Has Yandex N.V. (NASDAQ:YNDX) Got Enough Cash?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Investors looking for stocks with high market liquidity and little debt on the balance sheet should consider Yandex N.V. (NASDAQ:YNDX). With a market valuation of US$12b, YNDX is a safe haven in times of market uncertainty due to its strong balance sheet. These companies are resilient in times of low liquidity and are not as strongly impacted by interest rate hikes as companies with lots of debt. Today I will analyse the latest financial data for YNDX to determine is solvency and liquidity and whether the stock is a sound investment.

See our latest analysis for Yandex

Does YNDX Produce Much Cash Relative To Its Debt?

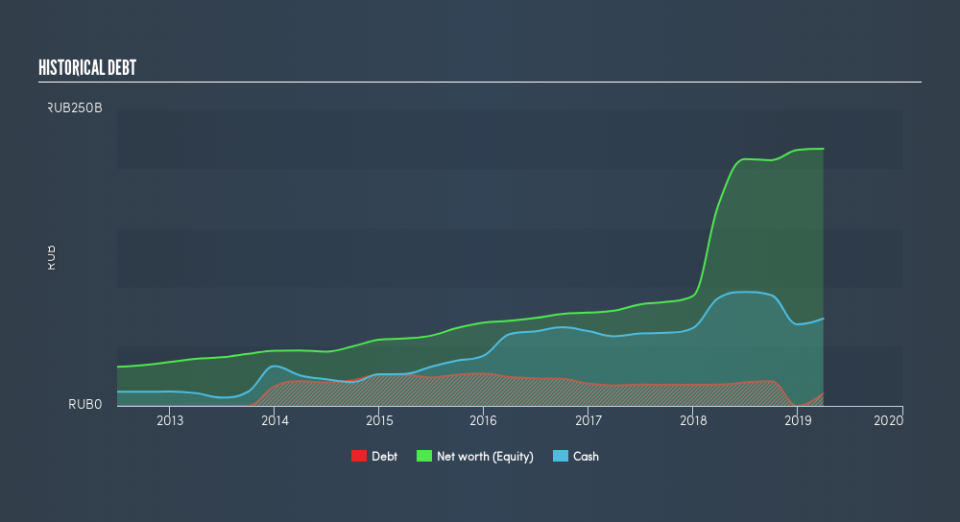

YNDX's debt levels have fallen from RUруб18b to RUруб10b over the last 12 months . With this debt repayment, YNDX's cash and short-term investments stands at RUруб74b , ready to be used for running the business. Additionally, YNDX has generated cash from operations of RUруб34b during the same period of time, resulting in an operating cash to total debt ratio of 321%, signalling that YNDX’s current level of operating cash is high enough to cover debt.

Does YNDX’s liquid assets cover its short-term commitments?

With current liabilities at RUруб38b, the company has been able to meet these obligations given the level of current assets of RUруб100b, with a current ratio of 2.6x. The current ratio is the number you get when you divide current assets by current liabilities. Generally, for Interactive Media and Services companies, this is a reasonable ratio as there's enough of a cash buffer without holding too much capital in low return investments.

Can YNDX service its debt comfortably?

Debt-to-equity ratio standards differ between industries, as some are more capital-intensive than others, meaning they need more capital to carry out core operations. As a rule of thumb, a financially healthy large-cap should have a ratio less than 40%. With a debt-to-equity ratio of 4.8%, YNDX's debt level is relatively low. YNDX is not taking on too much debt commitment, which can be restrictive and risky for equity-holders.

Next Steps:

YNDX has demonstrated its ability to generate sufficient levels of cash flow, while its debt hovers at a safe level. Furthermore, the company exhibits an ability to meet its near-term obligations, which isn't a big surprise for a large-cap. Keep in mind I haven't considered other factors such as how YNDX has been performing in the past. You should continue to research Yandex to get a more holistic view of the stock by looking at:

Future Outlook: What are well-informed industry analysts predicting for YNDX’s future growth? Take a look at our free research report of analyst consensus for YNDX’s outlook.

Valuation: What is YNDX worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether YNDX is currently mispriced by the market.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.