Why Monster Beverage (MNST) Continues to Outpace Its Industry

Monster Beverage Corporation MNST is trending up the charts, thanks to the continued strong demand for energy drinks. Product innovation plays a significant role in MNST's success. Its actions, including price increases, reducing reliance on imported cans and moving production closer to markets to mitigate the ongoing cost pressures, bode well.

Backed by the aforementioned tailwinds, MNST posted better-than-expected earnings in the quarter, while its top line lagged the Zacks Consensus Estimate. Meanwhile, sales improved 15.2% year over year, driven by continued strong demand for the energy drinks category. On a currency-adjusted basis, net sales rose 20.2%. Net sales to customers outside the United States rose 15.8% to $610.6 million, representing about 38% of the total net sales. On a currency-adjusted basis, sales to customers outside the United States improved 29.3%.

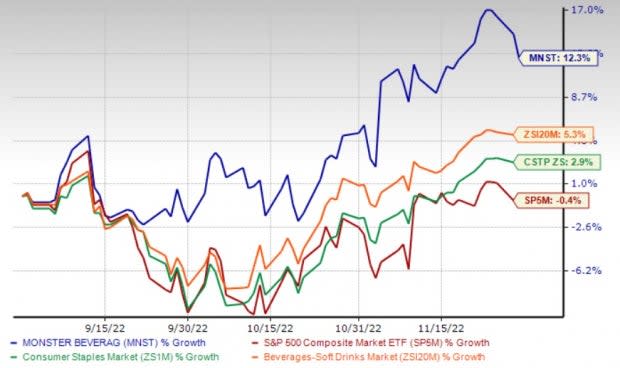

The Zacks Rank #3 (Hold) stock has gained 12.3% in the past three months, outperforming the industry and the Consumer Staples sector’s growth of 5.3% and 2.9%, respectively. The stock performance also compared favorably against the S&P 500’s fall of 0.4% in the same period.

The Zacks Consensus Estimate for Monster Beverage’s 2022 sales suggests growth of 15.2% from the year-ago period’s reported number, while earnings estimates indicate a decline of 11.3%.

Image Source: Zacks Investment Research

Factors to Aid Growth

Monster Beverage, which primarily markets and distributes energy drinks and alternative beverages, is a key beneficiary of the recent consumer awareness of health drinks. This has led to strength in its energy drink category, particularly the Monster Energy brand. We note that MNST offers a wide range of energy drinks brands such as Monster Energy, Java Monster, Cafe Monster, Espresso Monster, Monster Energy Mule, Juice Monster Pipeline Punch, Juice Monster Pacific Punch, Juice Monster Mango Loco, Monster Ultra Paradise and Monster Hydra Sport.

Management is optimistic about the strength in the global energy drinks category. It remains poised to gain from growth in the Monster Energy family of brands, and strength in Strategic and Affordable energy brands in the long run.

Monster Beverage also remains committed to product launches and innovation to boost growth. In third-quarter 2022, the company launched several products and expanded distribution in international markets.

The company is on track to launch Monster Energy Zero Sugar in fourth-quarter 2022, initially in the United States. Monster Energy Zero Sugar is developed to provide a zero-sugar variant of its original Monster Energy Green flavor. Monster Energy Lewis Hamilton Zero Sugar Energy Drink is likely to enter select EMEA markets in the fourth quarter of 2022, with a rollout to 20 additional markets in the first quarter of 2023.

In the first half of 2023, MNST plans to launch pure unflavored water, namely Monster Tour Water, in the United States in still and sparkling variants. The company intends to launch Rainstorm in 4 flavors in the first half of 2023. The company is optimistic about the launch of its first flavored malt beverage alcohol product, known as ‘The Beast Unleashed.’

Gains from the CANarchy acquisition, and a robust line-up of product launches for alcoholic and non-alcoholic drinks make it well-placed for long-term growth.

Monster Beverage continues to stand by its strategy to ensure product availability and solidify the continued long-term growth of its brands despite the ongoing supply-chain challenges. Some of the actions taken to navigate through the challenges are decreasing the company’s reliance on imported cans.

The company is currently purchasing aluminum cans from local sources in both the United States and EMEA. It expects the increased use of domestic cans to result in a reduction in the cost of sales over the next few quarters.

Additionally, Monster Beverage is implementing pricing actions to overcome the ongoing cost pressures. In third-quarter 2022, the company remained on track with the mitigation of higher production and distribution costs through pricing actions and lower promotional expenses. It implemented price increases for its products in the United States on Sep 1, 2022. The company also brought effective price increases in certain international markets in the third quarter. Some of these will be in addition to price increases already implemented earlier this year in order to mitigate inflationary cost pressures.

Hurdles to Overcome

Higher freight rates and fuel costs have been hurting Monster Beverage’s gross and operating margins for a while, which persisted in the third quarter as well. Inflationary operational costs for aluminum cans, shipping, freight and other inputs dented the company’s bottom line in the third quarter of 2022. In the quarter, the company continued to experience additional global supply-chain challenges, including the lack of adequate shipping containers, which resulted in shortages of certain ingredients and finished products.

Monster Beverage has been witnessing significant increases in the cost of sales, which have been majorly impacting the gross profit and the gross margin rate. Higher logistics costs, increased aluminum-can costs, unfavorable geographical and product sales, elevated ingredients, and other input costs, comprising secondary packaging materials and increased co-packing fees, hurt the cost of sales in the third quarter.

In addition to the aforementioned factors, Monster Beverage experienced a significant rise in distribution expenses, including increased fuel, freight and warehousing costs. This hurt operating expenses.

Stocks to Consider

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely Coca-Cola FEMSA KOF, Ambev ABEV and General Mills Inc. GIS.

Coca-Cola FEMSA produces, markets and distributes soft drinks throughout the metropolitan area of Mexico City, in Southeastern Mexico, and the metropolitan region in Buenos Aires, Argentina. It currently sports a Zacks Rank #1 (Strong Buy). KOF has a trailing four-quarter earnings surprise of 33.6%, on average. Shares of KOF have risen 9.7% in the past three months.

You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Coca-Cola FEMSA’s current financial-year sales and earnings suggests growth of 15.6% and 6.2%, respectively, from the year-ago period's reported figures. KOF has an expected EPS growth rate of 10.3% for three-five years.

Ambev is engaged in producing, distributing and selling beer, carbonated soft drinks, and other non-alcoholic and non-carbonated products in many countries across the Americas. ABEV currently has a Zacks Rank #2 (Buy). ABEV has a trailing four-quarter earnings surprise of 4.4%, on average. Shares of ABEV have risen 0.6% in the past three months.

The Zacks Consensus Estimate for Ambev’s current financial-year sales and earnings suggests growth of 19.4% and 6.7%, respectively, from the year-ago period’s reported figures. ABEV has an expected EPS growth rate of 9.1% for three-five years.

General Mills is a global manufacturer and marketer of branded consumer foods sold through retail stores. It currently has a Zacks Rank of 2. GIS has an expected EPS growth rate of 7.5% for three-five years. Shares of GIS have rallied 7.8% in the past three months.

The Zacks Consensus Estimate for General Mills’ current financial-year sales and earnings per share suggests growth of 2.7% and 3.8%, respectively, from the year-ago period’s reported figures. GIS has a trailing four-quarter earnings surprise of 6.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Ambev S.A. (ABEV) : Free Stock Analysis Report