Why Is Johnson & Johnson (JNJ) Down 8.5% Since its Last Earnings Report?

It has been about a month since the last earnings report for Johnson & Johnson JNJ. Shares have lost about 8.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to its next earnings release, or is JNJ due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

J&J Beats on Q4 Earnings, Misses Sales, Issues 2018 Outlook

J&J’s fourth-quarter 2017 earnings came in at $1.74 per share, beating the Zacks Consensus Estimate of $1.72 and increasing 10.1% from the year-ago period. Higher sales, higher net other income and a lower tax rate made up for higher operating costs in the quarter.

Adjusted earnings excluded amortization expense and some special items, which included a charge of approximately $13.6 billion related to the recent tax law changes. Including these items, J&J reported fourth-quarter net loss of $3.99 per share versus earnings of $1.38 per share in the year-ago period.

Sales came in at $20.20 billion, slightly missing the Zacks Consensus Estimate of $20.22 billion. Nonetheless, sales increased 11.5% from the year-ago quarter, reflecting an operational increase of 9.4% and a positive currency impact of 2.1%. Organically, excluding the impact of acquisitions and divestitures, sales increased 4.2% on an operational basis, better than 3.8% seen in the third quarter and 2.4% in the first half.

As expected, J&J’s sales growth accelerated in the second half backed by higher sales in the pharmaceutical segment and improving performance in Medical Devices.

Fourth-quarter sales grew 9.8% in the United States to $10.47 billion and 13.5% in international markets to $9.73 billion, reflecting 9% operational growth as currency favorably impacted reported international sales growth by 4.5%.

Segment Details

Pharmaceutical segment sales rose 17.6% year over year to $9.7 billion, reflecting 15.5% operational growth and 2.1% positive currency impact as sales rose in both domestic and international markets.

Sales in the domestic market rose 15.5% to $5.78 billion while international sales grew 20.9% to $3.91 billion (operational increase of 15.5%).

New products like Imbruvica and Darzalex continued to perform well. Other growth drivers were core products like Xarelto, Stelara, Zytiga and Invega Sustenna.

Organically, excluding the impact of acquisitions and divestitures, sales increased 7.6% on an operational basis outperforming the 6.7% growth seen in the third quarter.

Imbruvica sales rose 50.9% to $522 million in the quarter driven largely by higher market share and market growth across several indications in the Unites States and strong uptake outside Unites States.

Stelara sales rose 23% to $1.08 billion in the quarter. Stelara gained market share in the quarter driven by share gains in the psoriasis market as well as in the newer Crohn's disease market. Simponi / Simponi Aria sales rose 15% to $490 million in the quarter

Darzalex sales rose 85.5% to $371 million in the quarter. Darzalex enjoyed strong uptake in outside U.S. markets and accelerated adoption in the United States across all lines of therapy.

Xarelto sales rose 18.7% to $710 million in the quarter backed by increasing market share.

Zytiga sales rose 45.5% to $755 million in the quarter due to improved market share in a growing metastatic castration-resistant prostate cancer market. Invega Sustenna sales rose 18.5% to $693 million.

In the quarter, J&J recorded pulmonary arterial hypertension (PAH) revenues of $610 million, less than $670 million in the third quarter. Strong demand for Uptravi and Opsumit was partially offset by the expected decline of Tracleer outside the United States due to generic competition and the transition of patient assistance foundations. The Actelion acquisition added 4.2% to sales growth in 2017.

Invokana/Invokamet sales declined 28% to $267 million due to increasing discounts for managed care contracting and loss of market share.

Sales of Remicade declined 9.7% to $1.47 billion in the quarter with U.S. sales declining 8.5%. Meanwhile, international sales declined 18.7% due to biosimilar competition.

Regarding newly launched Tremfya, J&J said that the uptake of the product has been decent and it recorded sales of $47 million in the fourth quarter.

Medical Devices segment sales came in at $6.97 billion, up 8.3% from the year-ago period. It included an operational increase of 6.5% and positive currency movement of 1.8%.

Excluding the impact of all acquisitions and divestitures, on an operational basis, worldwide sales increased 2%.

Operational growth was driven by continued strong performance in Vision Care and Cardiovascular as well as improving growth in surgery, which made up for a weaker sales performance in the Diabetes Care unit.

Domestic market sales rose 5.3% year over year to $3.31 billion. International market sales increased 11.1% (operational increase of 7.5%) year over year to $3.66 billion.

The Consumer segment recorded revenues of $3.54 billion in the reported quarter, up 3.1% year over year (operational increase of 0.4%). Foreign currency movement positively impacted sales in the segment by 2.7%. Excluding the impact of acquisitions and divestitures, adjusted operational sales growth was 0.2% worldwide. Slower growth in domestic baby care products due to competitive pressure was offset by growth in beauty and over-the-counter products.

Sales in the domestic market declined 0.6% from the year-ago period to $1.38 billion.

Meanwhile, the international segment recorded an increase of 5.7% to $2.16 billion, reflecting an operational increase of 1.2% and a positive currency impact of 4.5%.

Margins Discussion

Cost of goods sold, as a percentage of sales, declined 80 basis points mostly due to favorable product mix. Selling, marketing and administrative expenses were up 50 bps year over year to 29.8% of sales due to investment behind new products. Research and Development costs, as a percentage of sales, rose 340 bps over the prior-year quarter to 18%.

2017 Results

Full-year 2017 sales rose 6.3% to $76.5 billion, falling slightly short of the Zacks Consensus Estimate of $76.8 billion. Operationally, sales rose 6% in the year, which was in line with the upper end of the guided range of 5.5.

Adjusted earnings for 2017 were $7.30 per share, above the Zacks Consensus Estimate of $7.28 and up 8.5% year over year. Earnings were at the higher end of the guidance range of $7.25 - $7.30 per share.

2018 Outlook Issued

J&J issued a mixed guidance for 2018 wherein the earnings range was above the consensus estimate while sales fell slightly short of the same.

J&J expects 2018 adjusted earnings per share in the range of $8.00 - $8.20, reflecting an operational growth rate between 6.8% and 9.6%. The company’s guidance exceeded the then Zacks Consensus Estimate of $7.86 per share. Currency fluctuations are expected to favorably impact earnings per share by 20 cents.

It expects revenues in the range of $80.6 billion to $81.4 billion, reflecting operational constant currency sales growth rate in the range of 3.5% to 4.5%. However, the sales guidance fell slightly short of the then Zacks Consensus Estimate of $81.55 billion. Organic sales growth, excluding the impact of acquisitions and divestitures, is expected to be in the range of 2.5%-3.5% which, though slightly higher than 2.4% seen in 2017, fell short of 4.2% in the fourth quarter. Currency fluctuations are expected to favorably impact sales by 200 basis points.

In 2018, J&J expects the Pharmaceutical segment to remain strong while the Consumer and Medical Device segments will continue to improve. We believe that new products in all segments, label expansion of drugs like Imbruvica and Darzalex and contribution from acquisitions, mainly Actelion, will support top-line growth.

Adjusted pre-tax operating margins are expected to increase by approximately 100 basis points in 2018 despite expectations for increased R&D investments. The company said that since tax rates on U.S. earnings will be lower in 2018, it will allow increased investment in R&D.

Adjusted tax rate guidance is in the range of 16.5.

The company does not expect any biosimilar entrants for Zytiga, Prezista, Risperdal Consta, or Invega Sustenna in the United States in 2018. However, the company is confident that it can absorb the impact of any potential Zytiga headwind should there be an earlier-than-expected generics launch in 2018.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed an upward trend in fresh estimates. There have been two revisions higher for the current quarter. While looking back an additional 30 days, we can see even more upward momentum. There has been three moves up in the last two months.

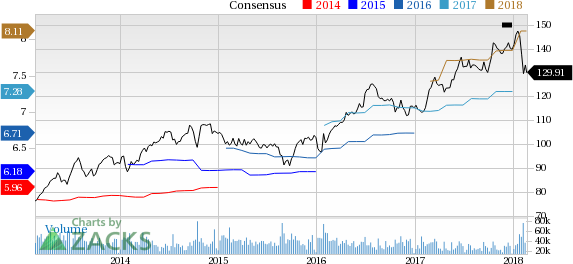

Johnson & Johnson Price and Consensus

Johnson & Johnson Price and Consensus | Johnson & Johnson Quote

VGM Scores

At this time, JNJ has a nice Growth Score of B, however its Momentum is doing a bit better with an A. Charting a somewhat similar path, the stock was allocated a grade of B on the value side, putting it in the second quintile for this investment strategy.

Overall,the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for momentum investors than those looking for value and growth.

Outlook

Estimates have been trending upward for the stock and the magnitude of these revisions looks promising. Interestingly, JNJ has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research