Why Trivago N.V. Stock Jumped 19% Last Month

What happened

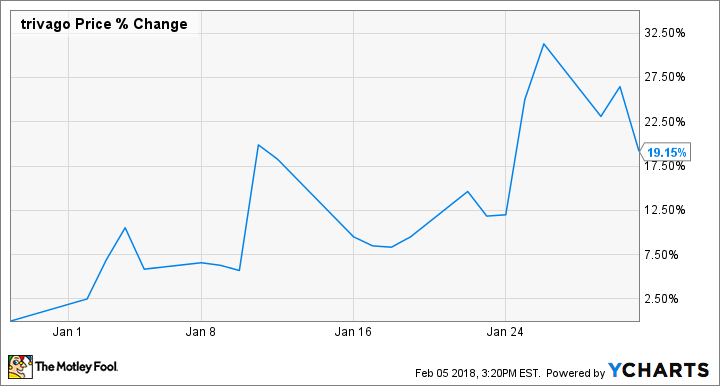

Shares of Trivago N.V. (NASDAQ: TRVG) moved higher last month, apparently on a short squeeze, as there was little company-specific news out on the hotel-booking platform. According to data from S&P Global Market Intelligence, the stock finished the month up 19.2%.

As you can see in the chart below, it was a volatile month for the stock, with no clear theme visible in its gains:

So what

From a wider perspective, Trivago's volatility in January was just a continuation of the stock's rocky history, as the stock had doubled at one point last year before finishing 2017 down 42%.

Last month, there was no direct news out on Trivago, but shares seemed to rise on a short squeeze, as bearish investors covered their bets while the stock rose, pushing it higher. About 20% of the stock is sold short.

The stock had a number of high-volume days when it rose for no apparent reason, first on Jan. 4 when it rose 3%, and then on Jan. 11 when it surged 13%. Finally, the stock had its biggest gains of the month over a two-day span on Jan. 25 and Jan. 26, when it climbed 17%.

Image source: Getty Images.

Now what

The online travel sector has been pressured of late; Priceline Group has scaled back on ad referrals to companies like Trivago and TripAdvisor as competition in the industry seems to be increasing. As a result, many of the sector's stocks have fallen in recent months. Trivago, meanwhile, has seen its revenue growth suddenly tank; analysts now expect sales to decline in the current quarter.

We'll learn more when the company reports fourth-quarter earnings on Wednesday. Analysts expect revenue to grow 8.3% to $229 million, and see a per-share loss of a penny, down from a $0.03 per-share profit a year ago. Guidance will be important, since the stock could tumble if management doesn't have a plan for boosting revenue growth.

More From The Motley Fool

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Priceline Group and TripAdvisor. The Motley Fool recommends Trivago. The Motley Fool has a disclosure policy.