WisdomTree (WETF) Q2 Earnings Meet Estimates, Revenues Rise

Have you been eager to see how WisdomTree Investments WETF performed in Q2 in comparison with the market expectations? Let’s quickly scan through the key facts from this New York-based exchange-traded fund (‘ETF’) and exchange-traded product (‘ETP’) sponsor and asset manager’s earnings release this morning:

In Line Earnings

WisdomTree came out with adjusted earnings per share of 9 cents in line with the Zacks Consensus Estimate. Results reflected increase in revenues and growth in assets under management, offset by higher expenses.

How Was the Estimate Revision Trend?

You should note that the earnings estimate revisions for WisdomTree depicted neutral stance prior to the earnings release. The Zacks Consensus Estimate has remained stable over the last seven days.

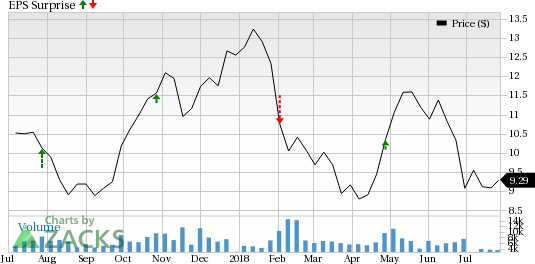

WisdomTree Investments, Inc. Price and EPS Surprise

WisdomTree Investments, Inc. Price and EPS Surprise | WisdomTree Investments, Inc. Quote

However, WisdomTree doen’t have a decent earnings surprise history. Before posting in line earnings in Q2, the company delivered positive surprises in one of the prior four quarters. Overall, on an average the company posted negative earnings surprise of 3.6% in the trailing four quarters.

Revenue Came in Better than Expected

WisdomTree posted revenues of $74.8 million, which surpassed the Zacks Consensus Estimate of $74.2 million. Also, revenues increased 33% year over year.

Key Takeaways:

Total Expenses: $60.2 million, up 46.2% year over year

Advisory fees increased 32.1% year over year to $73.8 million

As of Jun 30, 2018, U.S. listed ETF assets under management (AUM) was $41.3 billion, down 3.6% year over year.

The company witnessed net outflows of $1.3 billion compared with net inflows of $0.8 billion in prior-year quarter.

What Zacks Rank Says

The estimate revisions that we discussed earlier have driven a Zacks Rank #4 (Sell) for WisdomTree. However, since the latest earnings performance is yet to be reflected in the estimate revisions, the rank is subject to change. It all depends on what sense the just-released report makes to the analysts.

(You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

WisdomTree Investments, Inc. (WETF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research