Is Winnebago a Better Mobile Homes & RV Builder Than Patrick?

The Zacks Building Products - Mobile Homes and RV Builders industry has been in focus after the COVID-19 pandemic impacted the country. The COVID-19 pandemic led to greater interest among recreational vehicles (“RV”) consumers. The pandemic-imposed travel restrictions prompted many first-time buyers to opt for RVs.

RV Industry Association President & CEO, Craig Kirby, said, “RV shipments in 2021 are forecast to reach record highs as the industry continues its over 40 years of long-term growth. We expect consumers to continue to turn to RVs not only because they allow people to recreate responsibly, but also because RVs allow people the freedom to live a fun, active outdoor lifestyle.”

Notably, industry experts project 2021 to be the best year for RV shipments.

Among the industry bellwethers that include Thor Industries, Inc. THO and Skyline Champion Corporation SKY, let’s check out whether Patrick Industries, Inc. PATK or Winnebago Industries, Inc. WGO is a more profitable pick for investors right now. Notably, both the companies are almost neck to neck in terms of market cap and carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s delve deeper into both the company’s growth and profitability measures.

What Defines the Stock?

Winnebago — with a market cap of $2.49 billion — is a leading North American manufacturer with a diversified portfolio of RVs and marine products used primarily in leisure travel as well as outdoor recreation activities. Winnebago distributes RV and marine products through independent dealers across the United States as well as Canada. Meanwhile, it expects strong retail momentum in the prime spring season, backed by leading brand portfolio and high-quality products to its valued dealer network.

Conversely, Patrick — having a market cap of $2.04 billion — manufactures and distributes components as well as building products and materials to original equipment manufacturers, primarily in the RV, marine, manufactured housing and industrial markets. Patrick operates in two reportable segments, Manufacturing (accounted for 70% in 2020) and Distribution (30%), through a nationwide network, thereby reducing in-transit delivery time and cost to the regional manufacturing footprint. The company sees strong demand for outdoor recreation, and tremendous attractiveness and potential of RV as well as marine markets.

Stock Performance

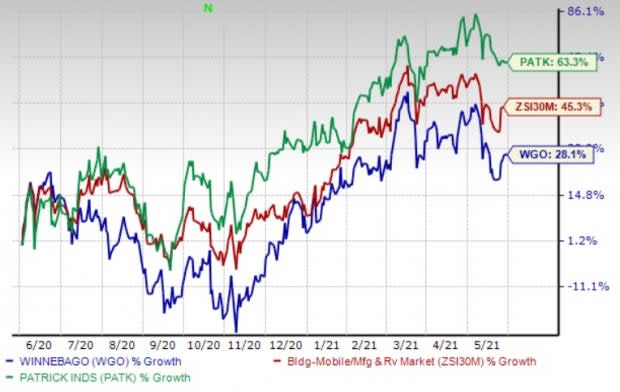

Shares of Winnebago and Patrick have gained 28.1% and 63.3% in the past year, respectively, compared with the industry 45.3% rally. Hence, when compared with the industry’s collective performance, Patrick fares better than Winnebago.

Image Source: Zacks Investment Research

Prospects & Surprise History

Analysts expect Winnebago’s earnings to grow 182.6% for fiscal 2021. Patrick’s bottom line for 2021 is likely to rise 78.6% year over year. Hence, Winnebago has an edge over Patrick in terms of profitability.

Meanwhile, considering a more comprehensive earnings history, Winnebago beat earnings estimates in 15 of the last 17 quarters, while Patrick surpassed the same in 16 of the trailing 17 quarters. Hence, Patrick is a clear winner in terms of surprise history.

ROE

Return on Equity in the trailing 12 months for Winnebago is 19.8%, while that of Patrick is 21.7%. Markedly, both the companies provide higher returns to investors compared with the industry’s 17.1%.

A Look at the Stocks’ Valuation

The trailing 12-month price-to-earnings multiple for Winnebago and Patrick is 14.79 and 16.84, respectively, compared with 19.37 of the industry. Patrick’s shares are costlier than Winnebago but cheaper than the industry average.

Trailing 12-month price-to-sales for Winnebago and Patrick is 0.9 and 0.73, respectively, compared with the industry’s 0.96. After having a look at these valuation metrics, we can say that both the companies are cheaper than the industry.

Our Take

With the help of the above-mentioned factors, we can come to the conclusion that although both the companies provide better returns to investors and are cheaper than industry, Patrick has an edge over Winnebago in terms of stock performance, surprise history and Return on Equity.

Going forward, both the companies remain optimistic about the overall Mobile Homes & RV Builders industry growth trend, given solid demand for RV and marine products as well as favorable housing backdrop.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thor Industries, Inc. (THO) : Free Stock Analysis Report

Skyline Corporation (SKY) : Free Stock Analysis Report

Winnebago Industries, Inc. (WGO) : Free Stock Analysis Report

Patrick Industries, Inc. (PATK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research