Xilinx's (XLNX) Q3 Earnings & Revenues Top Estimates, Up Y/Y

Xilinx Inc. XLNX delivered third-quarter fiscal 2021 adjusted earnings of 78 cents per share, beating the Zacks Consensus Estimate of 71 cents. Moreover, the bottom line comes in 15% higher than the prior-year quarter’s 68 cents.

Revenues of $803 million surpassed the Zacks Consensus Estimate of $776.1 million as well as increased 11% year on year. This double-digit growth in the top line was mainly driven by the strengthening business conditions and solid executions, partially offset by the impact of the Huawei ban and other trade-related uncertainties.

The company witnessed improved chip demand across Wired and Wireless Group (WWG), Automotive, Broadcast and Consumer (ABC), and A&D, Industrial and TME (AIT) markets. However, demand from the Data Center Group (DCG) business remained weak through the fiscal third quarter.

Quarter in Detail

Product wise, advanced product revenues climbed 15% year over year, contributing 72% to total revenues. Moreover, revenues from core products (28% of total revenues) inched up 1% from the year-ago quarter.

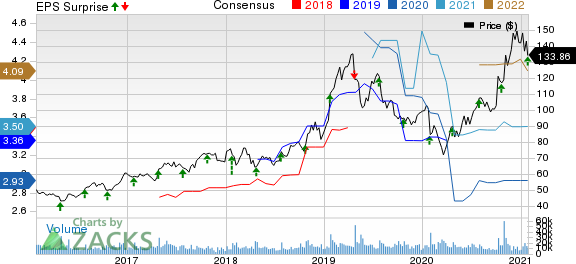

Xilinx, Inc. Price, Consensus and EPS Surprise

Xilinx, Inc. price-consensus-eps-surprise-chart | Xilinx, Inc. Quote

The company’s Zynq product-based revenues grew 29% year on year and 24% sequentially. This quarter-on-quarter improvement was primarily aided by the ramp-up in 5G Wireless and improvement in the automotive markets.

On the basis of end markets, AIT revenues (45% of total revenues) jumped 25% on a year-over-year basis and 7% sequentially, chiefly supported by the solid performance in the Test, Measurement and Emulation market.

ABC (19% of total revenues) grew 14% year over year and 27% quarter on quarter. This uptick mainly resulted from record performance at the Automotive and Broadcast end markets.

WWG revenues (29% of total revenues) increased 2% year over year and 14% sequentially on the ramped-up 5G deployments across multiple regions.

DCG revenues (7% of total) slid 15% from the year-ago period and 45% quarter on quarter.

Geographically, the company registered a year-over-year increase of 16% in North America, 4% in the Asia Pacific, 28% in Europe, and 2% in Japan.

Margins

Non-GAAP gross profit increased 13% year over year to $554 million, while margin expanded 220 basis points (bps) to 69%.

The company posted non-GAAP operating income of $201 million during the fiscal third quarter, up from the $174 million reported in the year-ago period. Operating margin expanded 100 bps to 25%, chiefly owing to higher gross margin, partially offset by inflated operating expenses as a percentage of revenues.

Balance Sheet and Cash Flow

Xilinx exited the fiscal third quarter with cash, cash equivalents and short-term investments of $3.32 billion compared with the prior quarter’s $3.1 billion.

The company’s total long-term debt (excluding current maturities) was $1.49 billion as of Jan 2. Long-term debt was significantly higher from the $747.1 million witnessed at the end of fiscal 2020. This upswing reflects the senior notes issuance of $750 million in May 2020.

Xilinx generated $360.2 million of cash from operations during the reported quarter and $853.2 million in the first three quarters of fiscal 2021.

During the fiscal third quarter, the company paid out dividends worth $93.2 million but didn’t repurchases stocks. In the first three quarters of fiscal 2021, it repurchased shares worth $53.7 million and paid out dividends worth $278.7 million.

Furthermore, pursuant to its merger agreement with Advanced Micro Devices AMD, Xilinx has suspended its dividend payment and share-repurchase program. Additionally, the company has not issued any outlook.

Zacks Rank and Key Picks

Xilinx currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector include Shopify SHOP, Micron MU and NetApp NTAP, all flaunting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Shopify, Micron and NetApp is currently pegged at 32.5%, 12.7% and 11.9%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Xilinx, Inc. (XLNX) : Free Stock Analysis Report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research