Why Is Transdigm Group (TDG) Down 1.7% Since its Last Earnings Report?

It has been about a month since the last earnings report for Transdigm Group Incorporated TDG. Shares have lost about 1.74% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is TDG due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

TransDigm's Q1 Earnings Impressive, Revenues Beat

TransDigm reported first-quarter fiscal 2018 adjusted earnings of $5.58 per share, which reflected growth of a whopping 121.4% year over year. The bottom line gained from the favorable impact of the recent tax reforms.

Decent top-line growth and improvements in the operating margin also drove earnings. In addition, continued efforts to boost productivity, lower refinancing costs as well as lower acquisition-related costs proved conducive to earnings growth. This was partially offset by higher interest outlay.

Inside the Headlines

Net sales for the reported quarter amounted to $848 million, reflecting year-over-year growth of 4.2%. However, the top line missed the Zacks Consensus Estimate of $862 million.

Decent growth in Commercial Aftermarket (up 10% year over year) revenues supplemented the top-line performance. Furthermore, contributions from the previously-completed acquisitions boosted the overall sales performance during the fiscal first quarter. TransDigm’s commercial aftermarket transport business witnessed solid year-over-year revenue growth. However, Defense and Commercial OEM remained flat year over year.

TransDigm’s EBITDA (earnings before interest, taxes, depreciation and amortization) grew 18.4% year over year to $382.5 million.

During fiscal 2017, TransDigm had announced the acquisition of three add-on aerospace product lines, for a total consideration of roughly $100 million. These product lines mainly comprise proprietary, sole-source products with significant aftermarket content. The product lines are in sync with the company’s long-term plan and highlight its strategy to acquire proprietary aerospace businesses with significant aftermarket content, in a bid to fortify its core business.

The acquired business lines have combined revenues of about $32 million and will be consolidated into TransDigm’s existing businesses. The company financed the acquisitions through existing cash on hand.

These acquisitions will add to TransDigm’s product range with the proprietary products which enjoy strong positions on high use of platforms, robust aftermarket content and an excellent reputation. Products offered include highly engineered aerospace controls, quick disconnect couplings, as well as communication electronics.

Liquidity

TransDigm ended the fiscal first quarter with cash and cash equivalents of $857.9 million, up from $650.6 million as of Sep 30, 2017. At the end of the reported quarter, the company’s long-term debt was $11.4 billion, nearly flat compared with the figure recorded at the end of September 2017.

Fiscal 2018 Guidance

Concurrent with the fiscal first-quarter results, the company reiterated its revenue outlook and revised its earnings guidance for fiscal 2018, to incorporate the new tax regulations. Adjusted earnings per share are now forecast to be in the band of $16.95-$17.59 per share, in comparison to the earlier guided range of $12.78-$13.42 per share. The company had generated earnings of $12.38 per share in fiscal 2017.

Sales are expected to lie in the range of $3,645-$3,725 million (compared with $3,504 million reported in fiscal 2017). The fiscal 2018 guidance assumes that commercial aftermarket and OEM revenues will grow in the mid-single-digit percentage range, while defense revenues will be up in the low- to mid-single-digit percentage range.

Estimated net income from continuing operations lies in the band of $906-$942 million, up from the earlier projection of $702-$738 million, while EBITDA is likely to be in the range of $1,805-$1,855 million.

How Have Estimates Been Moving Since Then?

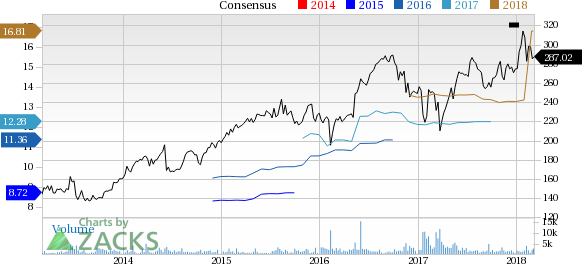

In the past month, investors have witnessed an upward trend in fresh estimates. There have been four revisions higher for the current quarter compared to one lower. In the past month, the consensus estimate has shifted by 15.21% due to these changes.

Transdigm Group Incorporated Price and Consensus

Transdigm Group Incorporated Price and Consensus | Transdigm Group Incorporated Quote

VGM Scores

Currently, TDG has a subpar Growth Score of D, however its Momentum is doing a lot better with an A. However, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for momentum based on our styles scores.

Outlook

Estimates have been broadly trending upward for the stock and the magnitude of these revisions looks promising. It comes with little surprise TDG has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Transdigm Group Incorporated (TDG) : Free Stock Analysis Report

To read this article on Zacks.com click here.