Who are the world's biggest Bitcoin investors?

There are currently 10 Bitcoin billionaires according to a website tracking global transactions of the cryptocurrency – and that list might well include government agencies, such as the FBI.

The price of Bitcoin, the most famous cryptocurrency, has rocketed from less than $2,000 (£1,500) six months ago to more than $16,000, making many people very rich in the process. The price is currently $16,832 (£12,609).

According to Bitinfo, a website tracking Bitcoin price and ownership data, there are 10 “digital wallets” holding more than $1bn worth of Bitcoin. It does not reveal where in the world those wallets are located or whether they are owned by syndicates, organisations or individuals.

According to the site, the 10 richest Bitcoin owners collectively hold $13.5bn worth of the cryptocurrency. In sterling terms this is worth £10.1bn or, to put it into another context, approximately half the value of grocery giant Tesco.

While information about digital wallets containing Bitcoin is publicly available, precise details of who owns those wallets is not. The information emerges only when investors admit their connection to certain wallets or when details are leaked.

It is possible that the individuals or groups may hold more than one wallet, further increasing their total wealth.

bitcoin price

There has been much speculation surrounding the identities of the world’s richest Bitcoin investors.

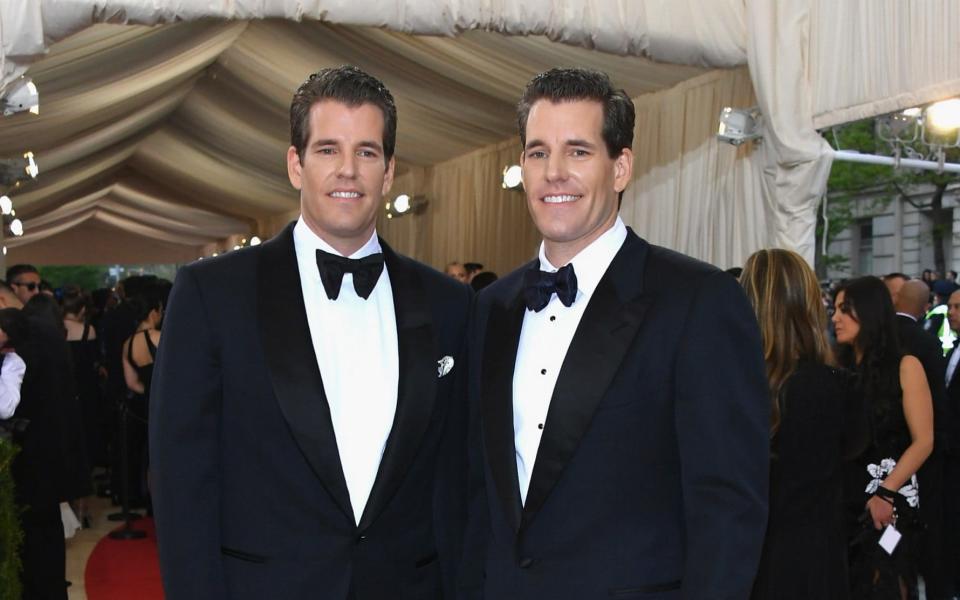

Tyler and Cameron Winklevoss, the twins who sued Facebook creator Mark Zuckerberg, claiming he stole their idea for the social network, are thought to have become billionaires by buying $11m worth of Bitcoin in 2013 and retaining ownership throughout its meteoric rise.

The pair hold an estimated 100,000 units of the cryptocurrency. At the current price of $16,832 their 100,000 holding would be worth $1.68bn (£1.3bn).

According to Fortune, venture capitalist Barry Silbert has long had an interest in digital currency and is thought to have made hundreds of millions, while fellow investor Ted Draper – best known for co-founding Californian venture capitl firm Draper Fisher Jurvetson – reportedly purchased 30,000 Bitcoins seized from Ross Ulbricht, the founder of the online drugs marketplace The Silk Road, which would now be worth $500m (£375m).

Bitcoin | Read more

Another individual who is likely to have been fabulously enriched by Bitcoin is the anonymous figure, known only as "Satoshi Nakamoto", who published the original white paper laying out what the currency would look like in 2008. Silicon Valley magazine Wired estimated last year he owned one million Bitcoins, which would now be worth a staggering $16.7bn.

Also likely to be among the biggest holders of the digital currency in the world is the FBI. Again according to Wired, the American Government owns at least 144,000 Bitcoins seized from operators of the Silk Road. At today’s valuation this haul would be worth $2.4bn. Both of these fortunes are thought to be spread across several different wallets.

New corporate and institutional owners of Bitcoin are also emerging. These vehicles buy Bitcoin on behalf of thousands or even millions of other, end investors.

The enormous interest in the currency is driving mainstream private investors as well as high net worth individuals to want to include Bitcoin within their portfolios. As a result, a plethora of investment funds, which list their shares on stock markets or issue units direct to investors, are now buying up the currency.

Investors can then buy shares or units in the funds.

One of the most famous of such funds is Grayscale's Bitcoin Investment Trust, with shares listed on the New York Stock Exchange. It currently owns $1.5bn (£1.1bn) Bitcoin on behalf of shareholders, but at $1.9bn (£1.4bn), is trading at a 26pc premium.

Several "exchange-traded funds" are also growing rapidly, operated out of financial centres all over the world and appealing to a wider range of investors. Two of the most popular among British investors are Sweden-based funds run by XBT. One is denominated in kronor and the other in euros.

sam.meadows@telegraph.co.uk