Yen Crosses to Collapse if Nikkei 225, S&P 500 Falter

Yen Crosses to Collapse if Nikkei 225, S&P 500 Falter

Fundamental Forecast for Japanese Yen: Bullish

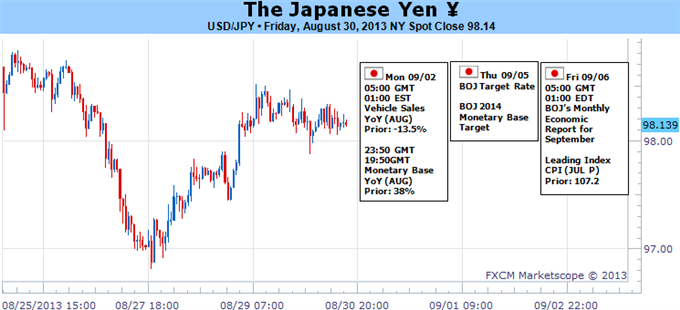

Traders mustn’t be sidetracked by long-term concerns on the tax hike debate and BoJ policy update

Expensive carry trades are prone to topple as surely as overvalued stocks should risk appetite falter

Use the DailyFX Calendar App to track all of the key events impacting the Yen this week

We were shown just exactly what can drive the Japanese yen this past week. A dense round of data that acted as a status report for the success of the Japanese monetary policy authority’s stimulus program was essentially overlooked. Meanwhile, the yen crosses lead by USDJPY tracked out the Nikkei 225 step for step. That tells us exactly what we should be watching going forward. Rather than following the traditional economic measures – even for their ability to update economic recovery, inflation and the persistence of the BoJ’s ambitious support program – we need to watch the ebb and flow of risk appetite as the market grows more critical of historically low carry yield.

It will certainly prove difficult to set key headlines surrounding the yen on the backburner this week. Starting over the weekend, Japanese Economic Minister Amari is set to give an update on an ongoing conversation surrounding the government’s possible approval of a controversial sales tax increase. A boosted levy on Japanese consumer, it is argued, can stall the fragile economic recovery. Stalled growth is a concern that wraps the globe; but for Japan, failure to keep traction after the Bank of Japan’s massive stimulus program and Prime Minister Abe’s ‘three arrows’ program could destroy credibility alongside the recovery.

On the other hand, Japan carries the largest debt relative to GDP in the developed world (over 200 percent). Maintaining a strong pace of consumption without raising the funds to support it could lead the country to a new and much more complicated crisis. Yet as weighty as this situation is for the yen’s future, it is unlikely to define its immediate future. No doubt, assurance of higher taxes could weigh on Japanese markets and destabilize carry trades; however we are unlikely to get clarity. Amari’s briefing is merely a progress report and not a final decision. The verdict to hike or not to hike is expected in early October.

Another, major fundamental theme that will draw the market’s attention and perhaps generate more response from the yen - though still falling short of the lasting trend threshold - will be the Bank of Japan’s (BoJ) rate decision. Due sometime Thursday (the central bank has no set time to deliver its policy decision), the gathering is unlikely to deviate from the last five meetings’ deliberation on the standard tools – no change to rates. That said, keeping the ship steady puts the yen crosses in an exposed position. In the incredible drop for the Japanese yen over the past year, the catalyst was the threat of an unprecedented stimulus program which could proactively devalue the currency. The threat worked. Yet, since the equivalent $70 billion-per-month program was actually introduced in April, progress has stalled. The market has priced in this incredible exchange rate pressure. And, general risk troubles are starting to create heavier cross winds.

As significant as Japan’s stimulus backdrop is, the yen is still beholden to a deeper market theme. For decades, the yen has been used as the preferred funding currency in prolific carry trades thanks to its liquidity, persistently low yield and the large savings of the Japanese people. Over the past year, considerable capital has found its way back into the short-yen carry trade, leveraged by the BoJ’s efforts. And, while there were substantial capital gains to be found out of the move, there is one critically absent component to the trade – carry. Where the yen is still sporting an extremely low yield, global interest rates that would offer the ‘return’ component are also near historic lows.

So long as volatility remains extremely low, the yen crosses can hold their current levels. Yet, extremes never last. Volatility will inevitably pick up, and the swings in exchange rates will unnerve FX traders and lead investors to unwind riskier foreign investments. Under such a market scenario, the idle holdings in low-return carry trades will be razed. This is a dangerous position for the currency to be in heading into the new trading week. Transitioning from the traditional ‘Summer lulls’, the global capital markets are facing a heavy global risk wave. We have open ended risk with a possible Syria intervention creating havoc in the energy market. The Fed’s Taper is on a countdown with Friday’s NFPs certain to generate fear. A round of growth data and monetary policy decision will weigh on a delicate global equilibrium. But, the most ominous threat is the market itself. With speculative benchmarks like the Nikkei 225 and S&P 500 threatening reversal, pure deleveraging and investor panic presents the yen crosses’ greatest threat. –JK

Use the DailyFX-Plus Technical Analyzer to identify possible trade setups.

Sign up for John’s email distribution list, here.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.