Yandex to Up the Ante With Self Driving Demonstrations at CES

Yandex N.V. YNDX is leaving no stone unturned to bolster presence in the autonomous driving space.

During the Consumer Electronics Show (CES) 2020, the company plans to demonstrate rides with self-driving cars. The demonstration will be held on the public streets of Las Vegas.

These cars will feature the latest generation of Yandex’s autonomous hardware and software, which include a new sensor array. These sensors enable the vehicles to work with more accuracy, thereby allowing it to prevent accidents. The cars are designed to take left turns and navigate around multilane streets, among other notable features.

Following CES, Yandex plans to provide an autonomous taxi service in Detroit to the visitors of the June 2020 North American International Auto Show.

These efforts are likely to aid the company in rapidly penetrating the self-driving market.

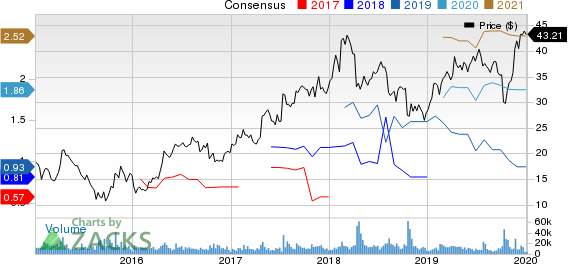

Yandex N.V. Price and Consensus

Autonomous Vehicles Hold Promise

Autonomous vehicles are set to revolutionize the concept of transport, while contributing significantly to the global economy. Per a McKinsey research, autonomous vehicles are expected to contribute to 66% of passenger-kilometers traveled in 2040, while generating $1.1 trillion in mobility services revenues and $0.9 trillion in sales.

Increasing popularity of mobility as a service (MaaS) solutions and accelerated deployment of 5G are anticipated to be tailwinds. According to Kenneth Research data, the self-driving car market is expected to hit $173.15 billion by 2023 at a CAGR of 36.2%.

Further, per a report by Grand View Research, the autonomous cars and trucks market is projected to hit 4,223 thousand units by 2030 at a CAGR of 63.1%.

Yandex seems to be well positioned to capitalize on the growing automotive market, which, even being a small fraction of the total market, is expected to see meaningful growth in a couple of years.

Bottom Line

Rapid development in the self-driving vehicle space can primarily be attributed to breakthroughs in technology, with the integration of robust AI and ML capabilities in advanced driver-assistance systems.

Moreover, improving neural networking capabilities and advancements in digital mapping and obstacle recognition functionalities are expected to lead to safer navigation, reduction in accidents, and commuter comfort.

Immense growth opportunities in this autonomous vehicle market are luring enough to attract technology companies like Alphabet GOOGL, NVIDIA NVDA, Intel INTC, among others, which are also leaving no stone unturned to grab a piece of this market pie.

Yandex has been making continuous efforts to accelerate the development of autonomous driving since 2017. The company had launched its first fully-autonomous taxi service in Europe in 2018. At CES 2019, the company expanded its self-driving system internationally. Now at CES 2020, the company’s move to demonstrate driving capabilities with self-driving cars is a testament to its efforts to boost footprint in this space.

Zacks Rank

Currently, Yandex carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Click to get this free report Yandex N.V. (YNDX) : Free Stock Analysis Report Alphabet Inc. (GOOGL) : Free Stock Analysis Report NVIDIA Corporation (NVDA) : Free Stock Analysis Report Intel Corporation (INTC) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research