Why Vitamin Shoppe Has the Right Growth Strategy

- By Robert Stephens, CFA

Changes to Vitamin Shoppe Inc.'s (VSI) strategy could catalyze its financial performance after a disappointing quarter. The company is set to invest heavily in its omnichannel offering, where greater personalization and flexibility may enhance the customer experience.

It is also seeking to innovate and strengthen its pipeline of new products. A review of its stores could help to improve productivity and efficiency. This is expected to contribute to rising profitability in the current fiscal year, which could continue over the medium term.

Warning! GuruFocus has detected 3 Warning Signs with VSI. Click here to check it out.

The intrinsic value of VSI

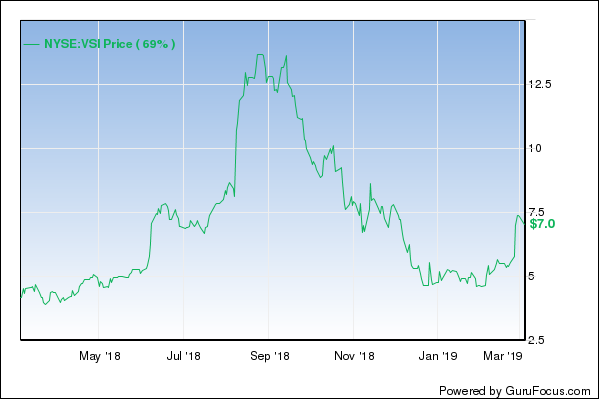

Having risen 76% in the last year versus a 3% gain for the S&P 500, the stock is appealing.

Omnichannel investment

Increased investment in the company's omnichannel experience is expected to lead to an improved customer experience. Central to this initiative will be the continued development of the VShoppe app, which will provide greater scope for personalized messaging, while offering easy reordering and auto delivery. It will also provide customers with access to special events, special sales days and other offerings that incentivize engagement.

Since omnichannel shoppers have been found to spend more than single-channel shoppers, Vitamin Shoppe intends to offer greater flexibility in terms of ordering online and picking up in store. It will introduce a digital personalized solution which seeks to simplify the customer experience, given the wide range of products it sells. For example, through a series of questions, customers will be provided with several recommendations based on their unique requirements. Customer feedback in the test market has been positive, with new customer acquisition and capture rates outpacing the rest of the chain.

Evolving strategy

Vitamin Shoppe is seeking to develop an improved product pipeline as it aims to be the first to market on emerging trends. It will increase its private brand portfolio of products, while improving its private brand sales penetration. This includes refreshed core products that are expected to become increasingly relevant to customers. The introduction of its lifestyle brand, V-thrive, is targeted toward experienced wellness enthusiasts and has the potential to catalyze its growth rate. Likewise, the launch of the premium BodyTech Elite brand could broaden the company's appeal to experienced fitness enthusiasts.

As part of its evolving strategy, the company is rationalizing its store estate. It is closing 60 to 80 underperforming stores over the next three years. At the same time, it will open new stores in strategic markets that will be smaller. The company is testing new formats and designs it is hoping will be more relevant to today's consumers.

Risks

The recent performance of Vitamin Shoppe has been disappointing. In the fourth quarter, for example, its revenue declined 5.1% annually. In-store comparable sales fell 5.4% and digital comparable sales dropped 0.1%, with total comparable sales declining 4.7%. In 2019, flat to negative single-digit comparable sales are expected. Although earnings per share growth of 7% is forecast for the 2020 fiscal year, the stock has a forward price-earnings ratio of 22. This suggests it lacks a margin of safety.

In response to the disappointing financial performance, Vitamin Shoppe will focus on becoming more efficient. It plans to optimize its distribution centers, while simultaneously enhancing its retail and direct-to-consumer transportation networks. It will also eliminate unproductive products, while leveraging data analytics to ensure its products are priced competitively. Improved efficiency measures are expected to result in a 100 to 200-basis point improvement in its selling, general and administrative costs as a rate of sales over the next three years.

Verdict

The long-term prospects for Vitamin Shoppe appear to be improving. The company is implementing a refreshed strategy that places greater importance on omnichannel retailing, where customer engagement and sales performance is higher. It is also rationalizing its store estate, while improving design and layout. This could boost the customer experience at a time when product innovation is set to be ramped up.

Although the stock trades at a high valuation and has had a lackluster performance, its profit growth forecasts are relatively appealing. With the demand for healthy products on the rise as a result of an increasingly health-conscious culture, the business may benefit from a tailwind over the next several years. Therefore, after a strong 12-month period, the stock could offer further outperformance of the S&P 500.

Read more here:

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Signs with VSI. Click here to check it out.

The intrinsic value of VSI