Why TransEnterix Stock Tanked Today

What happened

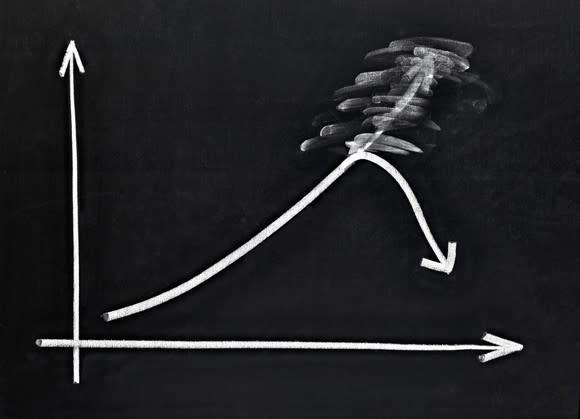

Shares of TransEnterix (NYSEMKT: TRXC), an early commercial-stage robotic surgery company, ended today's trading session down another 16.4%. The company's shares have now given back a healthy 22.3% of their enormous gains following the Food and Drug Administration's (FDA) approval of its Senhance Surgical Robotic System on October 13.

Image Source: Getty Images.

So what

This extreme volatility appears to stem from two core issues. First off, TransEnterix needs to raise capital in a big way. Turning to the specifics, the company stated during its second-quarter earnings report that it didn't have sufficient financial resources for the next 12 months -- and that bleak estimate didn't account for the enormous cost of launching the Senhance system in the United States.

Secondly, TransEnterix is attempting to steal market share away from the 800-pound gorilla, which is Intuitive Surgical's (NASDAQ: ISRG) da Vinci system. Intuitive Surgical presently has a functional monopoly in the robotic-surgery game by virtue of its 17-year head start on the rest of the field. As such, it won't be easy to convince hospital administrators to switch sides at this point.

Robotic surgery systems, after all, are expensive to purchase and require extensive training to operate and maintain. In addition, Intuitive has long-established relationships with its customer base.

Now what

Because of TransEnterix's limited financial resources and commercial infrastructure, the company's best play might be to sell itself in the wake of Senhance's FDA approval. If the company decides to take a go-it-alone approach, it may simply not be able to overcome Intuitive's first-mover advantage.

Novel medical devices also tend to have exceptionally slow penetration rates, which doesn't bode well for a poorly capitalized company like TransEnterix. That doesn't mean that TransEnterix is destined to disappoint investors, but the road ahead is far from certain.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

George Budwell has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Intuitive Surgical. The Motley Fool has a disclosure policy.