Why You Should Leave Pro Real Estate Investment Trust (TSE:PRV.UN)'s Upcoming Dividend On The Shelf

It looks like Pro Real Estate Investment Trust (TSE:PRV.UN) is about to go ex-dividend in the next 2 days. If you purchase the stock on or after the 30th of July, you won't be eligible to receive this dividend, when it is paid on the 15th of August.

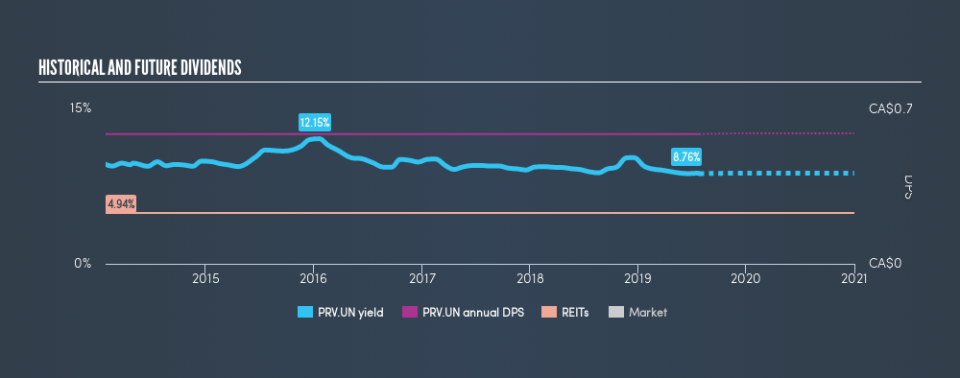

Pro Real Estate Investment Trust's next dividend payment will be CA$0.052 per share, and in the last 12 months, the company paid a total of CA$0.63 per share. Calculating the last year's worth of payments shows that Pro Real Estate Investment Trust has a trailing yield of 8.8% on the current share price of CA$7.19. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for Pro Real Estate Investment Trust

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Pro Real Estate Investment Trust paid out 118% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance. For regulatory reasons, it's not uncommon to see REITs paying out around 100% of their earnings. However, we feel Pro Real Estate Investment Trust's payout ratio is still too high, and we wonder if the dividend is being funded by debt. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 92% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's good to see that while Pro Real Estate Investment Trust's dividends were not covered by profits, at least they are affordable from a cash perspective. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're discomforted by Pro Real Estate Investment Trust's 20% per annum decline in earnings in the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

We'd also point out that Pro Real Estate Investment Trust issued a meaningful number of new shares in the past year. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Pro Real Estate Investment Trust's dividend payments are effectively flat on where they were five years ago. When earnings are declining yet the dividends are flat, typically the company is either paying out a higher portion of its earnings, or paying out of cash or debt on the balance sheet, neither of which is ideal.

Final Takeaway

From a dividend perspective, should investors buy or avoid Pro Real Estate Investment Trust? It's never fun to see a company's earnings per share in retreat. Additionally, Pro Real Estate Investment Trust is paying out quite a high percentage of its earnings, and more than half its cash flow, so it's hard to evaluate whether the company is reinvesting enough in its business to improve its situation. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Curious what other investors think of Pro Real Estate Investment Trust? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow .

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.