Yandex (YNDX) Earnings and Revenues Beat Estimates in Q1

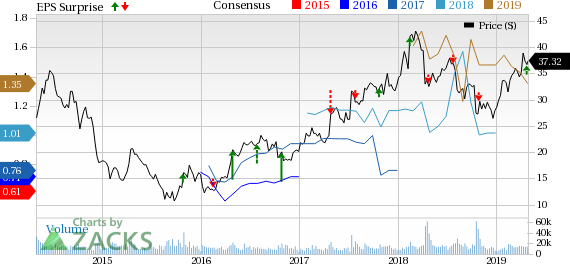

Yandex N.V. YNDX reported first-quarter 2019 adjusted earnings of 27 cents (RUB 10.59) per share beating the Zacks Consensus Estimate by 3 cents. Further, it surged from the year-ago quarter’s figure of RUB 7.10.

Revenues of $576 million (RUB 38.3 billion) surpassed the Zacks Consensus Estimate of $548 million. The figure exhibited year-over-year growth of 40% in ruble terms.

The company’s growing momentum in the Russian search market and increasing advertisement revenues drove the top line during the reported quarter. Further, robust performance by Taxi, Classifieds, Media Services and Experiments segments of the company contributed to the results.

Additionally, the company witnessed growth of 11% in its paid clicks during the reported quarter.

However, the deconsolidation effect of Yandex.Market remained an overhang throughout the first quarter. Excluding this impact, year-over-year growth in paid clicks would have come at 20%. Further, revenues would have reflected growth of 45% on a year-over-year basis.

Nevertheless, the stock price has surged 1.7% following the release of its earnings on Apr 25. This can primarily be attributed to the company’s better-than-expected results.

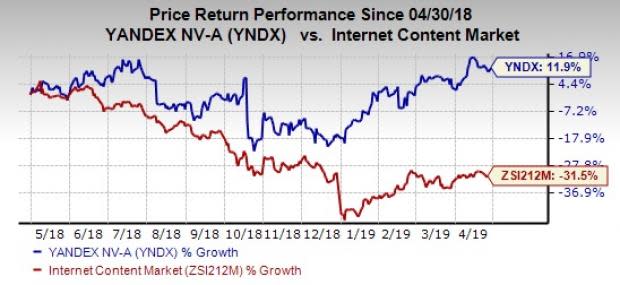

Coming to the price performance, shares of Yandex have gained 11.9% over a year, compared with the industry’s decline of 31.5%.

Top-Line Details

Total online advertising revenues came in RUB 27.04 billion (73% of total revenues), exhibiting growth of 18.4% on a year-over-year basis.

This was primarily driven by robust performance of Yandex properties which accounted for 77.3% of the total advertising revenues and exhibited year-over-year growth of 20%. Further, Advertising network revenues contributed 22.6% to advertising revenues and grew 14.2% from the year-ago quarter.

Excluding deconsolidation effect of Yandex.Market, the online advertising revenues would have improved 25%.

Taxi revenues of $7.6 billion (20% of total revenues) surged 145% on a year-over-year basis. This was driven by increasing number of rides.

Other revenues of RUB 2.6 billion (7% of total revenues) soared 325% from the prior-year quarter. This can be attributed to the well-performing Yandex.Drive and Yandex.Music. Further, strong IoT initiatives remained positive.

Segments in Detail

Search and Portal: The segment generated RUB 27.12 billion revenues (72.7% of total revenues), up 26% year over year. The company’s strong position in the Russian search market remains a key catalyst. Notably, its market share reached 57% during the reported quarter. This can be attributed to Yandex’s increasing desktop and mobile search shares which reached 68.5% and 49%, expanding 100 bps and 390 bps year over year, respectively. The company’s search share on Android and iOS came in 51.2% and 48.1%, respectively. Mobile traffic accounted for 51.8% of the total search traffic in the reported quarter.

Taxi: The segment generated RUB 7.6 billion revenues (20% of revenues), surging a whopping 145% from the year-ago quarter. Impressive year-over-year growth was driven by increasing number of rides which surged 64% from the prior-year quarter. This drove growth in the company’s ridesharing business. Further, robust performance by corporate Taxi and food delivery business contributed well.

Classifieds: The segment generated revenues of RUB 1.12 billion (3% of revenues), advancing 57% year over year. Revenues from listing fees and VAS accelerated top-line growth within this segment.

Media Services: The segment generated revenues of RUB 734 million (2% of revenues), advancing 74.3% from the year-ago quarter. This came on the back of growing subscription revenues, video advertising and commissions from ticket sales.

Other Bets and Experiments: The segment yielded RUB 2.5 billion revenues (6.6% of total revenues), up from $779 million in the prior-year quarter. This was driven by robust performance of Yandex’s Zen, Yandex.Drive and Geo services.

Yandex N.V. Price, Consensus and EPS Surprise

Yandex N.V. Price, Consensus and EPS Surprise | Yandex N.V. Quote

Operating Details

In first-quarter 2019, adjusted net income margin was 14.6%, contracting 50 bps from the year-ago quarter.

Per the company, its operating margin came in 14.4% in the first quarter, expanding 250 bps from the year-ago quarter.

Further, Adjusted EBITDA margin was 28.9%, contracting 10 bps year over year. This can be attributed to increasing investment in content, Yandex.Drive and Yandex.Cloud. Also, growing marketing and advertisement costs affected negatively.

Operating expenses as a percentage of revenue was 85.6%, contracting 250 bps from the year-ago quarter.

The company’s total traffic acquisition cost (TAC) came in RUB 5.3 billion, surging 23.7% on a year-over-year basis.

Balance Sheet & Cash Flows

As of Mar 31, 2019, cash and cash equivalents were $831.5 million, down from $990.3 million as of Dec 31, 2018.

Accounts Receivables totaled $233.8 million, increasing from $209.7 million in the previous quarter.

For the first quarter, cash flow from operations was $162.6 million which surged from the previous-quarter figure of $123.9 million.

Guidance

For 2019, management raised guided range for revenue growth from 28-32% to 30-34% in ruble terms from 2018, excluding the Yandex.Market.

The company also increased the guided range for revenue growth in Search and Portal from 18-20% to 19-21% from 2018 in ruble terms.

Zacks Rank and Stocks to Consider

Yandex currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader technology sector are Avid Technology, Inc. AVID, GoDaddy Inc. GDDY and Mettler-Toledo International, Inc. MTD. While Avid Technology sports a Zacks Rank #1 (Strong Buy), GoDaddy and Mettler-Toledo carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Avid Technology, GoDaddy and Mettler-Toledo is projected at 10%, 17% and 12.57%, respectively.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Click to get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yandex N.V. (YNDX) : Free Stock Analysis Report

GoDaddy Inc. (GDDY) : Free Stock Analysis Report

Avid Technology, Inc. (AVID) : Free Stock Analysis Report

Mettler-Toledo International, Inc. (MTD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research