Why Kinder Morgan Is a Good Pick for Value Investors

- By Dilantha De Silva

Kinder Morgan Inc. (NYSE:KMI) is a prominent energy infrastructure company in North America and is one of the largest operators of natural gas pipelines in the region.

When a polar vortex crippled the power grid in February and halted gas supplies, causing rates to skyrocket to unimaginable heights, gas and electricity sellers and distributors across Texas suffered billions of dollars in damages. Kinder Morgan and companies such as Comstock Resources Inc. (NYSE:CRK), however, profited handsomely on the other side of the trade thanks to higher gas prices.

In addition to its North American business, the company is laying the groundwork to become a leading liquified natural gas exporter as well, which could pay lucrative returns in the future.

Even though there is an overall decrease in oil and natural gas consumption today, the expected recovery of the global economy in the second half of this year will restore some lost demand, paving the way for Kinder Morgan to report strong earnings growth.

Shares have gained 19% in the last 12 months, but still seem undervalued in my opinion considering the improving prospects for the energy industry. Let's take a look at my reasons for thinking this way.

The business

Kinder Morgan, headquartered in Houston, Texas, is a leading energy infrastructure company that is part of the S&P 500 Index. The company owns and operates 83,000 miles of pipelines that transport natural gas, gasoline, crude oil, carbon dioxide and other commodities. Kinder Morgan also owns 144 terminals that have the capability to store and manage fossil fuels, refined petroleum products and ethanol. The company's pipelines contribute to about 40% of the natural gas consumed in the U.S. It is also the largest self-governing terminal operator and distributor of petroleum products in the country.

Kinder Morgan's earnings for the first quarter of 2021 were much better than analyst and investor expectations, led by a $1 billion windfall from the winter storm that devastated Texas and lifted natural gas and electricity prices higher as natural gas infrastructure failed due to lack of preparation for cold conditions.

According to Kinder Morgan's President, Kimberly Dang, the storm that struck in mid-February boosted the company's first-quarter earnings to a degree significant enough that the pipeline operator's results outperformed the average forecast by almost threefold. Net profit for the first quarter hit a whopping $1.41 billion, whereas analysts polled by Bloomberg were expecting the company to report net income of $550 million for the March quarter. This strong financial performance enabled the board of directors to approve a cash dividend of 27 cents per share, which represents an increase of 3% from the dividend paid in the fourth quarter of 2020.

The macroeconomic outlook is improving

According to Deloitte, global oil and gas demand dropped by 25% in April 2020 but has recovered sharply since then and is just 8% below the pre-recession level. The demand for energy sources is projected to rebound steadily this year but is likely to remain around 4% below the levels seen in 2019.

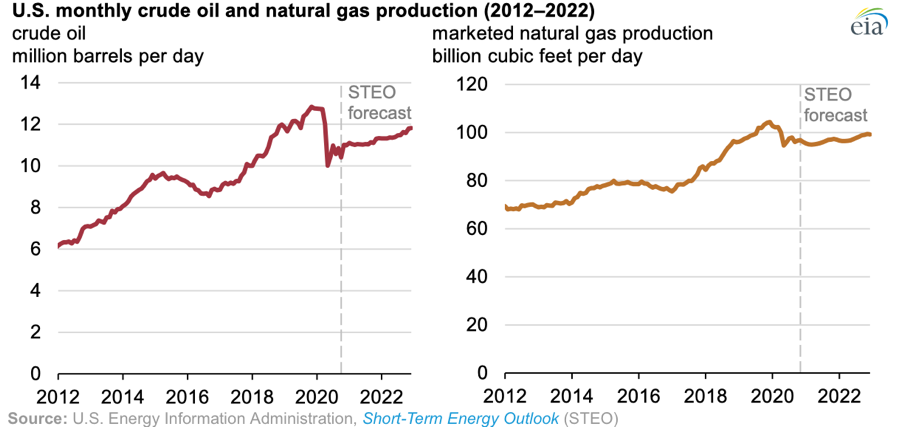

Based on findings by the Energy Information Administration, the decrease in natural gas demand in the U.S. is due to the low consumption of natural gas for electric power production because of the surge in prices relative to 2020. EIA anticipates a 1.1 billion cubic feet per day increase in residential and commercial natural gas usage and a 1.4 Bcf/d increase in industrial consumption from last year to this year, which would be a notable improvement.

The expected increase in demand for natural gas in the Asia-Pacific region is likely to be a strong driver of the energy industry in the foreseeable future, and many experts believe this region will be the largest contributor to industry growth in the coming years.

There are two macro-level developments that paint a very promising picture for what the future holds for energy infrastructure companies that own natural gas pipelines. First is the transition from coal to natural gas, which is likely to help pipeline operators monetize their existing infrastructure to a higher degree. Second is the 1 billion increase in the global population expected by 2030, and this growth in the population will create strong demand for new pipeline routes as governments would be required to cater to the growing energy demands of a larger population.

The company is on the correct path

Kinder has been focused on expanding its business scale by exporting natural gas and liquified natural gas from the Gulf Coast, which is one of the fastest-growing hubs for natural gas exports. The company is eyeing the attractive growth opportunity available in emerging markets, particularly in Asia, which is a risky yet prudent strategy to increase earnings. The favorable demographic characteristics in Asia will help Kinder Morgan attract higher prices for LNG exports, which could result in an expansion of profit margins.

Kinder Morgan is a cash-rich company, and for the last five years, the company has funded capital expenditures, buybacks and dividends with internally generated cash. This strong liquidity position will not only be helpful to navigate the challenges faced today but will also help the company establish strong competitive advantages that could lead to consistent economic profits.

Source: Investor presentation

The diversified portfolio of Kinder Morgan will be a driver of earnings growth as well. The International Energy Agency projects the overall energy demand to grow 20% in the next 20 years, and the fastest growth will come from hydropower, bioenergy and other renewables. The demand for natural gas is projected to increase by 29% as well, fueled by the transition from coal to natural gas. Kinder Morgan's pipelines are capable of transporting all these energy sources, and the investments the company has made to build such a diversified portfolio of assets are likely to pay off handsomely in the next couple of decades.

Takeaway

Kinder Morgan, unlike many energy companies, weathered the challenging macroeconomic conditions to an acceptable degree in 2020. This was possible because the company generates nearly 68% of revenue from take-or-pay contracts where energy companies are required to pay Kinder Morgan for the use of its pipelines regardless of throughput.

In the recovery phase of the current business cycle, it seems Kinder Morgan is likely to outpace its closest rivals and the overall energy sector from an earnings growth perspective because of its strong liquidity position and its dominant footprint in North America. The long-term outlook is promising as well, and the company is likely to reward shareholders handsomely via dividends and buybacks in the next couple of decades.

The quarterly dividend of 27 cents translates into a dividend yield of 6.05% at the market price of around $17.84 on May 10, and the company is well-positioned to increase dividends in the future. Kinder Morgan seems a good pick for value investors with a focus on income.

Disclosure: The author does not own any shares mentioned in this article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.