Update: Wilhelmina International (NASDAQ:WHLM) Stock Gained 15% In The Last Five Years

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Furthermore, you'd generally like to see the share price rise faster than the market Unfortunately for shareholders, while the Wilhelmina International, Inc. (NASDAQ:WHLM) share price is up 15% in the last five years, that's less than the market return. Unfortunately the share price is down 11% in the last year.

View our latest analysis for Wilhelmina International

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Wilhelmina International's earnings per share are down 22% per year, despite strong share price performance over five years. The strong decline in earnings per share suggests the market isn't using EPS to judge the company. The falling EPS doesn't correlate with the climbing share price, so it's worth taking a look at other metrics.

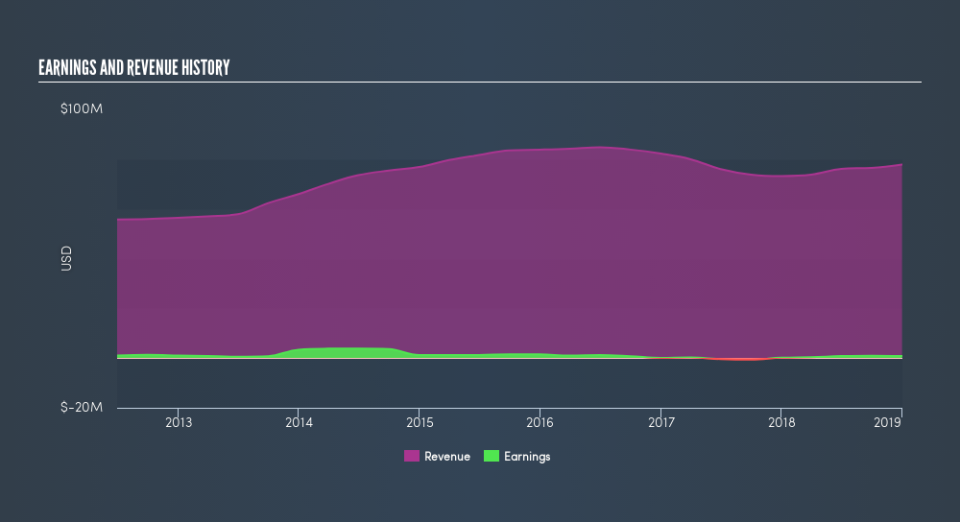

We are not particularly impressed by the annual compound revenue growth of 0.7% over five years. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Take a more thorough look at Wilhelmina International's financial health with this free report on its balance sheet.

A Different Perspective

Wilhelmina International shareholders are down 11% for the year, but the market itself is up 9.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 2.8%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. If you would like to research Wilhelmina International in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Wilhelmina International may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.