Why Is POOL Up 2.2% Since the Last Earnings Report?

A month has gone by since the last earnings report for Pool Corporation POOL. Shares have added about 2.2% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Pool Beats Q3 Earnings & Revenue Estimates

Pool posted solid third-quarter 2017 results, wherein both the top line and bottom line surpassed the Zacks Consensus Estimate.

Quarter Discussion

Pool’s third-quarter earnings of $1.16 per share surpassed the Zacks Consensus Estimate of $1.14 by 1.8%. Moreover, the figure rose 13% on a year-over-year basis backed by higher sales.

Net sales came in at $743.4 million, marking an increase of 8% year over year. Continued increases in swimming pool repair and remodel activities including major pool refurbishment and replacement of key pool equipment, led to the improvement in sales. As a result, sales outpaced the Zacks Consensus Estimate of $728 million by over 2%.

The recent weather events negatively impacted the quarter’s earnings and sales by roughly 2 cents and $4 million, respectively.

Behind the Headline Numbers

Pool reports operations under two segments, the Base Business segment (constituting majority portion of the business) and the Excluded segment (sale centers excluded from base business).

The Base business segment witnessed sales growth of 6% year over year, given the resiliency and favorable characteristics inherent to its business and consistent market share gains.

Gross profit increased 9% year over year to a record of $216.6 million, with base business gross profit increasing 7%. Also, the company’s gross margin in the third quarter was 29.1%, up 20 basis points (bps) year over year, given product mix and benefits from sourcing initiatives.

Additionally, selling and administrative expenses (operating expenses) increased roughly 7% year over year to $134.7 million in the reported quarter, with base business operating expenses increasing 5%.

While operating income improved 10% from the year-ago quarter to $81.9 million, operating margin increased 30 bps year over year to 11%.

Earnings Guidance for 2017

For 2017, Pool anticipates earnings in the band of $4.01 to $4.11 per share, down from the earlier guided range of $4.12–$4.32.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last month as none of them issued any earnings estimate revisions.

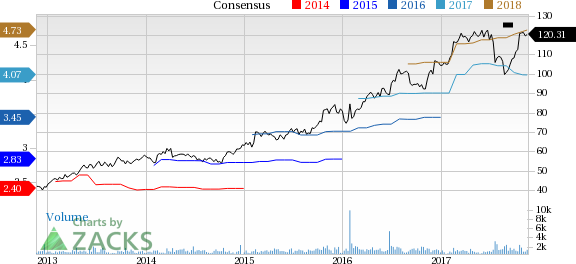

Pool Corporation Price and Consensus

Pool Corporation Price and Consensus | Pool Corporation Quote

VGM Scores

At this time, Pool's stock has a strong Growth Score of A, though it is lagging a lot on the momentum front with a D. The stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than value investors.

Outlook

Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pool Corporation (POOL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research