Here is Why Lululemon Athletica (NASDAQ:LULU) Rightfully Trades at a Premium

This article first appeared on Simply Wall St News .

Flying on the latest positive earnings results, Lululemon Athletica ( NASDAQ: LULU ) reached an impressive US$50b market cap in the last week. The stock doesn't seem to slow down, and it is a candidate to become a 10-bagger over a 5-year period soon. Yet, some critics might call the stock overbought or overextended. In this article, we will examine its returns to find out whether these valuations are justified.

Check out our latest analysis for Lululemon Athletica

Q2 Earnings Report

Non-GAAP EPS: US$1.65 (beat by US$0.46)

GAAP EPS: US$1.59 (beat by US$0.40)

Revenue: US$1.45b (beat by US$120m)

Y/Y Revenue Growth: 60.6%

FY21 Revenue Guidance: US$6.19b – US$6.26b (vs. US$5.98b consensus)

After extraordinary results, numerous analysts scrambled to push the price targets with notable changes, including Morgan Stanley – US$419, Piper Sandler – US$481, and the most optimistic Cowen at US$520 – 25% upside from the current levels.

CEO Calvin McDonald admitted that the company benefited from the changing social landscape, mainly the fact that people turned to more comfortable clothing in the pandemic, but also noted that the company is positioning for the post-pandemic world.

While the company is not without challenges – as it faces supply chain constraints and rising wages, these challenges are so prevalent nowadays that they are barely a surprise.

Furthermore, the company has no debt, and it has reduced the diluted shares outstanding by almost 7% in the last 5 years through stock buybacks . The company has used approximately half of the US$500m from the latest authorized buyback program.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE measures a company's yearly pre-tax profit (its return) relative to the capital employed in the business.Analysts use this formula to calculate it for Lululemon Athletica:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.33 = US$1.1b ÷ (US$4.4b - US$981m) (Based on the trailing twelve months to August 2021) .

Thus, Lululemon Athletica has a ROCE of 33%. That's a fantastic return and, it outpaces the average of 13% earned by companies in a similar industry. Thus, it is not surprising to see it trade at a premium against the competitors.

Check out our latest analysis for Lululemon Athletica

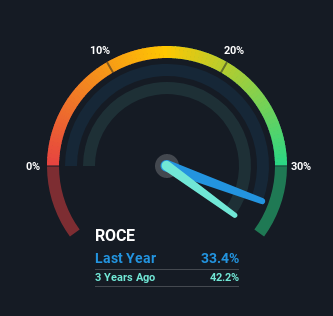

Above you can see how the current ROCE for Lululemon Athletica compares to its prior returns on capital, but there's only so much you can tell from the past.

If you're interested, you can view the analysts' predictions in our free report on analyst forecasts for the company .

What The Trend Of ROCE Can Tell Us

It's hard not to be impressed by Lululemon Athletica's returns on capital.Over the past five years, ROCE has remained relatively flat at around 33%, and the business has deployed 181% more capital into its operations.

Now considering ROCE is an attractive 33%, this combination is actually pretty appealing because it means the business can consistently put money to work and generate these high returns.If Lululemon Athletica can keep this up, we'd be very optimistic about its future.

The Bottom Line On Lululemon Athletica's ROCE

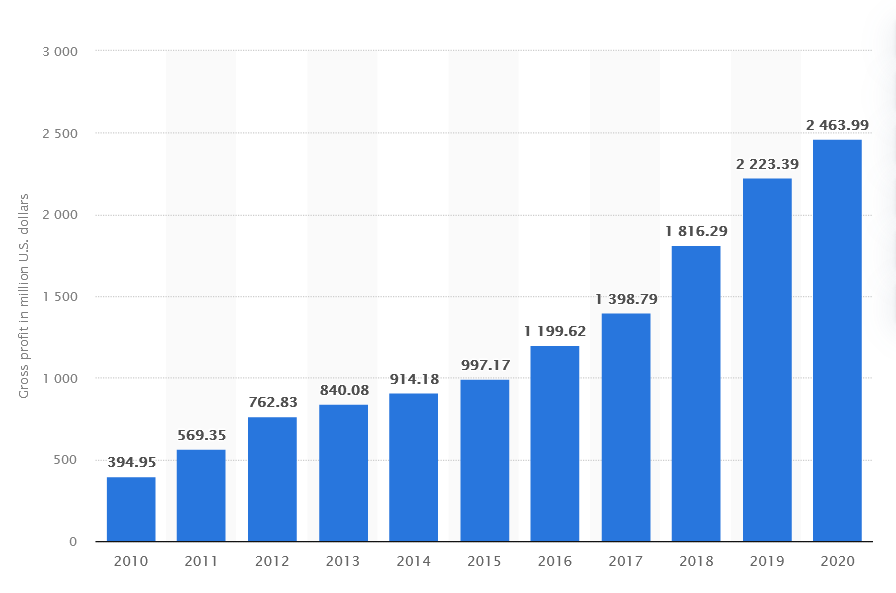

In short, we'd argue Lululemon Athletica mandates those optimistic forecasts since it's been able to compound its capital at very profitable rates of return.And the stock has done incredibly well with a 543% return over the last five years, so long-term investors are no doubt ecstatic with that result.

So while investors may account for the positive underlying trends, we still think this stock is worth looking into further.

Like most companies, Lululemon Athletica does come with some risks, and we've found 1 warning sign that you should be aware of.

Lululemon Athletica is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com