels by the end of the next decade. The remaining significant opportunities for ConocoPhillips in the Eagle Ford shale, wherein it owns about 3,800 undrilled locations, could lend the company an access to huge oil equivalent potential reserves.

As of Jun 30, 2020, the company had $2,907 million in total cash and cash equivalents, and total long-term debt of nearly $14,852 million. Its massive liquidity position will enable it to pay off short-term debt of only $146 million. Also, it has a debt to capitalization of 32%, lower than the industry average of 40.3%. As such, the balance sheet of ConocoPhillips is significantly less leveraged than the industry it belongs to.

The company has an intention of slowing down the pace of the 2020 stock buy-back program. Starting from the second quarter, the quarterly run rate of the program has been lowered to $250 million from the prior figure of $750 million. With this measure, ConocoPhillips believes that it will be able to save a total cash amount of $2.2 billion. This move is crucial, given the current market uncertainty.

ConocoPhillips’ acquisition of additional liquid-rich Montney acreage in British Columbia, Canada, from Kelt Exploration is encouraging. The move is expected to provide the company with the opportunity to scale up production from the region, without depending on new investment in infrastructures. The acquisition is expected to have added more than 1 billion barrels of oil equivalent to the company’s resource base. Notably, it has a cost of supply in mid-$30s on a West Texas Intermediate crude price basis. This move added more than 1,000 high-quality well locations to the company’s portfolio.

Hurdles in Growth Path

Lower oil and gas prices are currently haunting the exploration and production industry. Due to global economic slowdown owing to the coronavirus pandemic, demand for hydrocarbons are not expected to rise anytime soon. This, in turn, will affect oil and gas prices. The low-price environment will likely keep ConocoPhillips’ profits under pressure.

ConocoPhillips has downwardly revised 2020 capital budget in the wake of a weak crude pricing scenario. The company’s revised capital budget for this year is roughly 35% lower than the prior guidance. In its latest operational update, ConocoPhillips revealed its plan of slowing down development operations in the Lower 48 owing to lower capital budget. The upstream firm is also planning to defer drilling activities in Alaska. Reduced operating activities also compelled the firm to lower its production guidance for this year. Due to the volume curtailment measures, the company’s production will likely be lowered by 115,000 barrels of oil equivalent per day in third-quarter 2020. This can result in lower profit levels for the company during this period.

ConocoPhillips’ exploration costs more than doubled to $743 million in 2019 from $369 million recorded in 2018. Moreover, in first-half 2020, the upstream energy player’s exploration expenses increased significantly from the year-ago comparable period, which in turn hurt the bottom line.

To Sum Up

Despite significant prospects, ConocoPhillips’ increasing exploration costs and oil price volatility are concerning. Nevertheless, we believe that systematic and strategic plan of action will drive its long-term growth.

Stocks to Consider

Some better-ranked players in the energy space include Equinor ASA EQNR, Pioneer Natural Resources Company PXD and Concho Resources Inc. CXO, each holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Equinor’s bottom line for 2021 is expected to skyrocket 125% year over year.

Pioneer Natural’s bottom line for 2021 is expected to surge 180.8% year over year.

Concho Resources’ bottom line for 2020 is expected to rise 34.4% year over year.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

Concho Resources Inc. (CXO) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research