Why a Strong Product Mix Will Move General Motors Company Stock to $50

Shares of General Motors Company (NYSE:GM) should have held its yearly high but instead pulled back after a solid run-up that started in June. The investor sentiment is getting better. Instead of trailing Tesla Inc (NASDAQ:TSLA) by market capitalization, GM is now back on top. The company earned the recognition as it has a revamped suite of attractive vehicles and is returning shareholder value. Value investors should consider GM stock as the stock dips.

Source: Shutterstock

GM earned a solid $1.32 per share in its third quarter. The company maximized shareholder returns by buying back shares and paying a dividend, all of which totaled a return of invested capital of 27.6% in the last four quarters. Despite lower planned production in the period, GM still generated $2.5 billion in EBIT. It is also simplifying its business. It will close the sale of its Financial European operations by the end of this year and will merge all units outside of China and North America. This should improve General Motor’s business focus and raise its operating efficiencies.

GM’s financial results will impress investors. It delivered $82.6 billion in revenue from North America year-to-date and $9 billion in EBIT. Its adjusted margin was 10.9%. Cost-cutting is not slowing down, either. The company found $5 billion in savings since 2014 and will save $6.5 billion by the end of 2018.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Resonating Brand

Consumers are taking a liking to GM’s lineup of vehicles. The brand resonates with them because of its successful launch of new vehicles. Collectively, sales of GMC, Chevrolet, Buick and Cadillac all topped 25%, the best performance in GM’s history. In China, a region notoriously difficult for American manufacturers, GM launched five new models in the quarter. If its EV model, the Baojun E100 EV, does well, its eco-friendliness will complement the government’s goals of promoting green industries.

GM is also innovating in self-driving cars. It opened an office in New York City and plans to test Lidar technology there. Though the technology is developing at a rapid pace, Ambarella Inc (NASDAQ:AMBA), Intel Corporation’s (NASDAQ:INTC) MobileEye unit and Nvidia Corporation (NASDAQ:NVDA) are all developing the AI technologies that autonomous-driving vehicles will need. At a P/E of 9.1 times and a forward P/E of just seven times, GM stock just happens to give investors an inexpensive means for exposure in this fast-growing area of technology.

Outlook for GM Stock

GM’s management expects profit margin holding at 10% in 2018. It is broadening its truck and SUV platform to meet specific customer needs. EBIT margin will hold steady if General Motors maintains a breakeven point at a SAAR level of 10–11 million units. Margins improved from 8.6%, even though revenue was higher. Investors should expect the profitability increase trending higher over time, helped by a good mix of products, cost cutting and a better-focused company.

In Q3, passenger car demand weakened, but CUVs and trucks offset that negative impact on GM’s overall performance. The company should continue to benefit from the favorable mix in demand for the bigger vehicles next year. The trend for owning these bigger, utility vehicles will persist in the near term.

GM forecasts hitting 70 days of supply range. Next month, this will be much lower than last year (2016) but will be favorably balanced. For example, passenger car inventory will be 50 days, trucks and SUVs will be 80 days and crossovers will be 60–70 days.

Takeaway for GM Stock

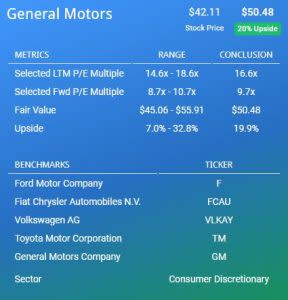

Based on nine financial finbox.io models, the GM stock price has at least 4% more upside. But on a relative market comparison to Ford Motor Company (NYSE:F), Fiat Chrysler Automobiles NV (NYSE:FCAU) and Toyota Motor Corp (ADR) (NYSE:TM), GM stock should trade to at least $50 a share.

If the company’s momentum for stronger profits keeps up, the stock could get there by next year.

Disclosure: Author owns shares of Ford Motor Company.

More From InvestorPlace

The post Why a Strong Product Mix Will Move General Motors Company Stock to $50 appeared first on InvestorPlace.