This Is Why We Think Aspira Women's Health Inc.'s (NASDAQ:AWH) CEO Might Get A Pay Rise Approved By Shareholders

Shareholders will be pleased by the robust performance of Aspira Women's Health Inc. (NASDAQ:AWH) recently and this will be kept in mind in the upcoming AGM on 22 June 2021. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

Check out our latest analysis for Aspira Women's Health

Comparing Aspira Women's Health Inc.'s CEO Compensation With the industry

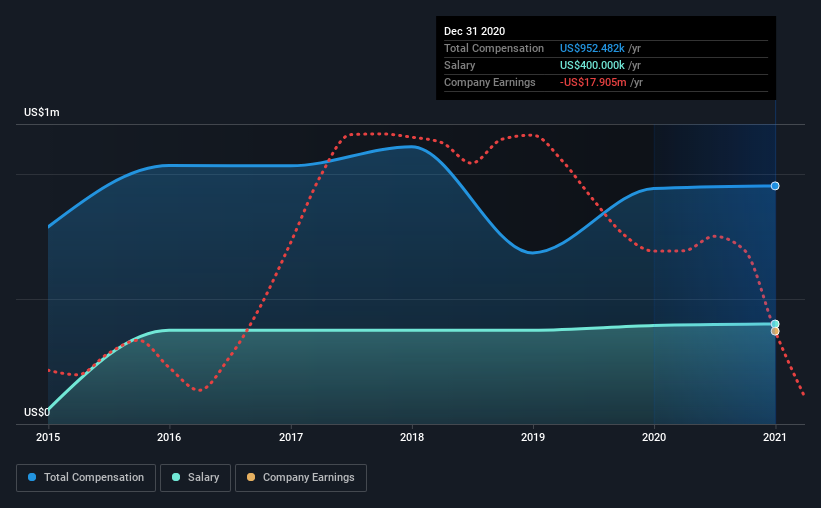

Our data indicates that Aspira Women's Health Inc. has a market capitalization of US$664m, and total annual CEO compensation was reported as US$952k for the year to December 2020. That is, the compensation was roughly the same as last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$400k.

On examining similar-sized companies in the industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$3.0m. Accordingly, Aspira Women's Health pays its CEO under the industry median. Furthermore, Valerie Palmieri directly owns US$1.3m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$400k | US$394k | 42% |

Other | US$552k | US$548k | 58% |

Total Compensation | US$952k | US$942k | 100% |

On an industry level, roughly 22% of total compensation represents salary and 78% is other remuneration. Aspira Women's Health pays out 42% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Aspira Women's Health Inc.'s Growth Numbers

Aspira Women's Health Inc.'s earnings per share (EPS) grew 3.2% per year over the last three years. The trailing twelve months of revenue was pretty much the same as the prior period.

We would prefer it if there was revenue growth, but the modest improvement in EPS is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Aspira Women's Health Inc. Been A Good Investment?

We think that the total shareholder return of 499%, over three years, would leave most Aspira Women's Health Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 5 warning signs (and 1 which shouldn't be ignored) in Aspira Women's Health we think you should know about.

Switching gears from Aspira Women's Health, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.