Yacktman Asset Management's Top 5 Sells of the 2nd Quarter

Yacktman Asset Management (Trades, Portfolio) disclosed this week that its top five sells during the second quarter were Oracle Corp. (NYSE:ORCL), Johnson & Johnson (NYSE:JNJ), The Walt Disney Co. (NYSE:DIS), Microsoft Corp. (NASDAQ:MSFT) and Booking Holdings Inc. (NASDAQ:BKNG).

Managed by Stephen Yacktman, the Austin-based firm employs a disciplined investment strategy that combines key principles of growth and value investing. Yacktman seeks companies with good businesses, shareholder-oriented management and low purchase prices.

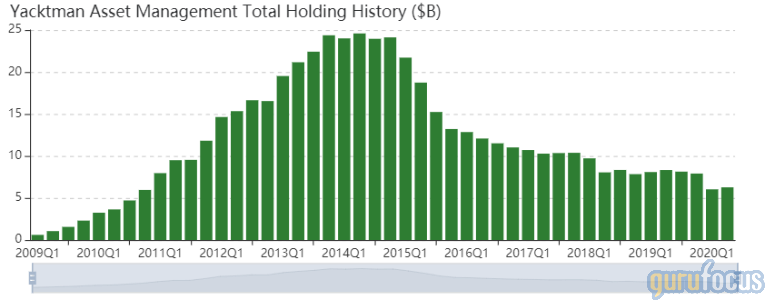

As of the quarter-end, the firm's $6.28 billion equity portfolio contains 60 stocks with a turnover ratio of 2%. Although the firm established four new positions during the quarter, the top three transactions in terms of portfolio impact featured reductions in existing holdings.

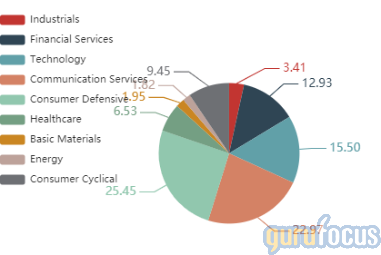

The top three sectors in terms of weight were consumer staples, communication services and technology, representing 25.45%, 22.97% and 15.50% of the equity portfolio.

Oracle

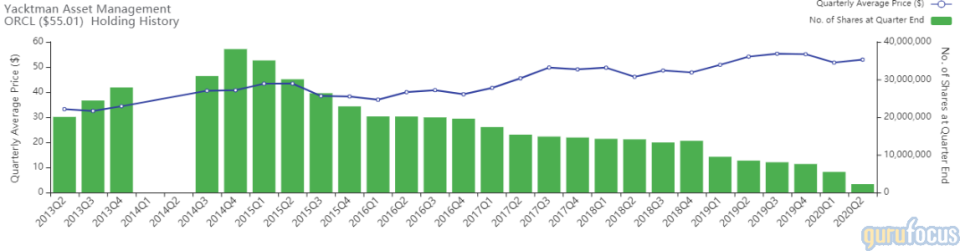

The firm sold 3,240,818 shares of Oracle, trimming the position 59.46% and the equity portfolio 2.60%. Shares averaged $52.90 during the second quarter.

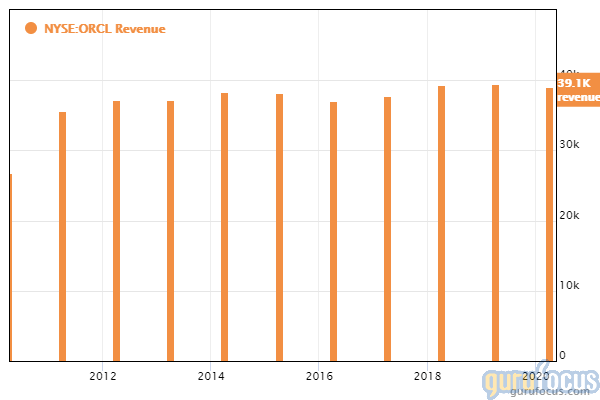

The Redwood City, California-based company develops a wide range of information technology solutions, including SQL and Java software. GuruFocus ranks Oracle's profitability 9 out of 10 on several positive investing signs, which include consistent revenue growth, a high Piotroski F-score of 7 and an operating margin that outperforms 96.98% of global competitors.

Gurus with large holdings in Oracle include First Eagle Investment (Trades, Portfolio) and Ken Fisher (Trades, Portfolio).

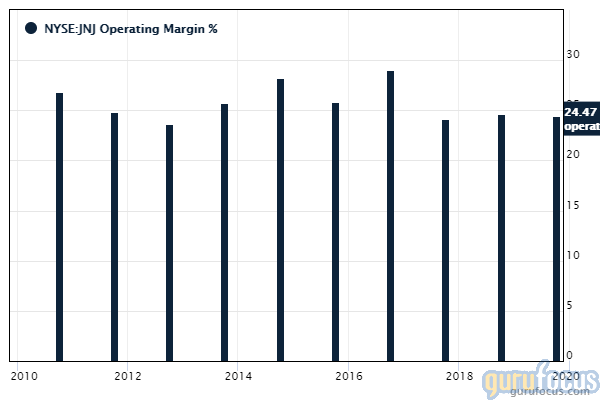

Johnson & Johnson

The firm sold 756,711 shares of Johnson & Johnson, reducing the position 25.90% and the equity portfolio 1.64%. Shares averaged $145.42 during the second quarter.

GuruFocus ranks the New Brunswick, New Jersey-based drug manufacturer's profitability 9 out of 10 on the back of profit margins and returns outperforming over 91% of global competitors. The website assigned Johnson & Johnson a 3.5-star business predictability rank.

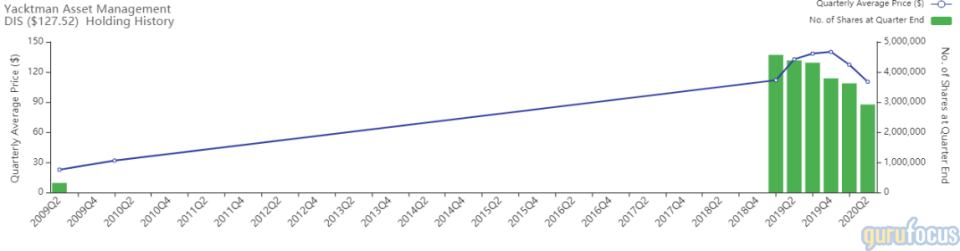

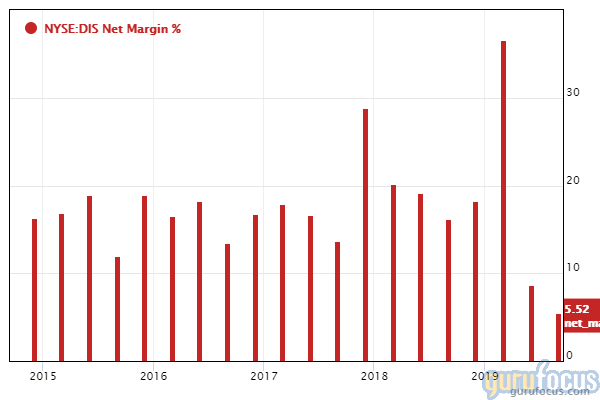

Walt Disney

The firm sold 702,929 shares of Walt Disney, reducing the position 19.41% and the equity portfolio 1.13%. While shares averaged $110.22 during the second quarter, shares of Disney closed at $130.82 on Thursday, up 2.5% from Wednesday's close of $127.62 and continuing its strong rally on the heels of reporting strong subscriber growth for the fiscal third quarter.

GuruFocus ranks Walt Disney's profitability 8 out of 10, driven by a 4.5-star business predictability rank and an operating margin that outperforms 70.55% of global competitors. Despite this, net profit margins are now underperforming 59.60% of global entertainment companies following Disney's $4.718 billion net loss during the June quarter based on generally accepted accounting principles.

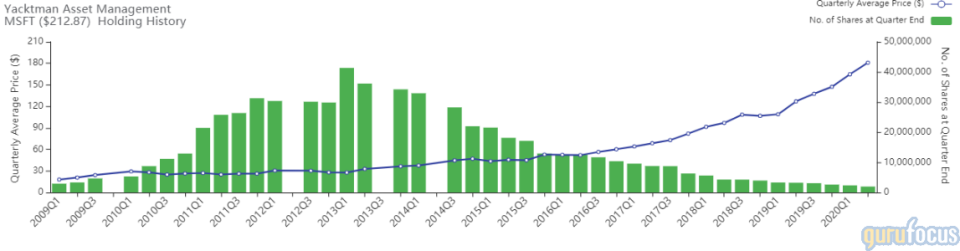

Microsoft

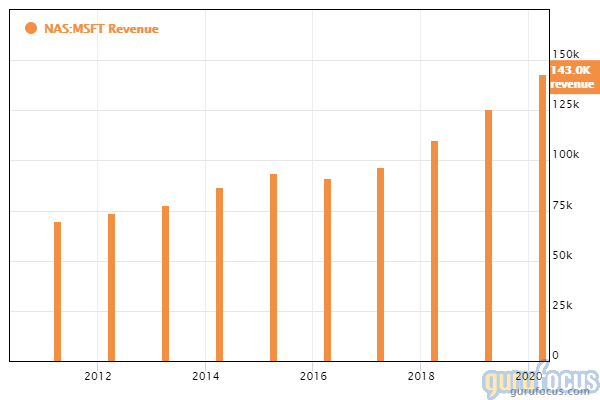

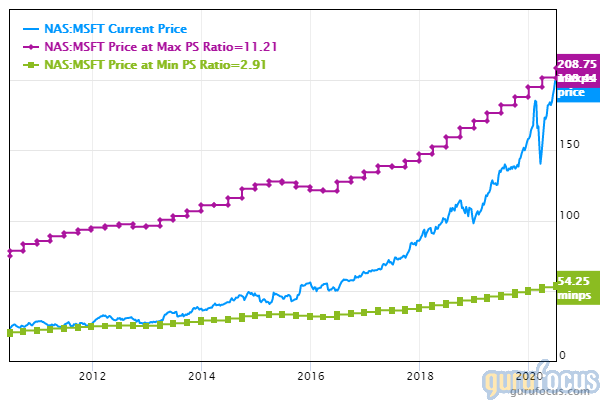

The fund sold 397,237 shares of Microsoft, reducing the position 16.91% and the equity portfolio 1.04%. While shares averaged $180.95 during the second quarter, shares of the company founded by Bill Gates (Trades, Portfolio) closed at $216.35, up 1.60% from the previous close of $212.94. Surging share prices from Microsoft and other Big Tech companies like Facebook Inc. (NASDAQ:FB) and Apple Inc. (NASDAQ:AAPL) resulted in the Nasdaq Composite Index closing at 11,108.07 and above 11,000 for the first time in history.

GuruFocus ranks the Redmond, Washington-based software giant's profitability 9 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8 and operating margins that have increased approximately 4.30% per year on average over the past five years and are outperforming over 97% of global competitors.

Microsoft's valuation ranks 1 out of 10 on several signs of overvaluation, including a price-book ratio and a price-sales ratio that are close to 10-year highs and underperform over 82% of global software companies.

Booking Holdings

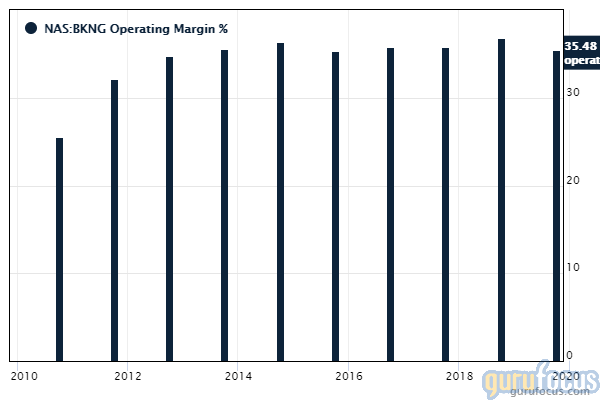

The firm sold 42,755 shares of Booking Holdings, reducing the position 20.09% and the equity portfolio 0.95%. Shares averaged $1,519.55 during the second quarter.

GuruFocus ranks the Norwalk, Connecticut-based reservation giant's profitability 9 out of 10 on several positive investing signs, which include a 3.5-star predictability rank and an operating margin that outperforms over 96% of global competitors.

Disclosure: Long Apple.

Read more here:

4 High-Quality S&P Stocks With High 6-Month Total Returns

Tom Gayner's Top 5 Sells in the 2nd Quarter

The 4 Most-Voted Stocks in the Considering Basket as of July

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.