Williams-Sonoma (WSM) Q3 Earnings Beat on E-commerce Growth

Williams-Sonoma Inc.’s WSM shares jumped more than 7% in the after-hours trading session on Nov 19, following solid third-quarter fiscal 2020 results. The company’s earnings and revenues handily beat the Zacks Consensus Estimate and significantly increased year over year, courtesy of strength across all brands and accelerated e-commerce growth.

Earnings & Revenues

Non-GAAP adjusted earnings of $2.56 per share surpassed the Zacks Consensus Estimate of $1.52 by 68.4%. The figure also increased 150% from $1.02 a year ago.

Revenues of $1,764.5 million beat the consensus mark of $1,555 million by 13.5% and grew 22.3% year over year. The better-than-expected revenues were driven by 49.3% notable acceleration in net comps growth of the e-commerce business, which includes purchases made through the company’s omni-channel services such as curbside pickup and shipping from stores. E-commerce penetration accounted for 70% of total revenues, buoyed by content-rich online experience and marketing strategies.

Comps increased 24.4%, higher than 10.5% growth in the fiscal second quarter and 5.5% in the year-ago period. Comps in Williams Sonoma increased an impressive 30.4% against 2.1% decline registered in the prior-year quarter. Comps in the Pottery Barn brand grew 24.1% compared with 3.4% growth in the prior-year quarter. Pottery Barn Kids and Teen’s comps rose 23.8% compared with 4% growth in the year-ago quarter. The West Elm brand’s comps rose 21.8% versus 14.1% growth in the year-ago quarter.

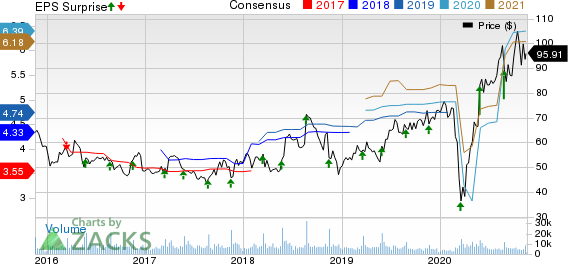

WilliamsSonoma, Inc. Price, Consensus and EPS Surprise

WilliamsSonoma, Inc. price-consensus-eps-surprise-chart | WilliamsSonoma, Inc. Quote

Operating Highlights

Non-GAAP gross margin was 40%, up 400 basis points (bps) from the year-ago period. The upside was primarily caused by higher merchandise and occupancy leverage in the quarter.

Non-GAAP selling, general and administrative expenses were 24.3% of net revenues compared with 28.4% in the year-ago quarter, reflecting an improvement of 410 bps. The upside was driven by advertising leverage owing to a gradual shift in advertising spend from catalog to more efficient digital initiatives. The company also generated solid returns from advertising investments due to strength of the multi-channel model. Furthermore, non-GAAP operating margin expanded 810 bps from the year-ago period to 15.7% for the quarter.

Financials

Williams-Sonoma reported cash and cash equivalents of $773.2 million as of Nov 1, 2020 compared with $432.2 million on Feb 2, 2020. Also, the company paid off full short-term borrowings under its $500-million revolver. It also reinstated the share repurchase program, repurchasing $109 million this quarter alone. It also remains committed to a quarterly dividend increase of 10%, effective with the next dividend payment in the fourth quarter.

Notably, the company generated more than $727 million in operating cash flow in the first nine months of fiscal 2020.

Fiscal 2020 Guidance Suspended

Given unpredictability stemming from the coronavirus outbreak, it did not provide its full-year guidance. Nonetheless, its businesses continue to be strong across all brands, as is evident from their performance in the first three weeks of the fiscal fourth quarter.

Zacks Rank

Williams-Sonoma — which shares space with RH RH, Tempur Sealy International Inc. TPX and At Home Group Inc. HOME in the Zacks Retail - Home Furnishings industry — currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RH (RH) : Free Stock Analysis Report

WilliamsSonoma, Inc. (WSM) : Free Stock Analysis Report

Tempur Sealy International, Inc. (TPX) : Free Stock Analysis Report

At Home Group Inc. (HOME) : Free Stock Analysis Report

To read this article on Zacks.com click here.