Why Northern Dynasty Minerals Stock Rocketed 37% in January

What happened

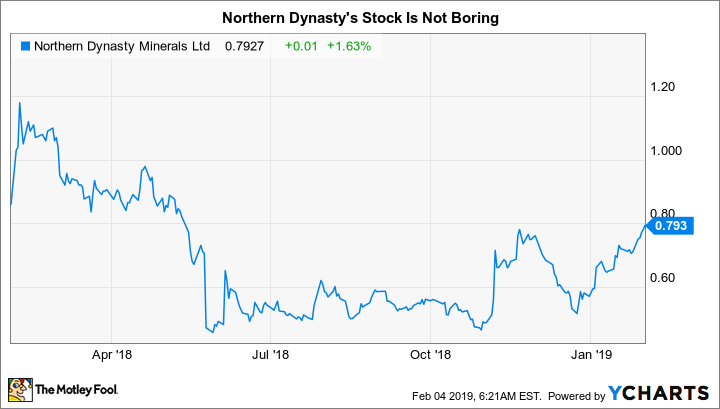

The shares of Northern Dynasty Minerals (NYSEMKT: NAK) rose an incredible 37% in January, according to data provided by S&P Global Market Intelligence. Believe it or not, however, that's not an outlandish gain for the company, which is attempting to develop the Pebble gold and copper project in Alaska. After some good news in November, the stock rocketed higher by 55%.

Image source: Getty Images.

So what

The thing is, there wasn't much news to back the January gain. However, gold prices were fairly strong in the last days of the month. Since Pebble is one of the largest undeveloped gold and copper projects globally, speculators tend to jump aboard when commodity prices rise. In fact, assuming Northern Dynasty can get the mine built, it could be a very attractive investment. Unfortunately, that won't happen for years, and the stock is a high-risk bet that most investors should avoid until there's more development progress. (Sell-offs here can be just as dramatic as the rallies.)

That said, there was some funding news in December and January that was interesting to see. With a big legal bill coming due related to U.S. Environmental Protection Agency interactions, Northern Dynasty sold warrants to raise cash. Those sales took place in December, with the company filing documentation for the transaction in January. The warrants allowed the company to raise around $6.3 million. However, the January regulatory filing provides for up to $50 million in security sales.

There are two potentially positive takeaways from these activities. First, investors remain willing to provide Northern Dynasty with the cash it needs to move through the process of building the Pebble project. At this point, the company would be dead in the water without market support. Second, it clearly has high hopes for continuing to raise cash.

Now what

Most investors should avoid Northern Dynasty. It's just too speculative, since its primary asset is a mine that it hopes to build over the next decade. And after a key investor in the project backed out in 2018, Northern Dynasty is currently on the hook for all of the costs. Yes, it looks like the company is preparing to sell securities so it can keep moving forward. Yes, the market still appears willing to keep providing cash. But that doesn't change the astounding level of uncertainty surrounding the stock. There's huge long-term potential, but it will only come to fruition if a lot of things go right for Northern Dynasty Minerals.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.