Why Retail Stocks Fell in May

What happened

A broad selection of retail stocks got pounded last month as the sector reacted to trade tensions between the U.S. and both China and Mexico. Retailers had previously warned about the potential effects of tariffs. The sector is highly sensitive to import taxes, especially from goods made in China since so many everyday products U.S. retailers sell come from there.

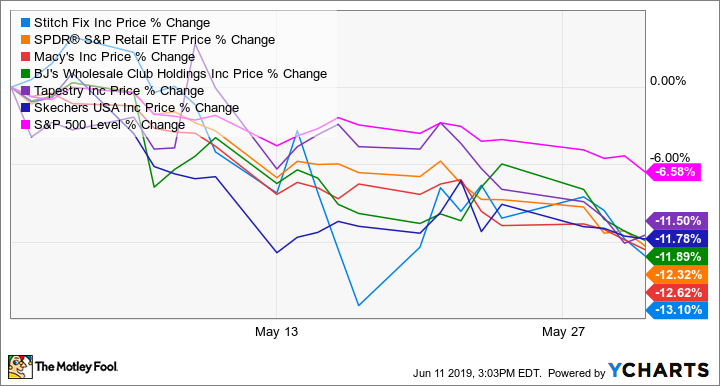

As a result of those tensions, shares of SPDR S&P Retail ETF (NYSEMKT: XRT) lost 12.3% in May, according to data from S&P Global Market Intelligence. And a number of retail stocks fell by double digits, including Macy's (NYSE: M), which lost 13%; Tapestry (NYSE: TPR), which fell 12%; Skechers (NYSE: SKX), which gave up 12%; BJ's Wholesale (NYSE: BJ), down 12%; and Stitch Fix (NASDAQ: SFIX), ending the month off 13%.

Image source: Getty Images.

As the chart below shows, the stocks moved similarly over the course of the month, more or less tracking with the broader decline in the Retail ETF, which includes dozens of diverse retailers.

So what

Coming into May, stocks were trading at all-time highs, and a long-awaited deal with China seemed near as Treasury Secretary Steven Mnuchin said the two sides were in the "final laps" of sealing an agreement.

However, the market was first rattled on May 6 when President Trump took to Twitter to suggest that he would ratchet up tariffs on China to 25%, from 10%, by the end of the week if it didn't meet U.S. demands. He also threatened to add tariffs on a different set of goods worth $300 billion. As the higher rates took effect, China responded in kind, promising to levy import taxes on $60 billion worth of American imports by June. Later in the month, the Trump administration announced it was blacklisting Huawei, the Chinese smartphone maker, though a few days later the White House delayed the measure by 90 days, giving the two sides time to negotiate.

Though a number of retailers reported earnings in May, tariffs remained a central focus on earnings calls, as retailers continued to plead their case that tariffs would hurt the U.S. economy and, more specifically, the retail sector. Macy's CEO Jeff Gennette acknowledged that the recent tariff hike would hurt his company's furniture business, but said it was taking steps to mitigate the effects of the trade war and was ready to adjust its supply chain if the administration imposed tariffs on the set of Chinese imports that had yet to face them.

Other retailers were also reacting to the import taxes. Skechers was one of 170 footwear companies to sign a letter to President Trump last month warning that hiking tariffs to 25% would be "catastrophic" for American consumers and businesses.

Tapestry, the maker of Coach handbags, moved production out of China to cope with tariffs, but even that strategy has been met with challenges as production in countries like Vietnam has been delayed.

Stitch Fix addressed the concerns on its recent earnings call, noting that the tariffs imposed thus far have had little impact on its business, as clothing hasn't been subject to tariffs. But CFO Paul Yee said the company was making preparations for potential tariffs, including moving production out of China.

Now what

Through the first seven trading sessions in June, retail stocks recouped some of last month's losses. The SPDR S&P Retail ETF is up 4.5% so far. Helping the situation was a resolution with Mexico over potential tariffs. There were also indications from the Federal Reserve that the central bank was willing to lower interest rates if the trade war slows growth.

With retail earnings season now behind us, the trade war should continue to be the major issue moving the sector for the coming weeks. Trump and President Xi Jinping of China are set to meet at the G20 summit in Japan at the end of the month. But Trump on Tuesday said he was ready to impose tariffs on another $300 billion in goods from China if Xi did not show up to meet him. Clearly, the situation remains volatile.

More From The Motley Fool

Jeremy Bowman owns shares of Stitch Fix. The Motley Fool owns shares of and recommends Skechers, Stitch Fix, and Tapestry. The Motley Fool has a disclosure policy.