Workiva's Enterprise Push Doesn't Come Cheap

Enterprise-software provider Workiva (NYSE: WK) reported its first-quarter results after the market closed on May 2. Losses grew as the company ramped up spending in an effort to win larger contracts. It's showing some progress on that front, boosting the number of large enterprise customers considerably over the past year.

But with guidance calling for widening losses in 2018, the company doesn't expect this strategy to help the bottom line this year. Here's what investors need to know about Workiva's first-quarter report.

Workiva results: The raw numbers

Metric | Q1 2018 | Q1 2017 | Year-Over-Year Change |

|---|---|---|---|

Revenue | $59.9 million | $51.9 million | 15.4% |

Net income | ($9.6 million) | ($5.8 million) | N/A |

Non-GAAP earnings per share | ($0.09) | ($0.04) | N/A |

Data source: Workiva.

What happened with Workiva this quarter?

Subscription and support revenue rose 17.5% year over year, to $46.5 million, while professional services revenue jumped 8.7%, to $13.4 million.

The adoption of the ASC 606 revenue recognition standard reduced professional services revenue by $1.7 million compared to what would have been reported under the old standard.

Workiva's total customer count reached 3,119 at the end of the first quarter, up from 3,063 at the end of the fourth quarter of 2017. Over the past year, Workiva has added 294 customers.

Workiva's revenue retention rate was 95.7% excluding add-on revenue and 105.3% including add-on revenue. Those numbers are down from 96% and 107.6%, respectively, during the fourth quarter of 2017. Add-on revenue includes the change in seat purchases and seat pricing for existing customers. Revenue retention rates are still being calculated using the old revenue-recognition standard.

Workiva had 335 customers with annual contract values of more than $100,000, up from 250 one year ago and 324 at the end of 2017. Within that group, 151 customers had an annual contract value above $150,000, up from 101 one year ago and 146 at the end of 2017.

Workiva provided the following guidance for the second quarter and full year:

Second-quarter revenue is expected to be between $55.7 million and $56.2 million, up 13.3% from the second quarter of 2017 at the midpoint.

Second-quarter non-GAAP net loss per share is anticipated to be between $0.24 and $0.25 compared to a loss of $0.14 in the prior-year period.

Full-year revenue is expected to be between $235.5 million and $237.0 million, up 13.6% from 2017 at the midpoint.

Full-year non-GAAP net loss per share should come in between $0.72 and $0.75 compared to a loss of $0.60 in 2017.

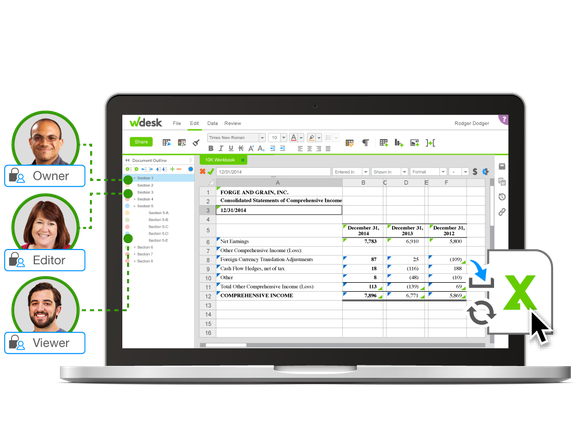

Workiva's Wdesk application. Image source: Workiva.

What management had to say

During the earnings call, Workiva CEO Matt Rizai commented on the company's push to win large enterprise customers:

We've made a very deliberate investment on sales and marketing around penetrating the enterprise and rolled that out at the beginning of the year and are seeing good progress in the pipeline that we expect to turn into bookings. But those are big deals and it's broadening the touch points that we have at customers beyond just the business user into the IT or the shadow IT side and it takes time but we like what we're seeing.

COO Matt Vanderploeg, in response to a question about the most surprising product category during the quarter, responded: "I'd say capital markets. We were really very pleased with the traction that we're getting there, recognition by the family of law firms and the group of law firms that dominate that business really beginning to understand the efficiency that Wdesk brings to an otherwise very painful process."

Looking forward

Workiva's push to win larger contracts again came at the expense of the bottom line. Losses grew on both a GAAP and non-GAAP basis compared to the prior-year period, driven by a 21.1% year-over-year increase in GAAP operating expenses. With guidance calling for growing losses in the second quarter and the full year, the payoff from this enterprise push likely won't fully materialize until 2019.

More From The Motley Fool

Timothy Green has no position in any of the stocks mentioned. The Motley Fool recommends Workiva. The Motley Fool has a disclosure policy.