Yacktman Fund's Top 5 4th-Quarter Trades

- By James Li

The Yacktman Fund (Trades, Portfolio), part of Austin, Texas-based Yacktman Asset Management (Trades, Portfolio), disclosed this week that its top five trades during the fourth quarter of 2020 included new positions in Charles Schwab Corp. (NYSE:SCHW) and Tyson Foods Inc. (NYSE:TSN) and three position reductions: Samsung Electronics Co. Ltd. (XKRX:005935), Fox Corp. (NASDAQ:FOXA)(NASDAQ:FOX) and Walt Disney Co. (NYSE:DIS).

Managed by Stephen Yacktman and Jason Subotky, the fund seeks long-term capital appreciation by investing in stocks in which some, but not all, pay dividends. The fund managers look for three key characteristics of companies: good business, shareholder-oriented management and low purchase price.

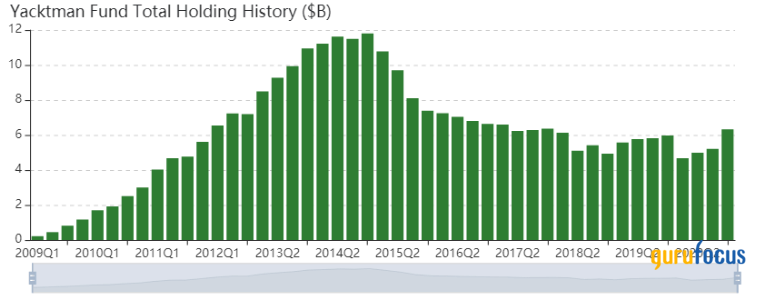

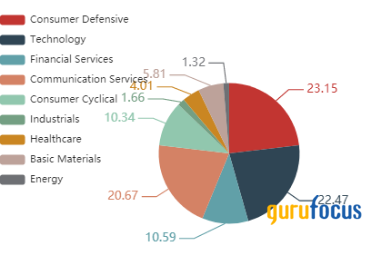

As of the quarter-end, the fund's $6.33 billion equity portfolio contains 51 stocks, with two new positions and a turnover ratio of 5%. The top three sectors in terms of weight are consumer defensive, technology and communication services, representing 23.15%, 22.47% and 20.67% of the equity portfolio.

Charles Schwab

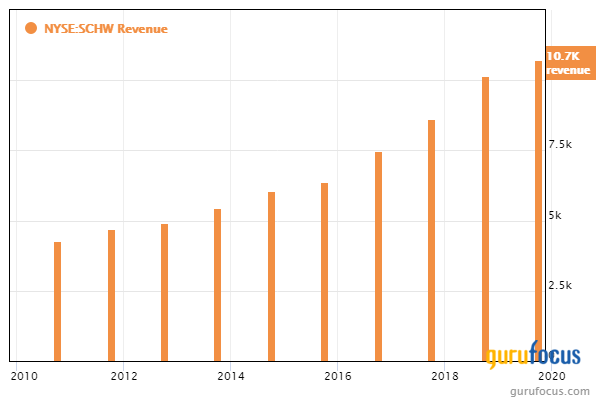

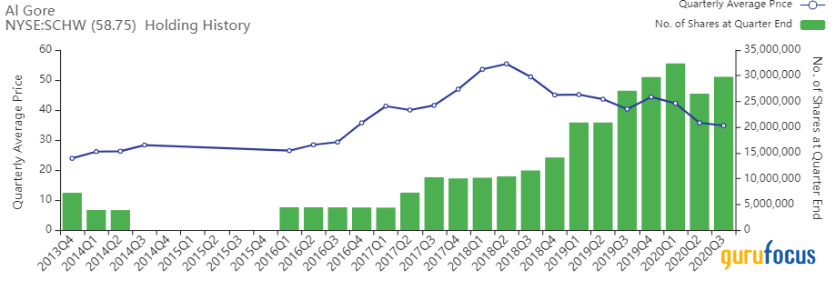

The fund purchased 1.825 million shares of Charles Schwab (NYSE:SCHW), giving the stake 1.53% weight in the equity portfolio. Shares averaged $45.56 during the fourth quarter of 2020; the stock is fairly valued based on last Friday's price-to-GF Value ratio of 1.09.

The San Francisco-based company provides brokerage, banking and asset management services. GuruFocus ranks the company's profitability 6 out of 10: Although the company has a 4.5-star business predictability rank, net margins are outperforming just over 73% of global competitors while returns on assets are underperforming more than half of industry peers.

Gurus with large holdings in Charles Schwab include Dodge & Cox, Al Gore (Trades, Portfolio)'s Generation Investment Management and Primecap Management.

Tyson Foods

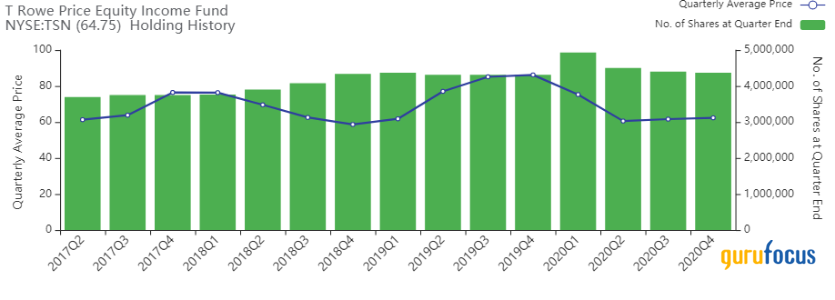

The fund purchased 1.46 million shares of Tyson Foods (NYSE:TSN), giving the position 1.49% weight in the equity portfolio. Shares averaged $62.34 during the fourth quarter of 2020; the stock is modestly undervalued based on last Friday's price-to-GF Value ratio of 0.87.

GuruFocus ranks the Springdale, Arkansas-based chicken and beef producer's profitability 8 out of 10 on several positive investing signs, which include a four-star business predictability rank and an operating margin that has increased approximately 3.4% per year on average over the past five years.

The T Rowe Price Equity Income Fund (Trades, Portfolio) also has a holding in Tyson Foods.

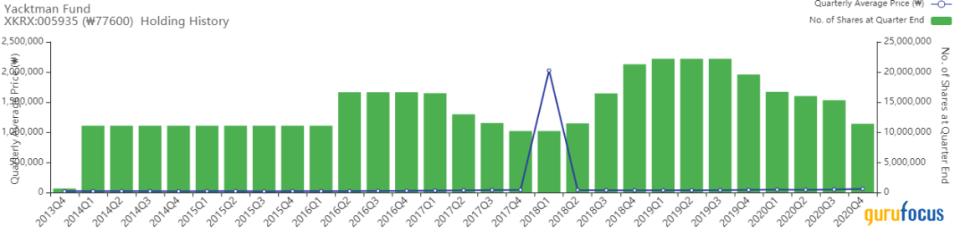

Samsung

The fund sold 3.9 million shares of Samsung (XKRX:005935), trimming the holding 25.49% and the equity portfolio 3.22%. Shares averaged 59,430.2 won ($53.77) during the fourth quarter of 2020.

GuruFocus ranks the South Korean electronics giant's financial strength 8 out of 10 on several positive investing signs, which include a strong Altman Z-score of 5.9, a safe Beneish M-score of -3 and interest coverage and debt ratios that are outperforming over 77% of global competitors.

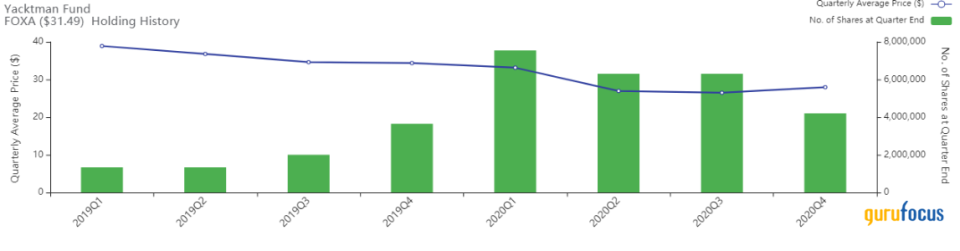

Fox

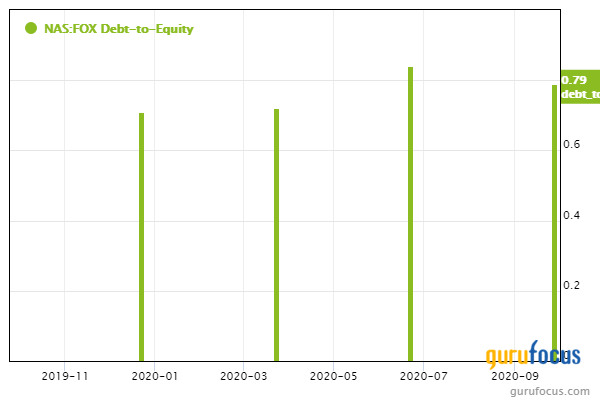

The fund sold 2.1 million Class A shares of Fox (NASDAQ:FOXA), trimming the position by one-third and the equity portfolio 1.12%. Shares averaged $27.96 during the fourth quarter of 2020.

GuruFocus ranks the New York-based diversified media company's financial strength 5 out of 10: Although the company has a safe Beneish M-score of -2.73, debt ratios are underperforming over 60% of global competitors.

Disney

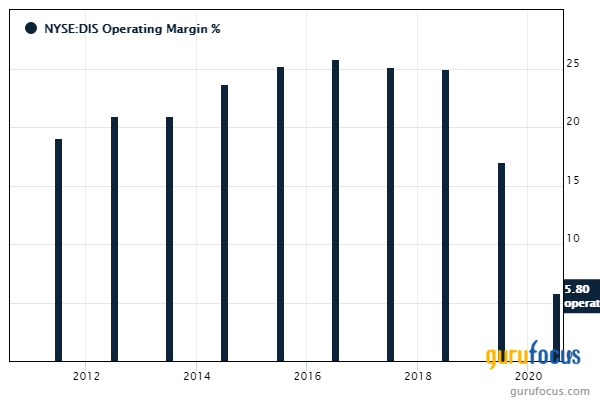

The fund sold 400,000 shares of Disney (NYSE:DIS), trimming the position by 25.81% and the equity portfolio 0.95%. Shares averaged $144.40 during the fourth quarter of 2020.

GuruFocus ranks the Burbank, California-based entertainment giant's profitability 7 out of 10 on the back of operating margins outperforming over 60% of global competitors.

Disclosure: No positions.

Read more here:

JPMorgan Slips Despite 4th-Quarter Revenue and Earnings Beat

4 Peter Lynch Growth Stocks With Good Financial Strength

The Stocks That 3 Japan-Centered Gurus Agree On

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.