Why Signet Can Deliver a Successful Turnaround

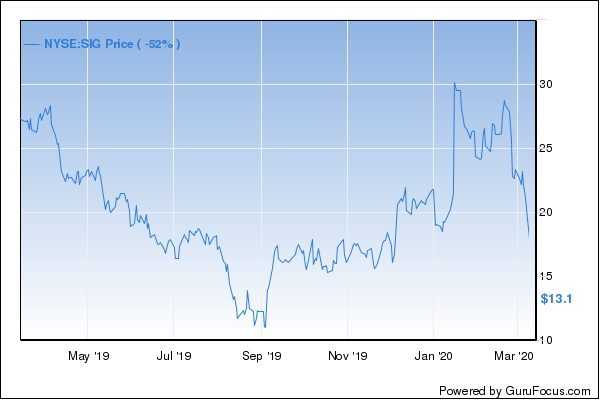

While Signet Jewelers (NYSE:SIG) has experienced a challenging 12-month period that has included a 78% decline in its stock price, the company offers recovery potential.

The retailer's focus on increasing the size of its total addressable market through offering new services, as well as enhancing its digital opportunities, suggests that it can deliver improving returns in an uncertain wider retail market.

New services

The company is expanding its range of services to increase its appeal to a wider range of consumers. For example, in its most recent quarter, the business has been testing piercing services across a range of its stores. They have proved popular among 11- to 17-year-olds, with whom Signet is aiming to build an early customer relationship.

This could increase the company's chances of gaining further sales from its younger customers in the future at key life moments such as engagements and major birthdays. According to its most recent quarterly results the business plans to further expand its piercing services, with it anticipating margin improvement as a result.

In addition, Signet is aiming to improve its range of services. For example, it is investing in better staff training and is developing new tools and technology to reduce the amount of time it takes to repair to its customers' products. This has led to an improvement in its repair net promoter score over the last four quarters, while increasing customer demand for its repair services may promote cross-selling.

Personalization

Signet is seeking to differentiate its offering from sector peers through customization. In its most recent quarter, the company expanded its Vera Wang online "design your own" tool into its stores. This has resonated with its customers, and the company is set to roll it out across all of its Zales stores in the remainder of its current fiscal year.

The company's online customization options are just one part of its improving omnichannel offering. It continues to make significant investments in the speed of its platform, as well as in boosting the usability of its mobile offering through faster load speeds and improved image quality. This is expected to increase its customer conversion rates and lead to increasing e-commerce penetration following its rise to 11.5% of the company's sales in its most recent quarter.

Potential challenges

The recent sales performance has been disappointing. For example, in its most recent quarter Signet reported a decline in its same store sales of 1.5% versus the same period of the previous year. Its finances could come under further pressure from weak consumer sentiment, which is currently at its lowest level since the start of the year, according to the University of Michigan's index.

Although previous tariffs have affected the company's imports from China, the introduction of List 4 tariffs on Sept. 1 is applicable to its jewelry merchandise. This could hurt its sales if additional costs are passed on to its customers, or reduce its margins if the company seeks to absorb them.

In response to additional tariffs, the company is working with its vendors to relocate a large pportion of its China manufacturing footprint to other countries. It expects to reduce its merchandise spend exposure to China to a mid-teens percentage level by the end of its 2020 fiscal year, and to make further reductions thereafter.

In addition, Signet is expecting to reduce its costs by between $70 million and $80 million in its current fiscal year. It is reducing costs through workforce optimization and new technology, with its cost reduction target being $225 million in total by fiscal 2022.

Outlook

The company's earnings per share are set to flat-line in its next fiscal year, according to market consensus forecasts. Since Signet trades on a forward price-earnings of 5.4, it appears to offer good value for money.

Disclosure: the author has no position in any stocks mentioned.

Read more here:

Why Abercrombie & Fitch Is a Buy

La-Z-Boy: An Undervalued Recovery Stock

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.