Why Target's Prospects Remain Sound

Target (NYSE:TGT) stock has suffered a significant drawdown lately after investors were spooked by a series of disappointments, including a poor earnings report, rising systemic risk and an announced inventory cost increase by the company. Consequently, Target's stock has drawn down by nearly 30% in the past month, which conveys an overreaction by investors in my opinion.

I believe Target's prospects remain bright, and the stock's recent drawdown provides a lucrative entry-point to value-seeking investors; here's why.

An overreaction to recent bad news

Target released its fiscal first-quarter earnings report last month and revealed an earnings miss of 87 cents per share compared to estimates amid rising input costs severely damaging the income statement. During the quarter, Target's gross margins fell to 25.7% from 30% a year ago amid rising costs of production and retreating economies of scale.

Furthermore, Target announced this week that its inventory costs would rise over the next quarter due to inventory liquidation implications. During the press briefing, Target's Chairman and CEO, Brian Cornell, stated:

"The additional steps we are announcing today will ensure that we deliver for our guests while driving further growth. While these decisions will result in additional costs in the second quarter, we're confident this rapid response will pay off for our business and our shareholders over time, resulting in improved profitability in the second half of the year and beyond."

Although matters might look bad for Target retrospectively, I expect its input costs to wane in the future. Additionally, the inventory liquidation process probably won't have a massive bearing on the company's long-term fortunes.

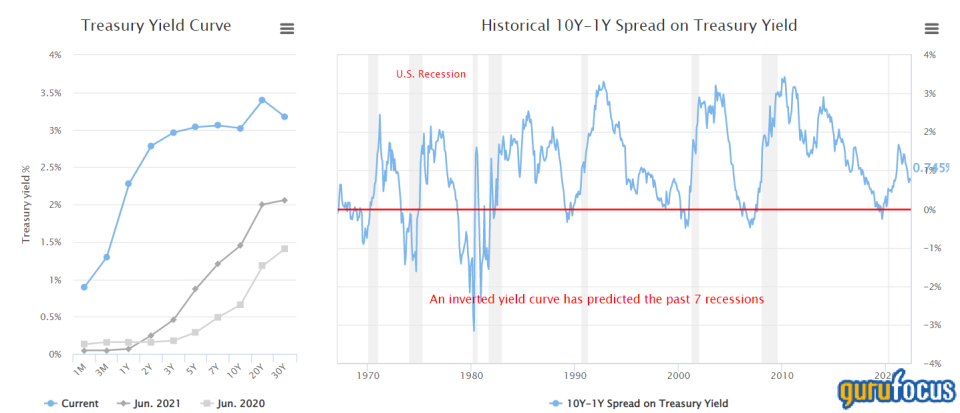

To delve into the cost concerns more, I'd like readers to consider the yield curve and Target's market segmentation. The yield curve suggests that interest rates could rise significantly in the short term, subsequently stabilizing rising input costs and Target's wage bill. Of course, contractionary policies provoke cyclicality in the consumer space as well, but Target operates in the defensive consumer goods market, which is non-cyclical. Thus, Target's top-line sales growth will likely sustain while its input costs wane.

Lastly, I'd like to add my two cents on the inventory liquidation. Although no formal steps have been announced, I'm assuming the process would be a standard reserve liquidation, which could see much of Target's inventory being disposed of at significantly discounted prices. We'll likely see some damage on the income statement. However, inventory liquidation is a frequent occurrence in the retail space, and likely won't derail Target's stock any further.

Valuation and dividend boost

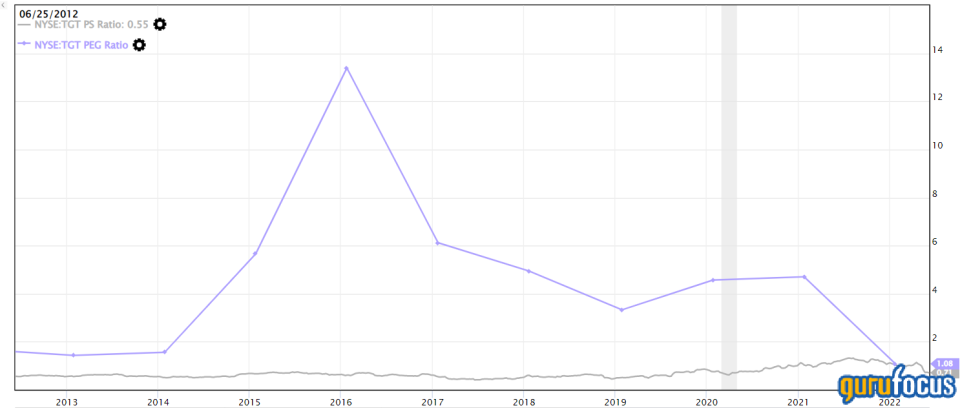

Quantitative metrics suggest that Target's current price level is undervalued. Firstly, the company's diluted earnings per share is garnering momentum once more, and secondly, Target's PEG ratio of 0.74 implies that the market has not yet priced in the growth potential.

In addition, Target's price-earnings and price-sales ratios are trading near normalized discounts worth 25% and 10%, respectively, implying that there's deep value in the cards.

Furthermore, Target announced on Thursday that it's increasing its quarterly dividend by 20% to $1.08 with a forward dividend yield of 2.76%. The dividend increase conveys the company's confidence in its long-term prospects and provides investors with a solid income-based investment opportunity.

The bottom line

Target is at a price level which is both quantitatively and qualitatively lucrative, in my opinion. The long-term prospects remain perfectly intact, and Target's stock is a solid dividend option after the recent increase.

This article first appeared on GuruFocus.