Yacktman Focused Fund's Top 5 Sells in the 4th Quarter

The Yacktman Focused Fund (Trades, Portfolio), part of Affiliated Management Group Inc.'s (NYSE:AMG) AMG Funds, disclosed this week that is top five sells during fourth-quarter 2019 were in Samsung Electronics Co. Ltd. (XKRX:005935), The Walt Disney Co. (NYSE:DIS), PepsiCo Inc. (NASDAQ:PEP), Proctor & Gamble Co. (NYSE:PG) and Johnson & Johnson (NYSE:JNJ).

The Austin-based fund seeks long-term capital appreciation through investments in U.S. and international companies, following a disciplined investment strategy. Chief Investment Officer Stephen Yacktman and fund partner Jason Subotky seek companies with at least one of the following characteristics: good business, shareholder-oriented management and low purchase price.

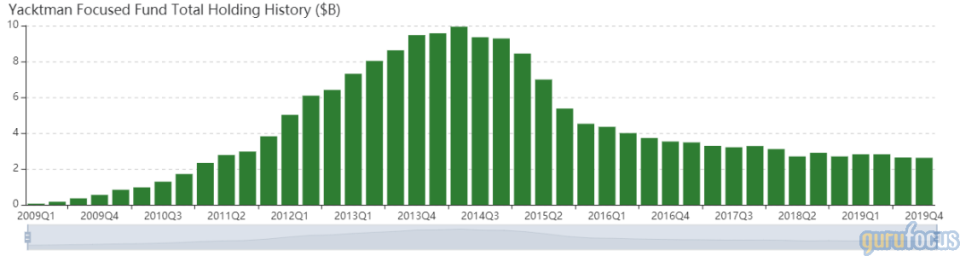

As of quarter-end, the fund's $2.62 billion equity portfolio contains 31 stocks, with a turnover rate of 5%. The top three sectors in terms of weight are technology, consumer defensive and communication services, with weights of 29.79%, 21.16% and 21.14%.

Samsung

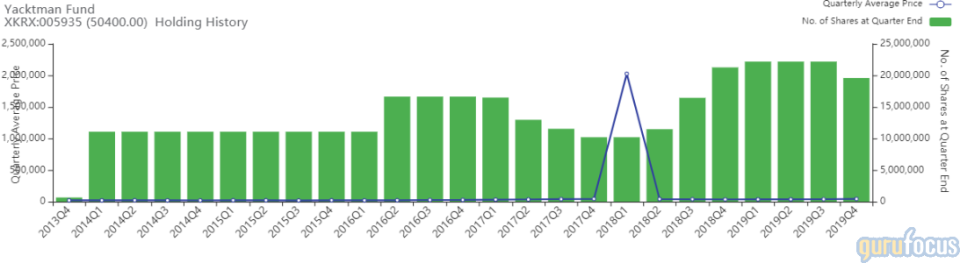

The fund sold 3,573,183 shares of Samsung, paring the stake 22.52%. With a portfolio impact of -4.46%, the transaction represents the fund's largest reduction for the quarter. Despite this, the company still remains the fund's top holding with 18.35% equity portfolio weight. Shares averaged 42,277.05 won ($36.35) during the quarter.

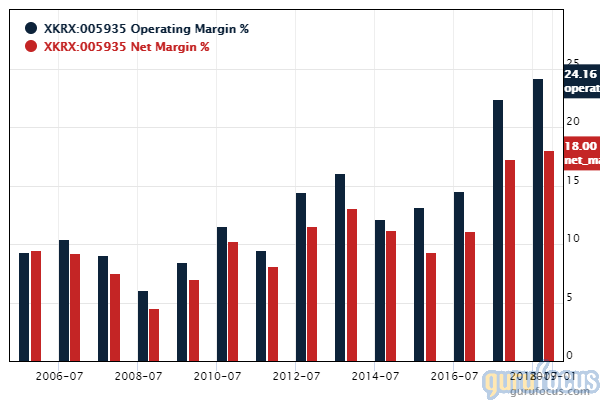

Samsung manufactures a wide range of products, including smartphones, semiconductor chips, printers, home appliances, medical equipment and telecom network equipment. GuruFocus ranks the South Korean electronics conglomerate's financial strength and profitability 8 out of 10 on several positive investing signs, which include a strong Altman Z-score of 5.05, expanding profit margins and debt ratios that are outperforming over 80% of global competitors.

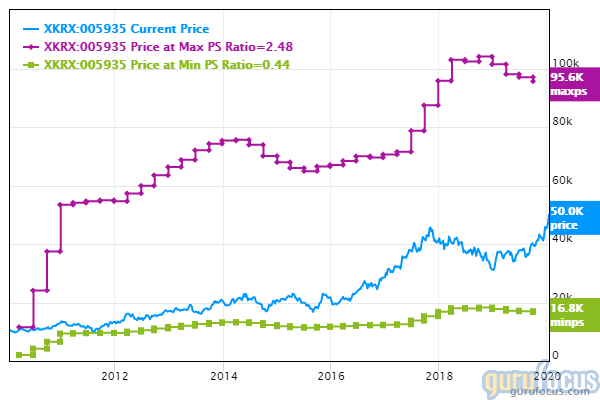

Despite high business quality, Samsung's valuation ranks 2 out of 10 on several cautionary signs, which include a share price and a price-sales ratio near a 10-year high. Samsung's price-sales ratio of 1.58 underperforms 60% of global competitors.

Yacktman and Subotky also own shares of Samsung in their Yacktman Fund (Trades, Portfolio).

Walt Disney

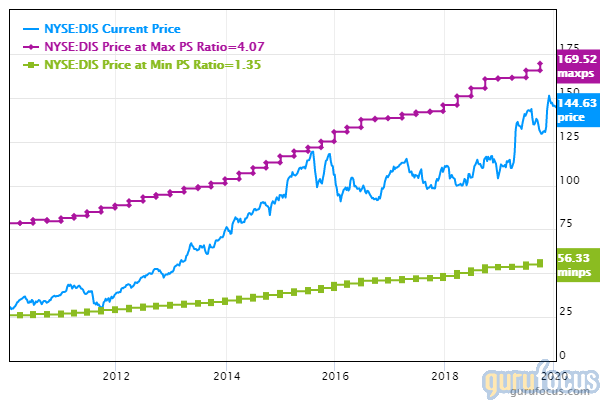

The fund sold 370,000 shares of Walt Disney, trimming the holding 29.60% and the equity portfolio 1.82%. Shares averaged $140 during the quarter.

The Burbank, California-based company operates a wide range of entertainment platforms, which include amusement parks like Disney World and the sports platform ESPN. GuruFocus ranks Disney's profitability 9 out of 10: The company has a 4.5-star business predictability rank even though the Piotroski F-score ranks a poor 3 out of 9. Additionally, Disney's operating margin is outperforming over 82% of global competitors despite contracting approximately 4% per year on average over the past five years.

Disney's valuation ranks 2 out of 10 on several signs of overvaluation, which include a share price near a 10-year high and a price-sales ratio that is near a three-year high and underperforms 81.33% of global competitors.

Other gurus with holdings in Disney include Yacktman Asset Management (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio) and Spiros Segalas (Trades, Portfolio).

PepsiCo

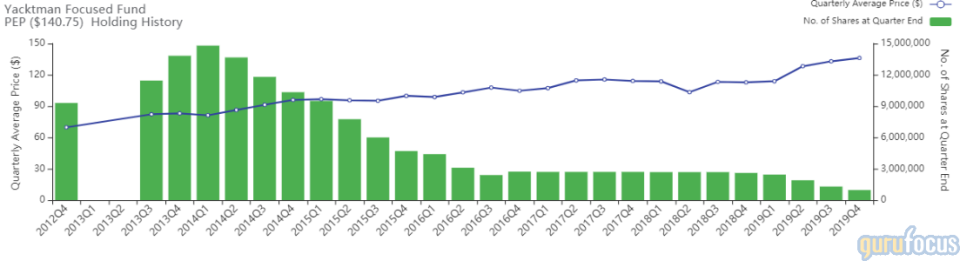

The fund sold 340,000 shares of PepsiCo, trimming the position 26.15% and the equity portfolio 1.76%. Shares averaged $136.08 during the quarter.

The Purchase, New York-based company manufactures and distributes nonalcoholic beverages like Pepsi and Diet Pepsi as well as grain-based food products like Lay's and Doritos. GuruFocus ranks PepsiCo's profitability 9 out of 10 on several positive investing signs, which include expanding profit margins and a five-star business predictability rank. Despite this, PepsiCo's valuation ranks just 3 out of 10 on the back of a price-sales ratio near a 10-year high of 3 and underperforming 76.09% of global non-alcoholic beverage competitors.

With a 5% equity portfolio weight, PepsiCo represents one of the fund's top five holdings.

Proctor & Gamble

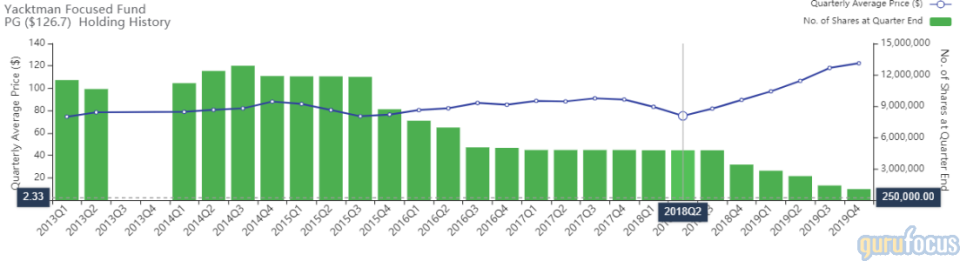

The fund sold 350,000 shares of Proctor & Gamble, reducing the position 25% and the equity portfolio 1.65%. Despite this, P&G remains one of the fund's top holdings with a 5% equity portfolio weight. Shares averaged $122.36 during the quarter.

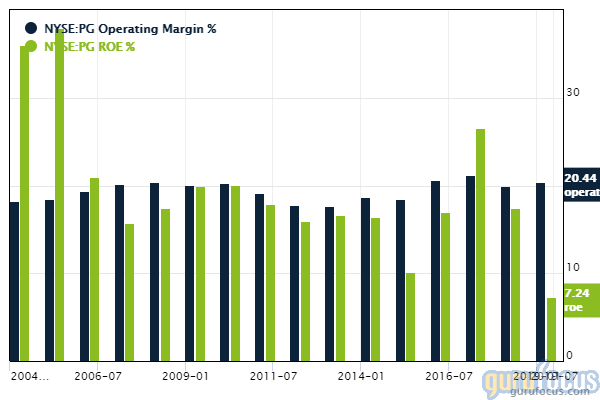

The Cincinnati-based company manufactures a wide range of consumer products, including Tide laundry detergent, Charmin toilet paper, Pantene shampoo and Pampers diapers. GuruFocus ranks P&G's profitability 7 out of 10: operating margins are expanding and outperforming over 94% of global competitors despite returns outperforming just over 56% of global household and personal product companies.

P&G's valuation ranks just 1 out of 10 on several signs of overvaluation, which include a share price, price-earnings ratio and a price-sales ratio all near a 10-year high, with price-earnings and price-sales ratios underperforming over 90% of global competitors.

Johnson & Johnson

The fund sold 310,000 shares of Johnson & Johnson, reducing the position 25.83% and the equity portfolio 1.52%.

The New Brunswick, New Jersey-based company manufactures goods through three business segments: pharmaceutical, medical devices and consumer goods. GuruFocus ranks Johnson & Johnson's profitability 8 out of 10 on several positive investing signs, which include a strong Piotroski F-score of 8 and profit margins that outperform over 85% of global competitors.

See also

While the fund sold shares in some of its top holdings, the fund did establish a few new positions during the quarter. Two new positions include Weatherford International PLC (WFTLF) and Associated British Foods PLC (LSE:ABF), with portfolio impacts of 2.58% and 1.23%.

Disclosure: No positions.

Read more here:

Tweedy Browne's Top 4 Sells of the 4th Quarter

FPA Capital Fund Buys 4 Stocks in 4th Quarter

4 High-Quality Health Care Companies for 2020

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.