Xilinx's (XLNX) Q1 Earnings and Revenues Top Estimates, Up Y/Y

Xilinx Inc. XLNX delivered first-quarter fiscal 2022 adjusted earnings of 95 cents per share, beating the Zacks Consensus Estimate by 15.9%. Moreover, the bottom line registered an increase of 46%, year over year, and 16%, sequentially.

Revenues of $879 million surpassed the Zacks Consensus Estimate of $865.8 million and climbed 21%, year on year, and 3%, sequentially despite the prevalent industry-wide supply-chain challenges. This double-digit year-over-year growth in the top line was mainly driven by strength in Automotive, Broadcast and Consumer (“ABC”) and Wired and Wireless Group(“WWG”) end markets.

However, decline in Aerospace & Defense, Industrial and Test, Measurement & Emulation (“AIT”) sales was headwind during the fiscal first quarter.

The company noted that pursuant to its pending acquisition by Advanced Micro Devices AMD, it will not hold an earnings conference call or provide any outlook. It also suspended the quarterly dividend as well as its share-repurchase program.

Notably, the two companies entered into an agreement in October 2020, under which Advanced Micro Devices had agreed to acquire Xilinx in an all-stock transaction worth $35 billion.

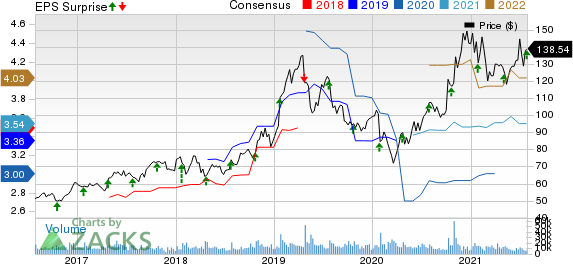

Xilinx, Inc. Price, Consensus and EPS Surprise

Xilinx, Inc. price-consensus-eps-surprise-chart | Xilinx, Inc. Quote

Quarter in Detail

Product wise, advanced product revenues climbed 27% year over year, contributing 72% to the total revenues. Moreover, revenues from core products (28% of total revenues) were up 8% from the year-ago quarter.

On the basis of end markets, ABC revenues (20% of total revenues) surged 94%, year over year, and 13%, quarter on quarter. This year-over-year uptick mainly resulted from record performance at the Broadcast and Consumer end markets.

WWG revenues (30% of total revenues) increased 13% year over year on ramped-up 5G deployments across multiple regions. However, sales at WWG remained flat sequentially.

AIT revenues (36% of total revenues) declined 2% on a year-over-year basis and 10%, sequentially, chiefly due to decline in TME and weak sales in Aerospace & Defense. Yet, strength in the industrial end market was a breather.

Data Center Group (“DCG”) revenues (10% of total) slid 1% from the year-ago period but increased 14% quarter on quarter on solid demand across hyperscale cloud customers and the Fintech market.

Revenues from the recently-added Channel group constituted 4% of total revenues.

Geographically, the company registered an increase of 7% in North America, 17% in the Asia Pacific, 44% in Europe and 55% in Japan, on a year-over-year basis.

Margins

Non-GAAP gross profit jumped 19% year over year to $596 million, while the gross margin contracted 110 basis points (bps) to 67.8%.

The company posted a non-GAAP operating income of $246 million during the fiscal first quarter, up 32% from the year-ago quarter. Operating margin expanded 230 bps to 28%, chiefly on lower operating expenses as a percentage of revenues, which more than offset the impact of lower gross margin.

Balance Sheet and Cash Flow

Xilinx exited the fiscal first quarter with cash, cash equivalents and short-term investments of $3.39 billion compared with the prior quarter’s $3.08 billion.

The company’s total long-term debt (excluding current maturities) was $1.49 billion as of Jul 3. Long-term debt was significantly higher from the $747.1 million witnessed at the end of fiscal 2020. This upswing reflects the senior notes issuance of $750 million in May 2020.

Xilinx generated $390 million of cash from operations and $373 million of free cash flow during the reported quarter.

Zacks Rank and Stocks to Consider

Xilinx currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include Digital Turbine APPS and Zoom Video Communications ZM, both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Digital Turbine and Zoom is currently pegged at 50% and 16.6%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Xilinx, Inc. (XLNX) : Free Stock Analysis Report

Digital Turbine, Inc. (APPS) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research